Wedbush’s Moshe Katri initiates Coinbase at outperform, but share-price target of $275 is lowest on the Street

Shares of Coinbase Global Inc. bounced sharply Thursday, putting the stock on track to snap a six-day losing streak, after a bullish call from Wedbush analyst Moshe Katri, who said the cryptocurrency trading platform’s business model is “more resilient” than perceived.

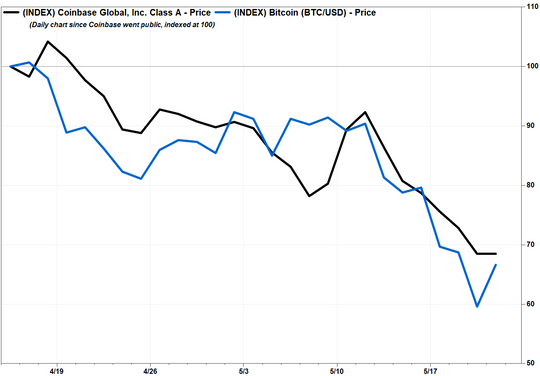

The stock COIN, +3.83% climbed 4.1% in afternoon trading. It had plunged 34.8% over the previous six sessions amid a selloff in cryptocurrencies, to close Wednesday 10.1% below the $250 reference price when it went public in mid-April.

In comparison, bitcoin BTCUSD, 1.59%, which bounced 6.3% on Thursday, had plummeted 34% over the past six days, according to FactSet data, while the S&P 500 index SPX, +1.06%, which rose 1.2% Thursday, had slipped 0.9%.

Wedbush’s Katri started coverage of Coinbase with an outperform rating and $275 share-price target, calling the company the one-stop-shop ecosystem for crypto.

The reasons he’s bullish:

- First-mover advantage: Coinbase is “the default starting place for new user journeys into the crypto economy,” with over 90% of retail users boarding the platform organically or through word-of-mouth.

- Growing share of crypto assets on its platform, with a “dominant” share in two top crypto assets, bitcoin and etherum ETHUSD, 0.36%.

- Integration of blockchain technology and traditional finance enables Coinbase to become part of the payments ecosystem: “[Coinbase] creates trusted and easy-to-use products, crypto assets that can be dynamically transmitted, stored and programmed to serve the needs of an increasingly digital and globally connected economy.”

- Diversifying trading-revenue exposure, with the expansion of the ecosystem and creation of an entire set of services.

Katri addressed investor concerns over the recent price volatility, and competition, by saying the Coinbase business model is likely “more resilient than perceived” given sensitivity to trading volume, with roughly 2% of revenue is directly linked to asset prices.

“Furthermore, the market is yet to fully appreciate the monetization potential of [Coinbase’s] ecosystem of ancillary products and services,” Katri wrote in a note to clients.

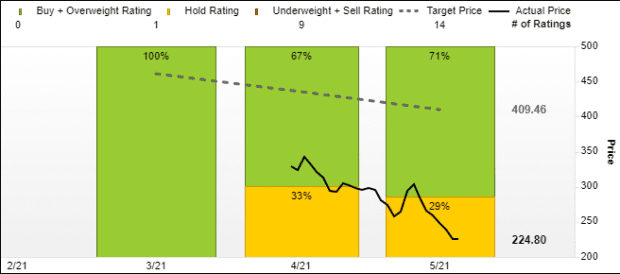

Katri is among the majority on Wall Street who are bullish on Coinbase, as 10 of the 14 analysts surveyed by FactSet have the equivalent of a buy rating on the company, while four rate it the equivalent of hold. There are no bears.

However, Katri is the least bullish analyst, as his price target is the lowest on the Street, and 33% below the average target of $409.45.

Separately, fellow bull Owen Lau, who rates Coinbase outperform with a $434 price target, came out in defense of the company, saying the stock’s recent selloff is overdone.

“Our analysis shows that at current valuation, [Coinbase’s stock] has not only priced in a substantial fee cut but also crypto winter has arrived,” Lau wrote in a research note. “We continue so see a sharp dislocation between [Coinbase’s] fundamentals and its share price.”

Lau said he believes there is a strong demand case of digital assets, and the underlying technology as an alternative, and the crypto investor community “is more resilient than many people have thought.”