Stock is trading at its second relative high versus Nike in a year, making it look overvalued, analyst says

still recommending that investors sell the yoga-gear maker’s shares after they hit a second valuation peak in a year.

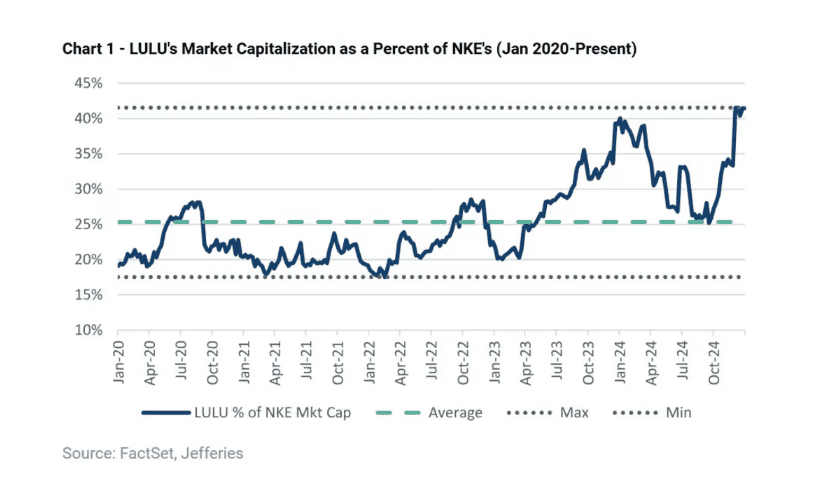

The stock LULU-2.64% is trading at its second relative high in a year versus the stock of Nike NKE-2.64%, making it look overvalued, analysts led by Randal J. Konik wrote in a note to clients.

“While we are HOLD rated on [Nike] and suggest investors Just Don’t Buy It, we believe [Nike] plays in a much better category of athletic footwear which has less competition and wider moat than the apparel category that [Lululemon] dominated previously,” the analysts wrote.

”[Lululemon] is now subject to rising competition, so we see U.S. sales/[earnings per share] declining in ’25 and continue to recommend selling [Lululemon] shares.”

Jefferies has had a sell rating on the stock since July 2022.

Lululemon’s stock has gained 43% over the last three months and got a big boost in early December when the company posted better-than-expected third-quarter earnings and raised guidance.

The positive numbers eased concerns the company was losing brand relevance, and at least 16 analysts raised their price targets.

Jefferies maintained its bearish stance, however, with Konik noting that about 75% of the business was lower than in the year-earlier period and that U.S. same-store sales were down for a second straight quarter.

“We believe that consensus expectations are too high, particularly in the international and men’s segments, given rising competition and relatively low brand awareness in many international markets,” Konik wrote on Thursday.

“Additionally, we see the U.S. market turning negative ahead against difficult compares,” he said.

The analyst outlined three scenarios for the stock, starting with a base case that sees growth slowing as the company’s core consumer remains cash-strapped in the current macroeconomic environment. In that scenario, the stock could fall 42% to $220.

An upside scenario in which the consumer remains strong and supports healthy growth and margins would see the stock fall 14% to $330.

A downside scenario would see the core consumer crumbling in the face of economic pressure, creating a significant shift in spending habits. That would see the stock fall 63% to $140.

Jefferies is one of four analyst firms on FactSet that have a sell rating or the equivalent on Lululemon’s stock. The average rating is overweight.

The stock has fallen 26% in the last 12 months, while the S&P 500 SPX-0.22% has gained 23%.