Bitcoin jumped 3% after the Federal Reserve on Wednesday raised its key interest rate by a quarter of a percentage point, but signaled that only “a couple more” rate increases may be needed before the central bank takes a pause on its fight against inflation.

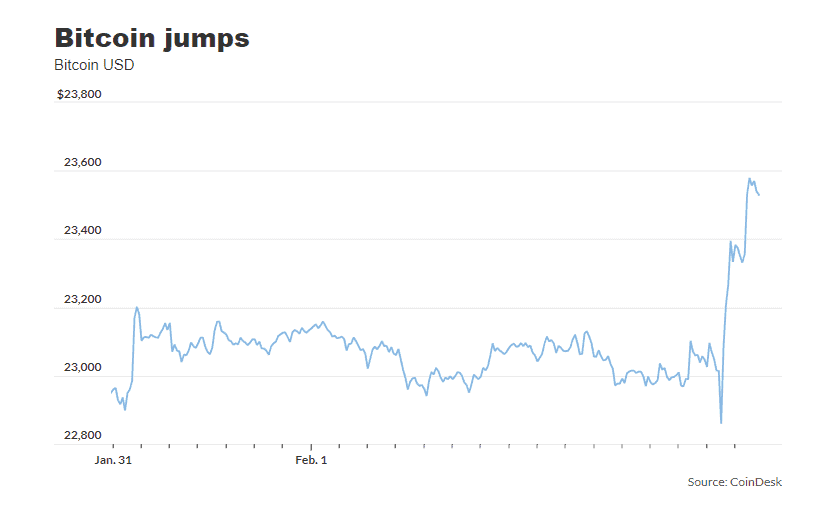

The largest cryptocurrency BTCUSD, 0.61% rose to as high as $23,650 on Wednesday, up 2% over the past 24 hours, according to CoinDesk data. The move coincided with a rally in technology stocks, with the Nasdaq Composite COMP, +2.00% rising 2% Wednesday, according to FactSet data.

The Fed’s interest rate hike on Wednesday followed six larger hikes in a row, as the central bank strives to bring down the worst inflation in 40 years. Fed chairman Jerome Powell said in a press conference Wednesday that a “disinflationary” process is underway, while the Fed is yet at a “sufficiently restrictive policy stance.”

“Bitcoin is rallying as rate cut bets grow after Fed Chair Powell said he is seeing progress with inflation,” said Edward Moya, a senior market analyst at OANDA, in an email to MarketWatch. “It was a dovish Fed press conference that is sending bond yields sharply lower, which is good news for cryptos.” Moya added that if inflation continues to ease at a healthy pace, the bull case for crypto will continue.

“Bitcoin turned positive as Powell didn’t fret over the recent easing of financial conditions. Powell didn’t go full hawk and that gave many traders permission to pile back into risky assets,” said Moya. “Bitcoin has massive resistance at the $24,000 level but if that is breached, momentum traders may try to keep the rally going towards the $26,500 region.”