Apple turns lower after hitting record high

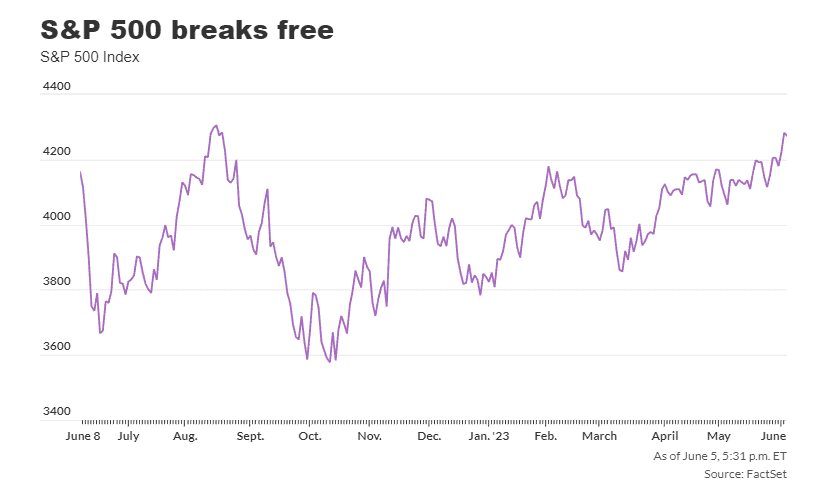

U.S. stocks ended slightly lower Monday afternoon, after the S&P 500 failed to hold a gain that would have seen it meet the threshold for exiting bear-market territory.

Meanwhile, shares of Apple Inc. AAPL, -0.76% ended the day with a loss, pulling back from a record high scored ahead of a WWDC developer event at which the company unveiled a mixed-reality headset.

What’s happening

- The Dow Jones Industrial Average DJIA, -0.59% fell 199.90 points, or 0.6%, to close at 33,562.86.

- The S&P 500 SPX, -0.20% fell 8.58 points, or 0.2%, to finish at 4,273.79, after trading as high as 4,299.28. A close above 4,292.44 would mark a rise of 20% or more from its October low, meeting widely used criteria for an exit from the large-cap benchmark’s long run in bear-market territory.

- The Nasdaq Composite COMP, -0.09% edged down 11.34 points, or 0.1%, to end at 13,229.42.

What’s driving markets

Stocks had rallied in recent sessions on the removal of fears of a U.S. debt default and on hopes that the labor market is showing an economy that can avoid a sharp slowdown in the face of the Federal Reserve’s inflation battle.

The S&P 500 surged 1.5% on Friday to its highest close since August after data showed the U.S. created net 339,000 jobs in May, much more than expected, but with cooling wage growth and a rising unemployment rate that may allow the Fed to pause its rate-hiking cycle in June.

Investors were also weighing the implications of the resolution of the debt-ceiling crisis on liquidity. Having run down its cash balance, the Treasury Department is set to unleash a deluge of bills that could drain liquidity from the financial system and raise short-term borrowing costs, said Seema Shah, chief global strategist at Principal Asset Management.

That could offer another challenge for beleaguered banks, she said.

Meanwhile, investors “are now refocusing on sticky inflation and the extremely tight labor market, prompting a repricing of the market’s rate outlook. Not only is a further policy-rate hike likely, but rate cuts this year are being steadily priced out,” Shah said.

Investors have significantly priced out expectations for a Fed rate hike when policy makers conclude a two-day meeting on June 14. Fed-funds futures traders have priced in a roughly 21% probability of a quarter-point rate hike this month but see a 64% chance rates will have risen by a quarter- or half-point by the conclusion of the Fed’s July policy meeting, according to the CME FedWatch tool.

“While we believe enough progress has been made on the inflation front that the Fed should conclude its rate hiking efforts, we think they may pause on rates in June but not fully remove their bias toward higher rates until the employment market shows sustained signs of weakening,” said Brent Schutte, chief investment officer at Northwestern Mutual Wealth Management Company, in a note.

That makes it unlikely a soft landing for the economy will materialize, he wrote.

A rise in oil prices after Saudi Arabia said it would trim its production by 1 million barrels a day seemed to be having little impact on broader market sentiment.

The Institute for Supply Management said its services index fell to a five-month low of 50.3% last month from 51.9% in April. A reading above 50% indicates activity is expanding, but the U.S. economy has slowed markedly from a year ago. Economists polled by The Wall Street Journal had expected the services index to rise to 51.8%.

Companies in focus

- Shares of Palo Alto Networks Inc. PANW, +4.40% jumped 4.4% after S&P Dow Jones promoted the $66 billion cybersecurity company to the S&P 500 index in a series of quarterly index adjustments to account for market cap.

- Planet Fitness Inc. PLNT, +3.71% shares rose 3.6%, while shares of Doximity Inc. DOCS, +2.90% gained 2.8% after S&P moved the stocks to its S&P MidCap 400 index MID, -1.05%.