The Dow advanced modestly Monday to notch its 23rd record close of the year

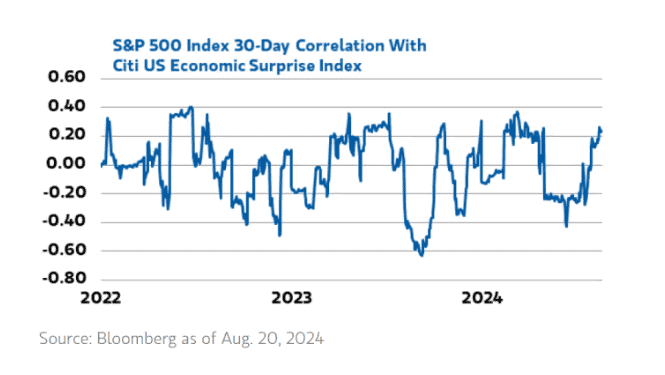

The Dow Jones Industrial Average rose to a record peak Monday, recovering after economic surprises to the upside were once again viewed as “good news” for the stock market, according to Morgan Stanley’s wealth-management business.

“Good is good again,” Morgan Stanley Wealth Management said in a note Monday. “Stock markets have regained their footing and retraced toward all-time highs.”

The note said that “a reversal in the negative correlation between market moves and economic news was critical to the stabilization” of the U.S. stock market.

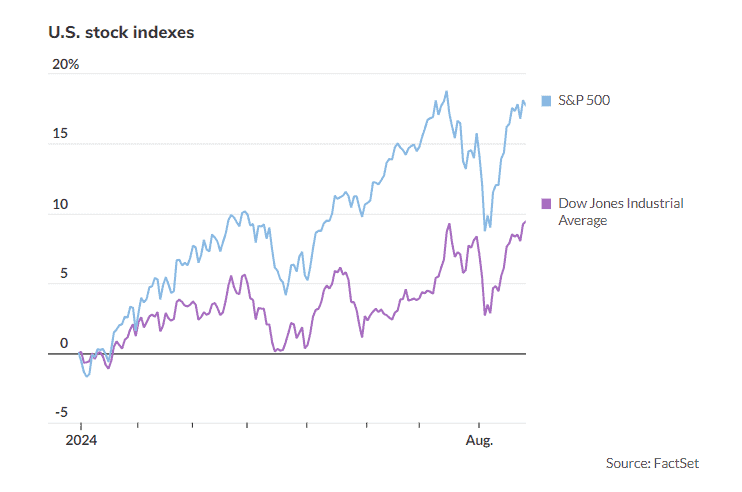

Stocks have rebounded from a ”rough patch” stretching from mid-July through the first week of August, “when market fears over a potential recession and Federal Reserve policy mistake were amplified by yen-carry-trade dynamics,” according to the note.

Investors are watching the Fed’s monetary policy closely, with some worrying the central bank risks unnecessarily causing a recession by leaving interest rates too elevated for too long.

But with a rate cut by the Fed appearing “all but guaranteed” in September, “good news is good again, supporting soft-landing forecasts,” Morgan Stanley said, referring to recent U.S. economic reports that were stronger than Wall Street had anticipated. “Stronger retail sales and Institute for Supply Management services PMI data catalyzed the switch,” according to the note.

U.S. stocks closed sharply higher Friday as investors appeared encouraged by Fed Chair Jerome Powell’s Jackson Hole speech, in which he said “the time has come” for rate cuts.

The S&P 500 ended Friday 0.6% below its record close, with the index notching a second straight week of gains after an early August selloff sparked by a softer-than-expected U.S. jobs report.

While the S&P 500 SPX-0.32% retreated Monday to 5,616.84, the index remained not far off its all-time closing high of 5,667.20 on July 16. The Dow DJIA0.16% rose modestly Monday to 41,240.52, notching its 23rd record close of 2024, according to Dow Jones Market Data.

The central bank has been aiming to engineer a soft landing for the U.S. economy, attempting to lower inflation to its 2% target through elevated rates without triggering a recession. Investors anticipate the Fed will begin lowering rates at its next policy meeting, which concludes Sept. 18, as inflation has significantly eased and the labor market has shown signs of cooling.

Fresh data from the Fed’s favored inflation gauge is due on Friday, when investors will see data from the personal-consumption-expenditures price index for July. A revised estimate of U.S. gross-domestic-product growth during the second quarter is scheduled to be released Thursday.

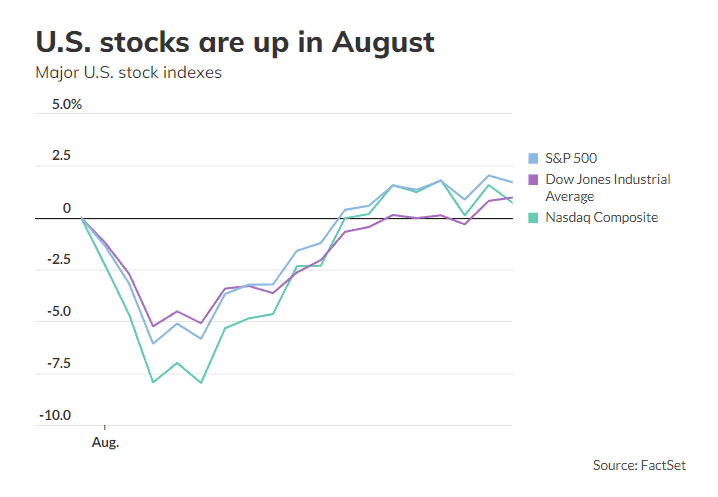

U.S. stocks ended Monday mostly down, with the Dow closing 0.2% higher while the S&P 500 fell 0.3% and the technology-heavy Nasdaq Composite COMP-0.85% dropped 0.9%, according to Dow Jones Market Data.

Still, all three major benchmarks have posted gains so far in August.

The Dow has gained 1% this month through Monday, while the S&P 500 has risen 1.7% and the Nasdaq has advanced 0.7%, FactSet data show.