Galecto is giving potential buyers and investors more data to chew over. Three months into a review of strategic alternatives, the biotech has posted topline results from a phase 2a clinical trial of a potential treatment for the bone marrow cancer myelofibrosis.

Boston-based Galecto laid off 70% of its staff and began looking for a buyer in September. The review followed the phase 2 failure of an inhaled treatment for idiopathic pulmonary fibrosis. While looking for a way out of its predicament, the biotech continued to track patients in a phase 2a trial of another drug candidate, the LOXL2 inhibitor GB2064.

Galecto posted topline data from the trial after the market closed Thursday. The study dosed 18 people with myelofibrosis, including 11 who had previously received Incyte’s JAK inhibitor Jakafi. Ten patients discontinued treatment because of an adverse event or disease progression.

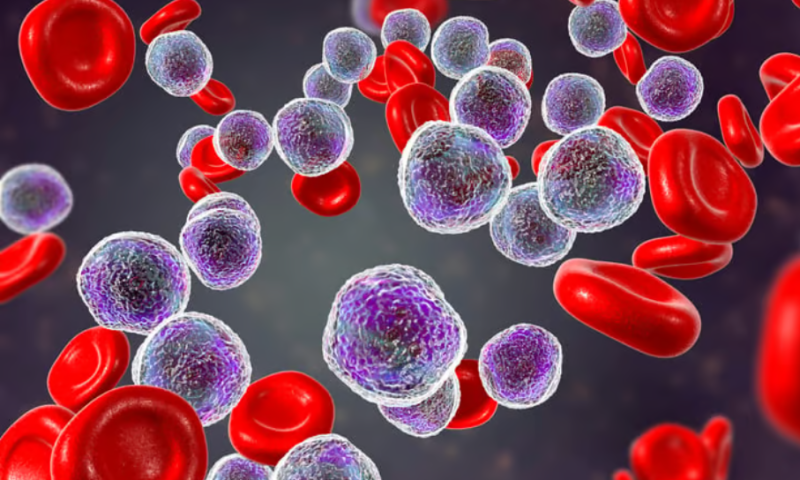

Six of the 10 evaluable patients who received the drug candidate for at least six months had a one-grade or greater reduction in collagen fibrosis of the bone marrow. Fibrosis affects the production of blood cells, leading to anemia, weakness and fatigue. Galecto presented the finding as evidence that “GB2064 could impact the progression of the disease and be disease-modifying.”

The six patients with reduced fibrosis had stable hematological parameters, including hemoglobin, white blood cell count and platelets. One patient had a 35% or greater reduction in spleen volume. Two people experienced a 50% or greater reduction on a symptom scale. Four patients have entered the extension stage of the study.

In a statement, Galecto CEO Hans Schambye said the study showed a “strong anti-fibrotic impact in a very challenging patient population.” However, the biotech will defer decisions on funding more trials of GB2064 until it has completed its strategic alternative process.

Investors appeared unsure what to make of the data. After spiking in the immediate aftermath of the news, Galecto’s share price fell 3% to 61 cents in pre-market trading.