Company priced IPO at $33 a share late Tuesday

Coursera Inc.’s stock bolted out of the gate Wednesday on its first day of trading with shares of the online-education company rallying as much as 25%.

Shares of Coursera COUR, 19.87% opened at $39 a share, 18% above their initial-public-offering price Wednesday, reached an intraday high of $45.98, and closed up 36% at $45.00.

The IPO priced at $33 a share late Tuesday, at the high end of Coursera’s expected range of $30 to $33 a share.

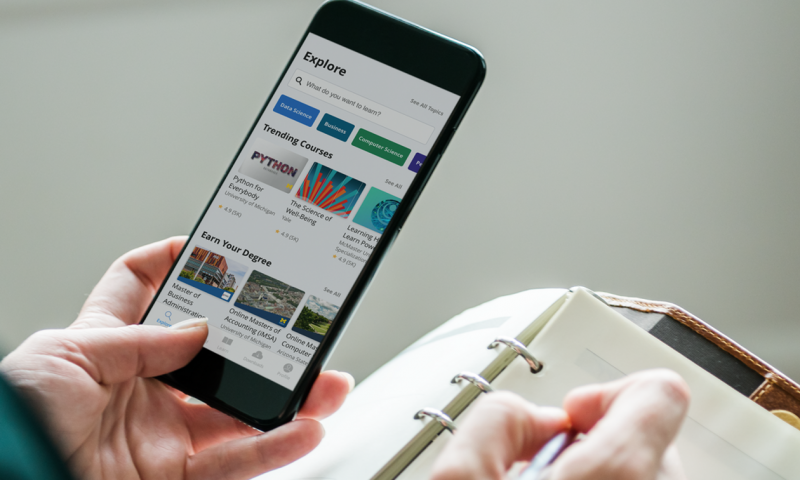

Coursera offers a variety of free and paid online classes, as well as certificate programs and enterprise-oriented skills courses for employees. The company also works with universities on degree programs, through which the schools admit and teach online courses while leveraging Coursera’s platform and technology.

Not only did the COVID-19 pandemic accelerate Coursera’s business but also it bumped up the company’s plans to go public, said Coursera Chief Financial Officer Ken Hahn in an interview with MarketWatch.

“It accelerated the business, as people couldn’t go out anymore, they ended up taking a lot of Coursera courses,” Hahn said. “The plan was to be public at some point, it just pushed it faster as we saw the world changing.”

The company generated $293.5 million in revenue during 2020, up from $184.4 million in 2019. Coursera recorded a net loss of $66.8 million in 2020, whereas it posted a $46.7 million loss a year prior. As of the end of 2020, 77 million people had registered to use the Coursera platform.

Coursera sees numerous growth avenues ahead. The company is looking to grow the number of businesses using its enterprise offering while also expanding to serve more employees who work for current enterprise customers. Coursera also points to “a substantial opportunity to increase the number of bachelor’s and master’s programs in new and existing academic disciplines within our current network of university partners,” according to the company’s prospectus.

Most of the people participating in these degree programs are “a different type of student,” Hahn said. Typically they’re working adults. “They can take these courses and advance their careers without having to uproot their lives and quit jobs,” he said.

The pandemic created a growing awareness of online-education tools, Coursera said in its prospectus, and the company argues that digital learning tools could help smooth out access to quality education.

“The need for technological change in education has been exacerbated by the recent global pandemic,” Coursera said in its prospectus, predicting that the future of education could “be characterized by blended classrooms, job-relevant education, and lifelong learning” with online education serving as “the primary means of meeting the urgent global demand for emerging skills.”

Coursera’s IPO comes as the Renaissance IPO ETF IPO, 2.57% has gained 136% over the past 12 months and as the S&P 500 SPX, 0.89% has risen 54% in that span.