Boston Scientific is en route to expand its vascular offerings with a $1.26 billion deal to acquire Silk Road Medical and its approach to reducing the risk of stroke via carotid artery procedures.

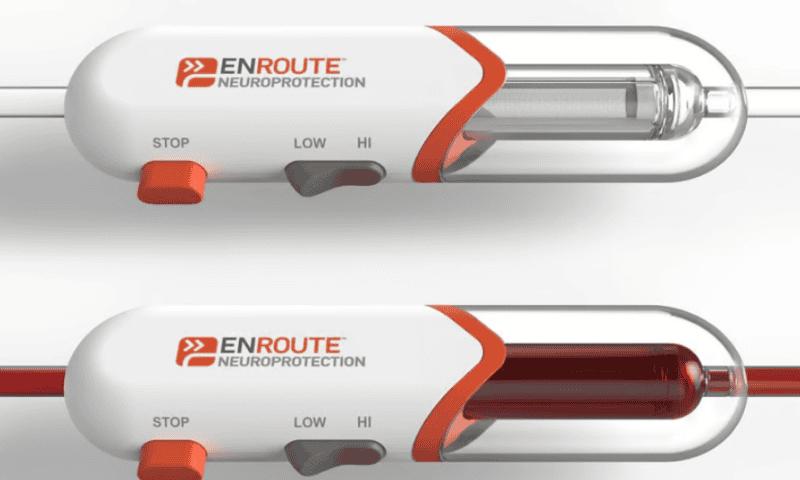

Silk Road is known as the developer of TCAR, for transcarotid artery revascularization. In patients that need a stent to help clear a path through a plaque-filled vessel, the company’s Enroute hardware temporarily reverses the flow of blood, to redirect any potentially dangerous loose clots away from the brain.

“The TCAR platform developed by Silk Road Medical is a notable advancement in the field of vascular medicine, which has revolutionized stroke prevention and the treatment of carotid artery disease,” Boston Scientific’s president of vascular peripheral interventions, Cat Jennings, said in a statement.

The companies said they plan to complete the transaction by the end of this year, with Boston Scientific paying about a 38% premium on top of Silk Road’s average share price over the past 60 days. With about $101 million in Silk Road’s coffers, Boston Scientific pegged the deal’s total enterprise value at about $1.16 billion. Once the ink is dry, Silk Road will become a wholly owned subsidiary.

For the first quarter of this year, Silk Road reported $48.5 million in revenue from over 6,700 TCAR procedures, a dollar amount up 21% from the same period the year before. Operating costs were also up, increasing 16% to $51.4 million, as the company grew the headcount and expenses within its commercial arms; its quarterly net loss came to $14.1 million.

In the full year of 2023, Silk Road posted $177.1 million in sales, up 28% versus 2022, with operating expenses topping out at $186.4 million. For 2024, the company forecast revenues between $194 million and $198 million.

On a late April earnings call with investors, Silk Road CEO Chas McKhann also predicted the company will pass the 100,000-patient mark this summer.

“We continue to see healthy demand and encouraging adoption trends for TCAR—as the tenure and experience of our commercial team grows, our innovation efforts bear fruit, and the marketplace responds to expanded Medicare coverage,” said McKhann, who will be marking his second sale of a company to Boston Scientific in just over a year. He previously served as CEO of the gastrointestinal device developer Apollo Endosurgery, which was bought for $615 million in 2023.

Meanwhile, Boston Scientific is still working to close its $3.7 billion deal for Axonics and its neuromodulation implants for urinary and fecal incontinence. The Federal Trade Commission asked the companies for more information on their union earlier this year, pushing back their closing date prediction to the latter half of this year.