Shares in the Bristol broker are up after an improved bid by a trio of private equity firms that values the FTSE 100 company at over £5 billion

Shares in FTSE 100 broker and fund supermarket Hargreaves Lansdown (HL) have bounced on news its board will accept a takeover bid from a group of private equity firms.

Yesterday, Hargreaves said US private equity giant CVC Capital, Denmark’s Nordic Capital, and a branch of the Abu Dhabi Investment Authority had made a consortium cash offer of £11.40 per share, valuing the Bristol business at £5.4 billion.

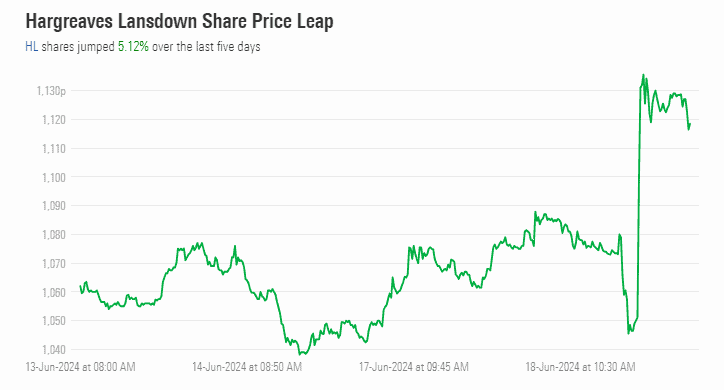

Over the last five days, Hargreaves’ share price is up 5.55% to £11.57, a sign investors are responding positively to the private equity interest.

The latest bid is the fourth such offer submitted to the investment firm. It had previously rejected three approaches on valuation grounds.

The companies now have until 1700 on July 19 to close their deal.

What Will Happen to Hargreaves if it is Sold?

If Hargreaves Lansdown is sold to a private equity business, or businesses, it will become the latest FTSE 100 firm to de-list from the index in favour of private ownership.

As a result, its shares will no longer be available to the public for purchase and trading.

If that occurs, the story would not just illustrate private equity interest in UK PLC, but also underline the malaise gripping the UK’s capital markets, which have struggled to display the compelling valuations on offer in the US and certain emerging markets.

Fund managers, investors, and businesses alike have complained about UK company valuations. This has led some firms to relist in more favourable markets, or simply to ignore the UK as a flotation location altogether.

In September last year, Cambridge-based chip designer Arm Holdings rejected London as a listing opportunity in favour of a place on the the Nasdaq. It shares have since prospered.

Betting firm Flutter also ditched its primary London listing in favour of New York, while the cyber security giant Darktrace, which floated in London 2021, accepted a US private equity bid in April this year.

Christian Kent, managing director of Houlihan Lokey, says the Hargreaves deal underscores the so-called “valuation disconnect” for wealth managers working with both public and private markets.

“With over 25 private equity-backed wealth management firms in the UK, this move isn’t surprising,” he told Morningstar.

“Over time, we expect to see further consolidation among these firms. With robust private equity backing, HL could emerge as a pivotal player in this consolidation through M&A activities.”

Kent now expects that, under private equity ownership, Hargreaves will experience strategic changes that will be designed to address its own historical challenges.

“One area of potential development is the integration of advisory services into Hagreaves’ business model, aligning it more closely with other private equity-backed strategies in the sector,” he says.

Is Hargreaves Lansdown a Healthy Business?

Founded by Peter Hargreaves and Stephen Lansdown in 1981, Hargreaves Lansdown has grown into one of the most successful financial services firms in the UK.

In particular, its proposition of selling units of investment funds on its platform to retail investors helped it provide a cheaper alternative to expensive initial investment charges fund managers typically imposed on their clients. It also streamlined the application process, easing the administrative burden on private investors.

As of March 2024, the business has over £150 billion of assets under management, and serves around 1.86 million clients. For the financial year ending 30 June 2023, it made £402 million in profits.

However, price pressures in the wider wealth management world mean the firm is now struggling to match offerings from competitor retail investing platforms like AJ Bell, Vanguard, and eToro. It has also has also struggled to attract younger customers.

In addition, the business’s reputation has also been affected by the Neil Woodford scandal in the UK. In 2019, Neil Woodford’s £3.7 billion LF Woodford Equity Income fund was frozen after investors frantically tried and failed to withdraw their money from the fund. Woodford has since been hit with an FCA warning notice over his conduct.

Hargreaves had held the fund on its “Wealth 50” “best-buy” list and was highlighting its apparent credentials to its own customers right up until the suspension. The incident put the company in the spotlight and raised serious questions about the way funds are marketed to customers without financial advisers.

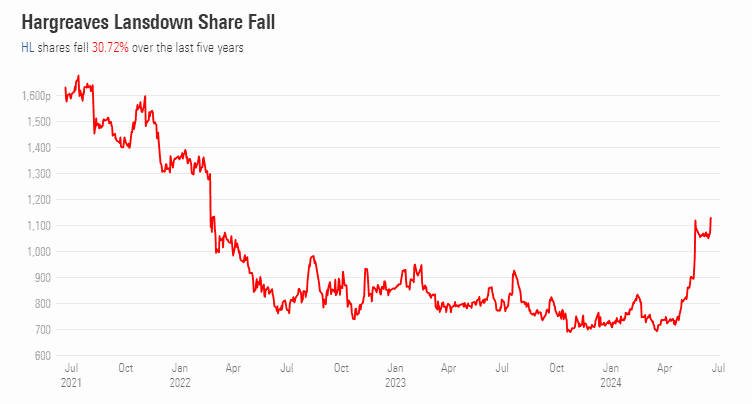

Since 2019, Hagreaves’ share price has been on a downward tear. At its all-time high in that year, its stock was worth over £22 per share.

Which Fund Managers Back Hargreaves Lansdown?

Certain fund managers do still back the business, however, and one is Nick Train, the manager of the Morningstar Bronze-Rated Finsbury Growth & Income Trust (FGT).

Train, who has recently repeatedly apologised for what he called “mortifying” underperformance, remains bullish on Hargreaves, which he says still has growth potential. Though the trust’s performance has been decidedly below par, Hargreaves is not one of the companies badly affecting its track record.

WS Lindsell Train UK Equity Fund (4.46%), Lindsell Train Global Equity Fund (4.20%), and Finsbury Growth & Income (3.08%). According to Morningstar Direct data, Train’s three strategies – WS Lindsell Train UK Equity, Lindsell Train Global Equity, and FGT itself – have a combined exposure of 12% to Hargreaves’ shares.

“[Hargreaves Lansdown] will [have] to take advantage of the data [it] generates, by dint of having more customers and more customer interactions than any of its peers,” Train said in a recent update to FGT investors.