Just $3 for every $100 invested has left the stock market, says the bank

At nearly the halfway mark in a volatile year of trading, the S&P 500 index is down, but not out to the point of an official bear market yet.

According to a widely followed definition, a bear market occurs when a market or security is down 20% or more from a recent high. The S&P 500 SPX, -0.57% is off 13.5% from a January high of 4,796, which for now, just means correction territory, often defined as a 10% drop from a recent high. The battered Nasdaq Composite COMP, -1.40%, meanwhile, is currently down 23% from a November 2021 high.

That S&P bear market debate is raging nonetheless, with some strategists and observers saying the S&P 500 is growling just like a bear market should. Wall Street banks like Morgan Stanley have been saying the market is getting close to that point.

Read: A secular bear market is here, says this money manager. These are the key steps for investors to take now.

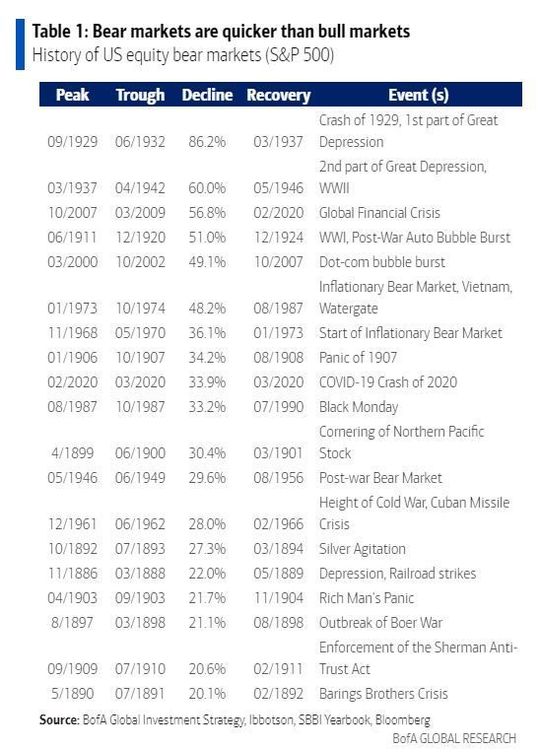

But should the S&P 500 officially enter the bear’s lair, Bank of America strategists led by Michael Hartnett, have calculated just how long the pain could last. Looking at a history of 19 bear markets over the past 140 years, they found the average price decline was 37.3% and the average duration about 289 days.

While “past performance is no guide to future performance,” Hartnett and the team say the current bear market would end Oct. 19 of this year, with the S&P 500 at 3,000 and the Nasdaq Composite at 10,000. Check out their chart below:

The “good news,” is that many stocks have already reached this point. with 49% of Nasdaq constituents more than 50% below their 52-week highs, and 58% of the Nasdaq more than 37.3% down, with 77% of the index in a bear market. More good news? “Bear markets are quicker than bull markets,” say the strategists.

The bank’s latest weekly data released on Friday, showed another $3.4 billion coming out of stocks, $9.1 billion from bonds and $14 billion from cash. They note many of those moves were “risk off” headed into the recent Federal Reserve meeting.

While the Fed tightened policy as expected again this week, uncertainty over whether its stance is any less hawkish than previously believed, along with concerns that the central bank may not be able to tighten policy without triggering an economic downturn, left stocks dramatically weaker on Thursday, with more selling under way on Friday.

The strategists offer up one final factoid that may also give investors some comfort. Hartnett and the team noted that for every $100 invested in equities over the past year or so, only $3 has been redeemed.

As well, the $1.1 trillion that has flowed into equities since January 2021 had an average entry point of 4,274 on the S&P 500, meaning those investors are “underwater but only somewhat,” said Hartnett and the team.