Apartment construction is the highest since the 1970s, investment bank says

The Federal Reserve’s preferred measure of inflation will fall below 3% by the end of next year as supply constraints ease, the cost of housing falls and the labor market cools, according to Goldman Sachs .

Such an outcome may allow the Federal Reserve to be less aggressive in its interest rate hiking cycle as its strives to push inflation back down to its 2% target. Markets are highly sensitive to the issue, with stocks and bonds rallying sharply at the end of last week after consumer price data for October came in softer than expected.

The S&P 500 SPX, +0.92% rose by 5.9% last week, its best showing since late June. The tech heavy Nasdaq Composite COMP, +1.88% soared 8.1%, its best weekly performance since March.

In a note published over the weekend, Goldman’s economic research team led by Jan Hatzius, said that the core price consumption expenditures index, the gauge of price pressures that strips out volatile items like food and energy which is closely watched by the U.S. central bank, will drop from the current level of 5.1% to 3.5% by the middle of 2023 and may hit 2.9% by December .

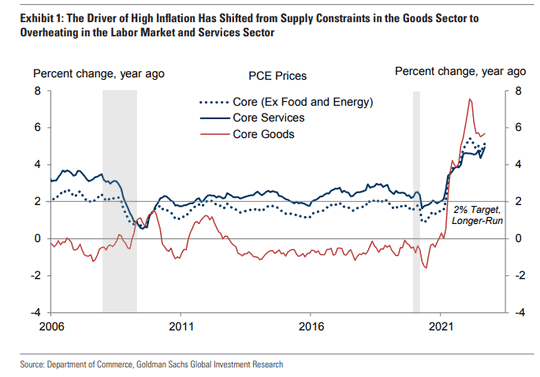

“We expect core inflation to fall significantly in 2023 for three key reasons,” wrote Goldman. ” 1) a negative swing in the contribution from supply-constrained goods categories, following supply-chain improvements, 2) a peak in shelter categories reflecting a further rebound in vacancies and a waning boost from reopening and the return to cities, and 3) slower wage growth, reflecting the continuing rebalancing of the labor market.”

Inflation due to supply constraints are presently adding 0.6 percentage points to the core PCE, but this will shift to minus 0.4 percentage points towards the end of next year, accounting for nearly half the slowdown in the overall core measure.

“Supply chain disruptions and shipping congestion eased significantly in 2022, and inventories of cars and consumer goods have rebounded from extremely depressed levels. The supply of semiconductors in particular has improved dramatically, with automotive microchip shipments now 42% above 2019. This has already catalyzed a 5% decline in the used car CPI, and we assume another 15% drop in 2023,” Goldman explained.

Shelter inflation should peak this spring, Goldman reckons, as recent strong demand for rental properties has already sparked an increase in supply, with 1 million apartments under construction, the biggest pipeline since the mid 1970’s.

“Rental vacancies rates are starting to rebound as a result and are likely to return to pre-pandemic rates next year. Additionally, the boost from continuing leases renewing at market rates now appears to be reflected in the monthly pace of shelter inflation, as CPI microdata reveal that it already embeds an acceleration in renewal rent growth to 8% year-on-year. Also, rent inflation for new leases has fallen sharply: we estimate to just +3% annualized last quarter,” says Goldman.

Finally, a softer jobs market should suppress wage growth and help reduce service sector inflation by late 2023.

“Labor market rebalancing is already lowering wage growth, particularly in sectors with large declines in the jobs-workers gap such as retail and leisure. We expect year-on-year wage growth to fall by 1.5 percentage points to 4% by late 2023, helping to slow inflation in labor-intensive services categories.”

Goldman does note however that the market consensus is for core PCE to fall even lower to 2.7% by late 2023, but reckons this is over optimistic as core services inflation will remain above 4%.

“This reflects a lower but still elevated pace of shelter inflation later in the year, as well as an outright increase in healthcare inflation in part reflecting the largest Medicare fee update in at least 15 years,” the bank concludes.