Park Hotels & Resorts Inc (NYSE:PK) – Research analysts at Jefferies Financial Group cut their Q2 2019 earnings estimates for shares of Park Hotels & Resorts in a note issued to investors on Monday, April 22nd. Jefferies Financial Group analyst D. Katz now expects that the financial services provider will earn $0.89 per share for the quarter, down from their prior estimate of $0.90. Jefferies Financial Group also issued estimates for Park Hotels & Resorts’ FY2019 earnings at $3.02 EPS, Q1 2020 earnings at $0.70 EPS, Q2 2020 earnings at $0.94 EPS, Q3 2020 earnings at $0.72 EPS, Q4 2020 earnings at $0.77 EPS and FY2020 earnings at $3.15 EPS.

PK has been the topic of a number of other research reports. JPMorgan Chase & Co. set a $29.00 price target on Park Hotels & Resorts and gave the company a “hold” rating in a report on Thursday, February 28th. Zacks Investment Research downgraded Park Hotels & Resorts from a “hold” rating to a “sell” rating in a report on Friday, February 15th. TheStreet downgraded Park Hotels & Resorts from a “b-” rating to a “c” rating in a report on Tuesday, January 22nd. Goldman Sachs Group upgraded Park Hotels & Resorts from a “sell” rating to a “neutral” rating and set a $27.00 price target on the stock in a report on Thursday, January 10th. Finally, Nomura lifted their price target on Park Hotels & Resorts from $32.00 to $36.00 and gave the company a “buy” rating in a report on Thursday, February 28th. Seven analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. The company currently has a consensus rating of “Hold” and an average price target of $33.00.

Shares of PK stock opened at $31.26 on Wednesday. Park Hotels & Resorts has a 1-year low of $25.30 and a 1-year high of $34.27. The company has a current ratio of 1.55, a quick ratio of 1.55 and a debt-to-equity ratio of 0.53. The firm has a market cap of $6.17 billion, a PE ratio of 10.56, a price-to-earnings-growth ratio of 2.11 and a beta of 1.28.

Park Hotels & Resorts (NYSE:PK) last issued its quarterly earnings results on Wednesday, February 27th. The financial services provider reported $0.27 earnings per share for the quarter, missing analysts’ consensus estimates of $0.67 by ($0.40). Park Hotels & Resorts had a net margin of 17.25% and a return on equity of 8.29%. The business had revenue of $686.00 million for the quarter, compared to analysts’ expectations of $659.09 million. During the same quarter in the prior year, the firm posted $0.68 EPS. The business’s quarterly revenue was up .0% compared to the same quarter last year.

The company also recently disclosed a quarterly dividend, which was paid on Monday, April 15th. Investors of record on Friday, March 29th were given a dividend of $0.45 per share. The ex-dividend date was Thursday, March 28th. This represents a $1.80 dividend on an annualized basis and a yield of 5.76%. Park Hotels & Resorts’s payout ratio is 60.81%.

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Rehmann Capital Advisory Group boosted its position in Park Hotels & Resorts by 110.2% during the third quarter. Rehmann Capital Advisory Group now owns 807 shares of the financial services provider’s stock valued at $26,000 after purchasing an additional 423 shares during the last quarter. Zurcher Kantonalbank Zurich Cantonalbank boosted its position in Park Hotels & Resorts by 1.1% during the fourth quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 54,509 shares of the financial services provider’s stock valued at $1,416,000 after purchasing an additional 582 shares during the last quarter. State of Alaska Department of Revenue boosted its position in Park Hotels & Resorts by 0.9% during the first quarter. State of Alaska Department of Revenue now owns 88,060 shares of the financial services provider’s stock valued at $2,735,000 after purchasing an additional 776 shares during the last quarter. Pekin Singer Strauss Asset Management IL boosted its position in Park Hotels & Resorts by 1.7% during the fourth quarter. Pekin Singer Strauss Asset Management IL now owns 50,300 shares of the financial services provider’s stock valued at $1,307,000 after purchasing an additional 850 shares during the last quarter. Finally, Robecosam AG boosted its position in Park Hotels & Resorts by 28.6% during the fourth quarter. Robecosam AG now owns 4,500 shares of the financial services provider’s stock valued at $116,000 after purchasing an additional 1,000 shares during the last quarter.

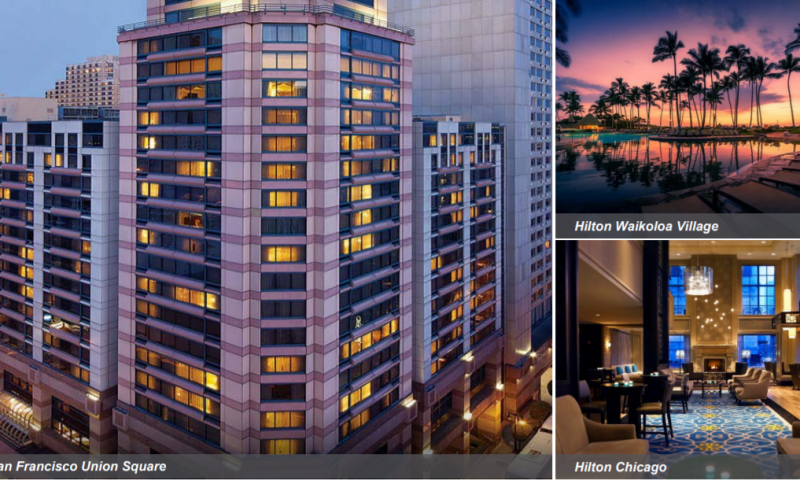

About Park Hotels & Resorts

Park is the second largest publicly traded lodging REIT with a diverse portfolio of market-leading hotels and resorts with significant underlying real estate value. Park’s portfolio consists of 54 premium-branded hotels and resorts with over 32,000 rooms, a majority of which are located in prime United States markets with high barriers to entry.