Small investors are flocking to high-flying growth stocks after the brokerage industry made trading free.

In the months since major brokers cut fees to zero, names like Tesla and Virgin Galactic have seen double-digit moves and become fan-favorites favorites for retail traders.

Wells Fargo analyst Christopher Harvey said the “seeds” for the recent moves in Tesla and Virgin Galactic were first planted in October when online brokers started slashing fees.

“This newly-found confidence and risk appetite among retail investors does not seem like a great signal to us,” Harvey said in a note to clients Friday. “It has been somewhat of a contra-indicator and mainly tells us that the great equity run is mostly behind us not in front of us.”

In October, Charles Schwab stopped charging trading fees for U.S. stocks, exchange traded funds and options. It previously charged $4.95 per trade. Rival firms TD Ameritrade, Interactive Brokers, E-Trade and Fidelity all took the same step in slashing commissions. Start-up Robinhood, which said in December it has 10 million users, first made inroads in the brokerage world by offering free trades.

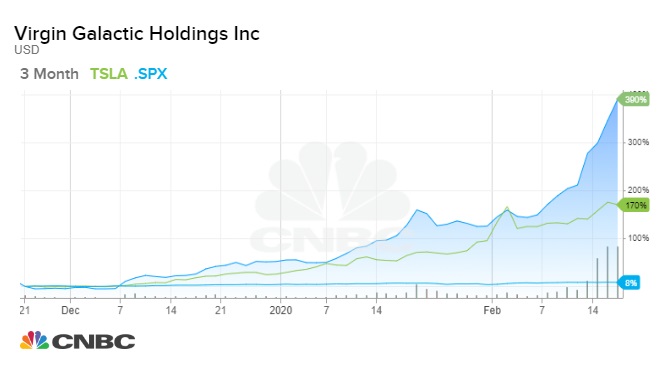

Shares of Tesla are up more than 170% in the past three months, while Virgin Galactic is up more than 390%. The S&P 500 is up 8% in the same time period.

Overall, retail activity is up significantly in the past two months. Daily active revenue trades — a metric used by the brokerage industry before trading was free — have jumped more than 30% at the major brokers and are up “significantly” since the move to zero, according to Richard Repetto, principal at Sandler O’Neill + Partners.

Charles Schwab, TD Ameritrade and E-Trade have seen a more than 30% increase month over month in so-called DARTs, according to data from Piper Sandler.

Fidelity told CNBC this week that that Virgin Galactic was bought more than any other stock earlier this week — topping Apple, Tesla and others. Fintech company SoFi said this week saw “by far the largest purchase day ever for the stock” on its platform. It was also the most-traded stock on SoFi overall. “Trading activity on [Virgin Galactic is] up 7x this year compared to 2019,” SoFi told CNBC.

Firms have also been lowering the barrier for entry by offering the option to trade fractions of a share. For as little as a dollar, investors can buy names like Amazon which closed above $2,000 per share Friday. SoFi began offering fractional trading in July. Charles Schwab, Square and Robinhood have since announced the same “fractional trading” feature.

SoFi said there have been a record number of traders buying expensive stocks in fractions of a share. In February, SoFi saw the most users buying a Tesla “stock bit” of a security in the platform’s history.