Madrigal Pharmaceuticals’ metabolic dysfunction-associated steatohepatitis (MASH) drug has been approved, to be sold as Rezdiffra. For the other companies with up-and-coming treatments trailing in the clinic, the question is: What now?

Terns Pharmaceuticals already signaled a retreat from the space in January, shelving the oral thyroid hormone receptor-beta (THR-β) agonist TERN-501 in MASH, previously known as nonalcoholic steatohepatitis (NASH). But the therapy was expected to go on, potentially finding a foothold in another competitive indication: obesity. In an earnings release that coincidentally was released the same day as Madrigal’s triumph, the company indicated that the hunt for a future indication is still ongoing for TERN-501.

While the journey may be over for Terns, analysts at William Blair and Global Data saw a brighter side to the Rezdiffra label. The FDA will not require a liver biopsy before treatment, which means patient selection should be easier and access more streamlined. Could there still be hope for the companies to come after Madrigal?

“The absence of liver biopsy requirement in Rezdiffra’s label should buoy biotech stocks with exposure to MASH,” William Blair wrote in a Friday morning note. “Accordingly, we expect biotech companies with MASH exposure to broadly rally today, given that one of the commercial overhangs has been removed.”

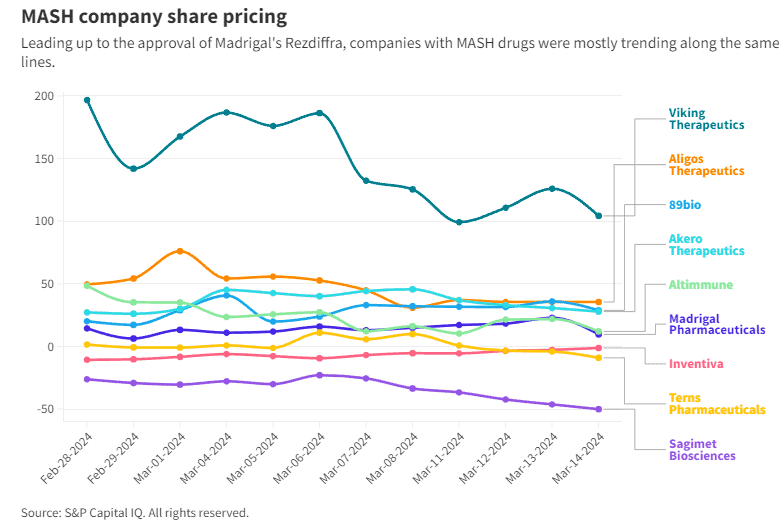

That’s exactly what happened Friday morning when the markets opened—at least for Madrigal, which jumped more than 16% to $283.55. Other companies in the space had more modest bumps, such as 89bio, which climbed 4.5% to $13.18; Aligos Therapeutics saw barely a blip, with a 1% gain to 88 cents; Terns stepped up just over 6% to $7.15. The closer trailing competitors fell: Viking Therapeutics went down 2% to $63.47, while Akero Therapeutics fell just under 5% to $26.07.

While the bulk of the MASH companies have traded steadily along the same lines over the past month, Viking is an outlier, thanks to data published Feb. 26 linking the company’s obesity drug VK2735 to weight loss of up to 14.7% after 13 weeks of treatment.

The dual agonist of GLP-1 and GIP has emerged as the star of Viking’s pipeline, but VK2809 has put up strong data in MASH. The therapy was linked to mean relative changes in liver fat of up to 51.7% without causing widespread gastrointestinal side effects in a phase 2b study that read out in May 2023.

Viking used the weight loss data to raise $550 million in an underwritten public offering after the obesity data, with the proceeds going toward both VK2809 and VK2735 as well as VK0214 for the rare genetic disorder X-linked adrenoleukodystrophy.

William Blair believes VK2809 could “outshine” Madrigal’s clinical profile.

Rezdiffra was specifically approved for the treatment of MASH with moderate or severe liver scarring, or fibrosis, consistent with stage F2 and F3 disease. The therapy met both goals of MASH resolution and fibrosis improvement in a phase 3 trial.

The FDA nod was based on an analysis of about 900 patients with biopsy-confirmed MASH and liver fibrosis who enrolled in the MAESTRO-NASH trial. In the study, Rezdiffra, given at either 80 mg or 100 mg once daily, cleared MASH with no worsening of fibrosis in 25.9% and 29.9% of patients, respectively, versus 9.7% for those who received placebo, according to data published in The New England Journal of Medicine.

In addition, 24.2% and 25.9% of patients on the two Rezdiffra doses showed fibrosis improvement of at least one stage, with no worsening on a fatty liver disease activity score. The rates were significantly more than the 14.2% seen in the placebo group.

These data will now be the bar that companies like Viking will have to clear, Global Data Senior Pharma Analyst Sravani Meka said in a Friday morning note.

“In an indication where there were previously no approved therapies and multiple development failures, the approval of Rezdiffra will now set the standard for all other treatments in development,” Meka said. “Future therapies will now have to meet or outperform efficacy and safety data generated from resmetirom’s Phase III MAESTRO studies.”

GlobalData estimates that the total MASH market is expected to reach $25.7 billion in 2032 across the U.S., France, Germany, Italy, Spain, the U.K. and Japan. Competitors such as Viking and the GLP-1 heavyweights Novo Nordisk and Eli Lilly should arrive in 2024 through 2032. Madrigal has a major head start, but the GLP-1 challengers like Novo’s Wegovy and Lilly’s Zepbound pose a huge challenge to the small biotech’s potential market share.

Novo has also looked outside its GLP-1 stable to lock in future prospects in the market. The company signed a deal with venture creation firm Flagship Pioneering in January to gain access to two cardiometabolic disease partnerships, each worth up to $532 million. Flagship biotech Cellarity is working on a small molecule to treat MASH.

Elsewhere, Boehringer Ingelheim recently announced that a Zealand Pharma-partnered candidate called survodutide improved disease activity and liver scarring in a phase 2 trial. Up to 83% of adults treated with survodutide achieved a statistically significant improvement of MASH, with the trial also meeting all secondary endpoints, including a statistically significant improvement in liver fibrosis. Boehringer was not specific on the phase 3 plans in MASH but did say the therapy has already moved into late-stage studies across subpopulations of people living overweight and with obesity, including cardiovascular and chronic kidney disease patients.

Meanwhile, small biotechs in the race will need to differentiate. 89bio just this week initiated a phase 3 program for pegozafermin with hopes of securing an accelerated approval for non-cirrhotic MASH, or fibrosis stages F2-F3—the same as Madrigal. That could be a tough climb, as patients in that category now have a treatment option with Rezdiffra. The biotech will likely have to show MASH improvements way outside of what Madrigal has achieved to convince the FDA that an accelerated nod is warranted.

89bio CEO Rohan Palekar acknowledged the huge achievement that the approval of Rezdiffra is for patients, in a statement provided to Fierce Biotech Friday afternoon. But his company is charging ahead with its plans.

“This is just the beginning and we at 89bio look forward to building further on this success as we progress development of pegozafermin,” Palekar said. “Because of the large and growing patient population in MASH, many therapeutic options will be both needed and successful.”

He specifically cited patients with advanced fibrosis and suggested the community needs options that improve tolerability and dosing convenience to ensure compliance.

Palekar is confident the FDA will be open to an accelerated approval.

“We worked closely with the FDA prior to the initiation and aligned on key elements of our MASH development strategy. Based on these discussions, if our phase 3 trials are successful, we do expect the FDA will grant pegozafermin accelerated approval for both F2-F3 and cirrhotic MASH using histology endpoints,” the CEO said.

Over at Aligos, CEO Lawrence Blatt, Ph.D., similarly made the case for his own drug, issuing a statement suggesting there’s room for more.

“Despite this approval, there still remains a large patient population that may need additional or different therapy than what resmetirom can offer,” Blatt said in a statement. “Aligos is not only supportive of the progress this approval represents but happy to see this class validated as we begin the phase 2a trial of our own highly potent and selective THR-β agonist, ALG-055009.”