Iveric Bio is coming for Apellis Pharmaceuticals. Tuesday, the biotech revealed its second late-phase geographic atrophy clinical trial has hit its primary endpoint and outlined plans to file for FDA approval in the eye disease by the end of the first quarter.

Apellis is the front-runner in the space, with the PDUFA date for its C3 therapy in the calendar for the last week of November, but Iveric now boasts something its rival lacks: primary endpoint hits in two pivotal trials. While Apellis has gone to the FDA with one hit and one miss in its pivotal program, Iveric followed up the success of its first phase 2/3, GATHER1, in 2019 with another hit in GATHER2.

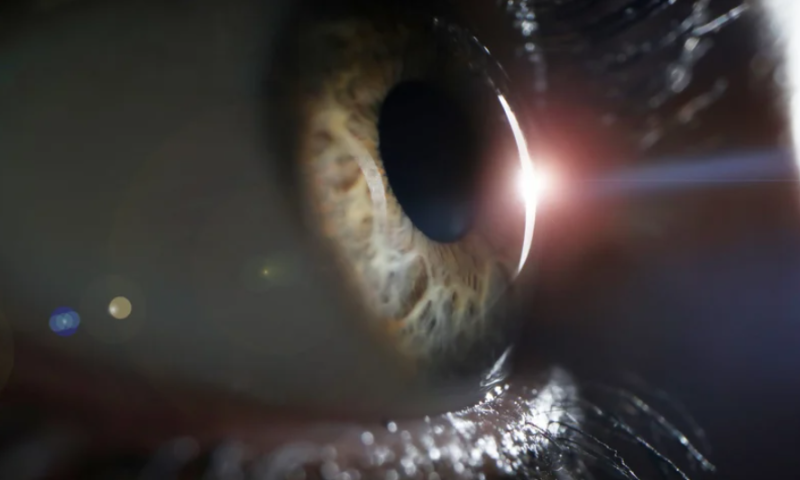

The latest data drop comes from a study of almost 450 patients with geographic atrophy, an advanced form of dry age-related macular degeneration. Participants received intravitreal injections of Zimura, a complement C5 inhibitor, or a sham administration every month for the first year of the study.

After 12 months, Iveric saw a 14.3% difference between the treatment and control groups in the mean rate of growth in the geographic atrophy area. The figure is down on the 27.7% difference seen in the first phase 2/3 clinical trial but was still large enough to cause GATHER2 to hit its primary endpoint. Iveric saw regional variation in GATHER2, with a post hoc analysis showing the difference in the U.S. was 25.5%.

Iveric is yet to link the changes to improved vision, only reporting a favorable trend for Zimura on an eye test, but it thinks it has the data to support a filing for FDA approval early next year. The biotech has hits on two pivotal trials, unlike Apellis, and the lack of intraocular inflammation gives it another potential edge over the front-runner.

While the lack of inflammation has been a strong suit of Zimura since GATHER1, the increased rate of new blood vessels, known as choroidal neovascularization, has been a potential negative. In GATHER2, 6.7% of participants in the Zimura arm had choroidal neovascularization at Month 12 compared to 4.1% of their peers in the sham control group.

Investors responded favorably to the data, sending shares in Iveric up more than 40% in premarket trading to around $14 each. Iveric traded below $1 a share before it released data from GATHER1 in 2019.