Wall Street Sets More Records and Closes a 6th Straight Winning Week

U.S. stocks rose to records to close out their latest winning week

U.S. stocks rose to records to close out their latest winning week

It’s a trend that has surprised many: Why, despite being squeezed by high prices, have Americans kept spending at retail stores and restaurants at a robust pace

The average rate on a 30-year mortgage in the U.S. moved higher for the third week in a row and reached the highest level since late August

Stock Markets

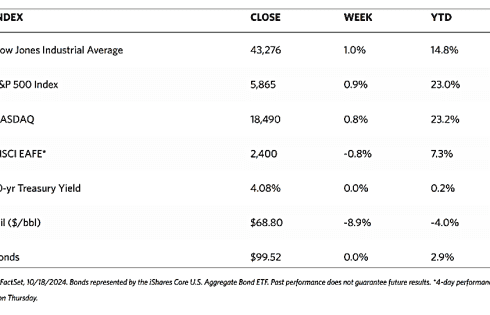

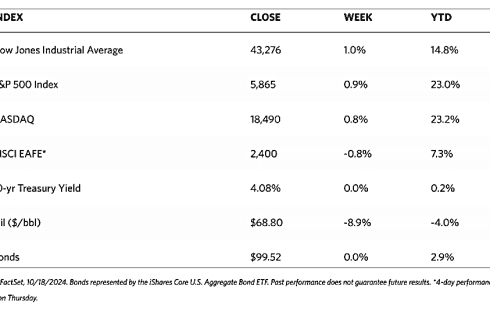

All of the major stock market indexes scored gains week-on-week as risk perception dropped. The 30-stock Dow Jones Industrial Average (DJIA) added 0.96% over the week which mirrored the performance of the Total Stock Market Index which likewise rose by 0.96%. The broad S&P 500 Index climbed by 0.85% with the Small Cap 600, Mid Cap 400, and Super Composite 1500 all sowing more than 1% gains. The technology-heavy Nasdaq Stock Market Composite advanced by 0.80% while the NYSE Composite climbed by 0.88%. The investor risk perception indicator, the CBOE Volatility Index (VIX) fell by 11.88%.

The utilities and real estate sectors fueled the advancement of the S&P 500 Index. Energy stocks tracked the pullback of oil prices that weakened as anticipation of possible Israeli attacks on Iran’s oil and gas infrastructure abated. Down the market cap spectrum, returns were stronger as evidenced by the outperforming of the small-cap Russell 2000 Index and the S&P MidCap 400 Index.

The Nasdaq Composite rallied during Friday’s trading session after lagging for much of the week. The buying interest was buoyed by strong quarterly earnings reports from Taiwan Semiconductor Manufacturing, a company that operates foundries that make advanced digital semiconductors. Excitement was reignited for artificial intelligence (AI)-related stocks in the Nasdaq. Other companies reported surprise results on the upside and spurred the technology-heavy index. An example is Netflix which grew its subscriber number and expanded its operating margins by more than expected in the third quarter.

U.S. Economy

The value of U.S. retail sales increased by 0.4% last month, accelerating from the 0.1% August reading, which is an encouraging sign for third-quarter economic growth. The September uptick of 0.4% was slightly higher than the consensus forecast of 0.3%. Strength in consumer spending was broad-based, as 10 of the 13 retailer categories reported higher sales for the month. A measure of retail sales that excluded auto dealerships, building materials, food services, and gas stations exhibited the fastest growth rate in three months, expanding by 0.7% from the preceding month. Industrial production fell by 0.3% in September after increasing by 0.3% in August. The final statistic for August was revised downward from an initial estimate of 0.8%. The weakness was attributed by the Federal Reserve to Hurricanes Francene and Helene together with a Boeing aircraft machinist strike.

In the first week of October, new applications for unemployment benefits spiked. This was partly brought about the damage and disruptions caused by Hurricane Helene in late September across several Southeastern States. During the week ended October 12, however, initial jobless claims fell unexpectedly to 241,000, constituting a decline of about 19,000 filings. The number of people receiving jobless benefit for more than one week rose by 9,000 to 1.867 million, which is short of the consensus estimate of 1.876 million.

Metals and Mining

Prices of gold and silver rallied above $2,700 and $33, respectively, in one of the quietest bull markets analysts have encountered. Because it was not clear to analysts who attended the London Bullion Market Association’s (LBMA) 2024 Precious Metals Conference in Florida who exactly was buying gold and silver at high prices, the sense of optimism brought about by the rally was not overly bullish. Analysts see gold prices rising to as high as $2,941 per ounce, but not quite above $3,000 per ounce before the end of 2024. But sentiments suggest that even at these record highs, there remains some potential upside. It is probably best that the advance is measured rather than euphoric, the latter usually accompanying a market peak. While the upcoming presidential election in the U.S. may mean that markets can peak at that point, the positive may not cool off immediately thereafter because whichever candidate wins, the geopolitical uncertainty is expected to remain elevated.

The spot price of precious metals recorded gains during the week. Gold, which ended last week at $2,656.59, closed this week at $2,721.46 per troy ounce for a gain of 2.44%. Silver began at the prior week’s close at $31.54 and ended this week at $33.72 per troy ounce to register an increase of 6.91%. Platinum came from $987.76 last week and closed this week at $1,015.31 per troy ounce for a gain of 2.79%. Palladium closed a week ago at $1,071.21 and this week at $1,084.09 per troy ounce to return 1.20% for the week. The three-month LME prices of industrial metals were mixed for the week. Copper lost by 1.00% for the week from its previous weekly close at $9,723.00 to close at $9,625.50 per metric ton. Aluminum ended one week ago at $2,586.00 and this week at $2,612.00 per metric ton for a gain of 1.01%. Zinc came from $3,086.50 one week ago to end this week at $3,089.50 per metric ton to realize a slight gain of 0.10%. Tin came from its prior closing price of $32,817.00 to end this week at $31,313.00 per metric ton for a decline of 4.58%.

Energy and Oil

As ICE Brent futures slid back to $79 per barrel, where it was last seen in early October, geopolitical risk premiums have slowly diminished from oil prices. Anticipation that Israel would launch retaliatory attacks against Iran sustained higher oil price levels, but coinciding with this wait was the slowdown of China’s economic growth to 4.6% in the third quarter of 2024. Furthermore, investors have been alerted to the downside of Chinese demand, the fifth consecutive month-over-month decline in Chinese refinery runs, which has deflated the bullish sentiment once more. In other news, the International Energy Agency (IEA) released a warning that world fossil fuel demand will hit its peak by the end of this decade. After it has done so, the surplus in fossil fuel supplies would enable it to spend more on renewables, which is seen as the start of the “age of electricity.”

Natural Gas

For the report week from Wednesday, October 9, to Wednesday, October 16, 2024, the Henry Hub spot price fell by $0.21 from $2.42 per million British thermal units (MMBtu) to $2.21/MMBtu. Concerning Henry Hub futures, the price of the November 2024 NYMEX contract decreased by $0.29, from $2.660/MMBtu at the start of the report week to $2.367/MMBtu by the week’s end. The price of the 12-month strip averaging November 2024 through October 2025 futures contracts fell by $0.19 to $2.945/MMBtu. At most major pricing locations, price changes ranged from a decrease of $0.70 at SoCal Citygate to an increase of $0.34 at the Waha Hub.

International natural gas futures prices climbed this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia advanced by $0.07 to a weekly average of $13.17/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $0.01 to a weekly average of $12.79/MMBtu. In the week last year that corresponded to this report week (the week beginning October 11 and ending October 18, 2023), the prices were $16.50/MMBtu in East Asia and $15.78/MMBtu at the TTF.

World Markets

The pan-European STOXX Europe 600 Index closed the week 0.58% higher in local currency terms as the markets were replete with expectations of a second consecutive interest rate cut by the European Central Bank (ECB) in furtherance of the easing of monetary policy. The major regional stock indexes advanced: France’s CAC 40 Index rose by 0.46%, Germany’s DAX gained 1.46%, and Italy’s FTSE MIB surged by 2.61%. The UK’s FTSE 100 Index added 1.27%. In line with expectations, the ECB cut its key deposit rate by a quarter of a percentage point to 3.25% in the first back-to-back rate reduction in 13 years. The disinflationary process was pronounced by ECB President Christine Lagarde to be “well on track” based on recent downside surprises in economic activity data. Financial markets appeared to expect the ECB to reduce rates in December to support the economy, although the ECB reiterated that it would not pre-commit to a particular rate path. According to the European Commission’s statistics office, the annual inflation came in at 1.7% in September. This is well below the ECB’s stated target of 2% and a downward revision from its initial estimate of 1.8%. The ECB does not expect the trend to be constant, however, as it forecasts that inflation will rise again before receding once more toward the 2% target next year.

Japan’s stock markets fell in local currency terms due to easing domestic inflation in September. While expected, this led to some speculation that the Bank of Japan (BoJ) may be less likely to raise interest rates again this year. The Nikkei 225 Index fell by 1.58% and the broader TOPIX lost 0.64%. BoJ officials observed that the prerequisite conditions for beginning monetary policy normalization have already been met, namely the breadth of items undergoing price increase as cited by BoJ Board Member Seiji Adachi. Nevertheless, rate hikes should be implemented at a very gradual pace. Adachi cautioned against a drastic change in policy given uncertainties surrounding the global economic outlook and domestic wage growth. The yield on the 10-year Japanese government bond rose to 0.97% from 0.94% at the end of the prior week. The yen weakened from the low to the high end of the JPY 149 range against the U.S. dollar. According to Japan’s top currency diplomat, Atsushi Mimura, recent moves in the yen were described as “somewhat one-sided and rapid.” The yen is once more trending towards levels where authorities intervened earlier in the year to stem the currency’s decline. Japan’s core consumer price index (CPI) indicated that inflation eased in September, although the country’s exports for that month declined from year-ago levels, the first decline in 10 months, due to weak Chinese demand.

China’s stocks rose in response to more support measures unveiled by the central bank after data indicated that deflationary pressures grew more entrenched in the economy. The Shanghai Composite Index advanced 1.36% in local currency terms while the blue-chip CSI 300 gained 0.98%. The Hong Kong benchmark Hang Seng Index fell by 2.11%. In the third quarter, China’s economy expanded by 4.6% year-on-year, exceeding consensus estimates. The growth rate was slightly lower than the second quarter expansion of 4.7% and continues to fall short of Beijing’s stated target of “around 5%.” The economy grew by 0.9% on a quarterly basis. Other economic data point to signs of improvement. In September, industrial production rose by a better-than-expected 5.4% from last year and up from 4.5% in August. Retail sales grew by 3.2% year-on-year which exceeded forecasts and further accelerated from the 2.1% growth recorded in August on the back of higher sales of household appliances, a major contributing factor. Annual inflation was at its lowest level in three months, registering 0.4% in September. This fell below consensus estimates and marked a slowdown from the August reading of 0.6%. Core inflation (excluding food and energy costs) increased by 0.1%, the lowest since February 2021. The producer price index dropped by a larger-than-expected 2.8% from last year, deepening from the 1.8% drop in August.

The Week Ahead

Included among the important economic reports scheduled for release this week are PMI data, new home sales, and final consumer sentiment for October.

Key Topics to Watch

Markets Index Wrap-Up

Stock Markets

All of the major stock market indexes scored gains week-on-week as risk perception dropped. The 30-stock Dow Jones Industrial Average (DJIA) added 0.96% over the week which mirrored the performance of the Total Stock Market Index which likewise rose by 0.96%. The broad S&P 500 Index climbed by 0.85% with the Small Cap 600, Mid Cap 400, and Super Composite 1500 all sowing more than 1% gains. The technology-heavy Nasdaq Stock Market Composite advanced by 0.80% while the NYSE Composite climbed by 0.88%. The investor risk perception indicator, the CBOE Volatility Index (VIX) fell by 11.88%.

The utilities and real estate sectors fueled the advancement of the S&P 500 Index. Energy stocks tracked the pullback of oil prices that weakened as anticipation of possible Israeli attacks on Iran’s oil and gas infrastructure abated. Down the market cap spectrum, returns were stronger as evidenced by the outperforming of the small-cap Russell 2000 Index and the S&P MidCap 400 Index.

The Nasdaq Composite rallied during Friday’s trading session after lagging for much of the week. The buying interest was buoyed by strong quarterly earnings reports from Taiwan Semiconductor Manufacturing, a company that operates foundries that make advanced digital semiconductors. Excitement was reignited for artificial intelligence (AI)-related stocks in the Nasdaq. Other companies reported surprise results on the upside and spurred the technology-heavy index. An example is Netflix which grew its subscriber number and expanded its operating margins by more than expected in the third quarter.

U.S. Economy

The value of U.S. retail sales increased by 0.4% last month, accelerating from the 0.1% August reading, which is an encouraging sign for third-quarter economic growth. The September uptick of 0.4% was slightly higher than the consensus forecast of 0.3%. Strength in consumer spending was broad-based, as 10 of the 13 retailer categories reported higher sales for the month. A measure of retail sales that excluded auto dealerships, building materials, food services, and gas stations exhibited the fastest growth rate in three months, expanding by 0.7% from the preceding month. Industrial production fell by 0.3% in September after increasing by 0.3% in August. The final statistic for August was revised downward from an initial estimate of 0.8%. The weakness was attributed by the Federal Reserve to Hurricanes Francene and Helene together with a Boeing aircraft machinist strike.

In the first week of October, new applications for unemployment benefits spiked. This was partly brought about by the damage and disruptions caused by Hurricane Helene in late September across several Southeastern States. During the week ended October 12, however, initial jobless claims fell unexpectedly to 241,000, constituting a decline of about 19,000 filings. The number of people receiving jobless benefit for more than one week rose by 9,000 to 1.867 million, which is short of the consensus estimate of 1.876 million.

Metals and Mining

Prices of gold and silver rallied above $2,700 and $33, respectively, in one of the quietest bull markets analysts have encountered. Because it was not clear to analysts who attended the London Bullion Market Association’s (LBMA) 2024 Precious Metals Conference in Florida who exactly was buying gold and silver at high prices, the sense of optimism brought about by the rally was not overly bullish. Analysts see gold prices rising to as high as $2,941 per ounce, but not quite above $3,000 per ounce before the end of 2024. But sentiments suggest that even at these record highs, there remains some potential upside. It is probably best that the advance is measured rather than euphoric, the latter usually accompanying a market peak. While the upcoming presidential election in the U.S. may mean that markets can peak at that point, the positive may not cool off immediately thereafter because whichever candidate wins, the geopolitical uncertainty is expected to remain elevated.

The spot price of precious metals recorded gains during the week. Gold, which ended last week at $2,656.59, closed this week at $2,721.46 per troy ounce for a gain of 2.44%. Silver began at the prior week’s close at $31.54 and ended this week at $33.72 per troy ounce to register an increase of 6.91%. Platinum came from $987.76 last week and closed this week at $1,015.31 per troy ounce for a gain of 2.79%. Palladium closed a week ago at $1,071.21 and this week at $1,084.09 per troy ounce to return 1.20% for the week. The three-month LME prices of industrial metals were mixed for the week. Copper lost by 1.00% for the week from its previous weekly close at $9,723.00 to close at $9,625.50 per metric ton. Aluminum ended one week ago at $2,586.00 and this week at $2,612.00 per metric ton for a gain of 1.01%. Zinc came from $3,086.50 one week ago to end this week at $3,089.50 per metric ton to realize a slight gain of 0.10%. Tin came from its prior closing price of $32,817.00 to end this week at $31,313.00 per metric ton for a decline of 4.58%.

Energy and Oil

As ICE Brent futures slid back to $79 per barrel, where it was last seen in early October, geopolitical risk premiums have slowly diminished from oil prices. Anticipation that Israel would launch retaliatory attacks against Iran sustained higher oil price levels, but coinciding with this wait was the slowdown of China’s economic growth to 4.6% in the third quarter of 2024. Furthermore, investors have been alerted to the downside of Chinese demand, the fifth consecutive month-over-month decline in Chinese refinery runs, which has deflated the bullish sentiment once more. In other news, the International Energy Agency (IEA) released a warning that world fossil fuel demand will hit its peak by the end of this decade. After it has done so, the surplus in fossil fuel supplies would enable it to spend more on renewables, which is seen as the start of the “age of electricity.”

Natural Gas

For the report week from Wednesday, October 9, to Wednesday, October 16, 2024, the Henry Hub spot price fell by $0.21 from $2.42 per million British thermal units (MMBtu) to $2.21/MMBtu. Concerning Henry Hub futures, the price of the November 2024 NYMEX contract decreased by $0.29, from $2.660/MMBtu at the start of the report week to $2.367/MMBtu by the week’s end. The price of the 12-month strip averaging November 2024 through October 2025 futures contracts fell by $0.19 to $2.945/MMBtu. At most major pricing locations, price changes ranged from a decrease of $0.70 at SoCal Citygate to an increase of $0.34 at the Waha Hub.

International natural gas futures prices climbed this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia advanced by $0.07 to a weekly average of $13.17/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $0.01 to a weekly average of $12.79/MMBtu. In the week last year that corresponded to this report week (the week beginning October 11 and ending October 18, 2023), the prices were $16.50/MMBtu in East Asia and $15.78/MMBtu at the TTF.

World Markets

The pan-European STOXX Europe 600 Index closed the week 0.58% higher in local currency terms as the markets were replete with expectations of a second consecutive interest rate cut by the European Central Bank (ECB) in furtherance of the easing of monetary policy. The major regional stock indexes advanced: France’s CAC 40 Index rose by 0.46%, Germany’s DAX gained 1.46%, and Italy’s FTSE MIB surged by 2.61%. The UK’s FTSE 100 Index added 1.27%. In line with expectations, the ECB cut its key deposit rate by a quarter of a percentage point to 3.25% in the first back-to-back rate reduction in 13 years. The disinflationary process was pronounced by ECB President Christine Lagarde to be “well on track” based on recent downside surprises in economic activity data. Financial markets appeared to expect the ECB to reduce rates in December to support the economy, although the ECB reiterated that it would not pre-commit to a particular rate path. According to the European Commission’s statistics office, the annual inflation came in at 1.7% in September. This is well below the ECB’s stated target of 2% and a downward revision from its initial estimate of 1.8%. The ECB does not expect the trend to be constant, however, as it forecasts that inflation will rise again before receding once more toward the 2% target next year.

Japan’s stock markets fell in local currency terms due to easing domestic inflation in September. While expected, this led to some speculation that the Bank of Japan (BoJ) may be less likely to raise interest rates again this year. The Nikkei 225 Index fell by 1.58% and the broader TOPIX lost 0.64%. BoJ officials observed that the prerequisite conditions for beginning monetary policy normalization have already been met, namely the breadth of items undergoing price increase as cited by BoJ Board Member Seiji Adachi. Nevertheless, rate hikes should be implemented at a very gradual pace. Adachi cautioned against a drastic change in policy given uncertainties surrounding the global economic outlook and domestic wage growth. The yield on the 10-year Japanese government bond rose to 0.97% from 0.94% at the end of the prior week. The yen weakened from the low to the high end of the JPY 149 range against the U.S. dollar. According to Japan’s top currency diplomat, Atsushi Mimura, recent moves in the yen were described as “somewhat one-sided and rapid.” The yen is once more trending towards levels where authorities intervened earlier in the year to stem the currency’s decline. Japan’s core consumer price index (CPI) indicated that inflation eased in September, although the country’s exports for that month declined from year-ago levels, the first decline in 10 months, due to weak Chinese demand.

China’s stocks rose in response to more support measures unveiled by the central bank after data indicated that deflationary pressures grew more entrenched in the economy. The Shanghai Composite Index advanced 1.36% in local currency terms while the blue-chip CSI 300 gained 0.98%. The Hong Kong benchmark Hang Seng Index fell by 2.11%. In the third quarter, China’s economy expanded by 4.6% year-on-year, exceeding consensus estimates. The growth rate was slightly lower than the second quarter expansion of 4.7% and continues to fall short of Beijing’s stated target of “around 5%.” The economy grew by 0.9% on a quarterly basis. Other economic data point to signs of improvement. In September, industrial production rose by a better-than-expected 5.4% from last year and up from 4.5% in August. Retail sales grew by 3.2% year-on-year which exceeded forecasts and further accelerated from the 2.1% growth recorded in August on the back of higher sales of household appliances, a major contributing factor. Annual inflation was at its lowest level in three months, registering 0.4% in September. This fell below consensus estimates and marked a slowdown from the August reading of 0.6%. Core inflation (excluding food and energy costs) increased by 0.1%, the lowest since February 2021. The producer price index dropped by a larger-than-expected 2.8% from last year, deepening from the 1.8% drop in August.

The Week Ahead

Included among the important economic reports scheduled for release this week are PMI data, new home sales, and final consumer sentiment for October.

Key Topics to Watch

Markets Index Wrap-Up

Elevance Health surprised Wall Street with a rare, late-year guidance cut Thursday after a jump in Medicaid costs marred its third quarter

Wireless and fixed-network equipment maker Nokia has reported better-than-expected third quarter earnings, mainly on the back of cost cutting measures, but saw its sales dive 8% largely due to a weaker India market

The European Central Bank, which sets interest rates for the 20 countries that use the euro currency, is not expecting the bloc to fall into recession as it cut borrowing costs once again after figures showed inflation across the bloc falling to its lowest level in more than three years and economic growth waning

U.S. stocks drifted around their record heights following the latest signals that the U.S. economy continues to hum

Shares of Proficient Auto Logistics slid after the company said it expects revenue and profit to fall in the third quarter, dragged down by lower volumes.