Weekly Market Review – April 15, 2023

Stock Markets

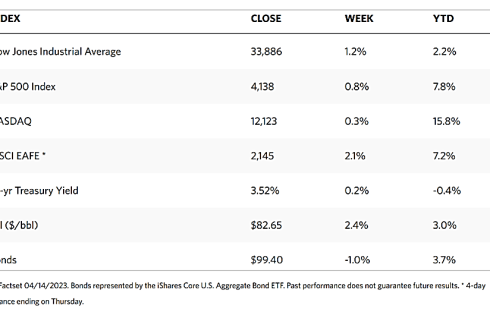

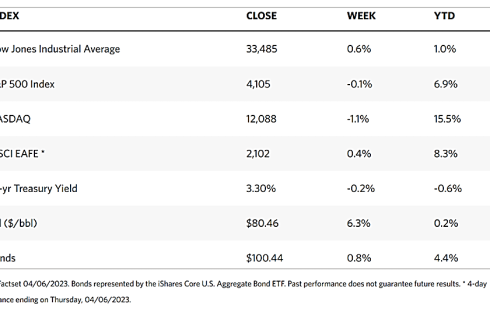

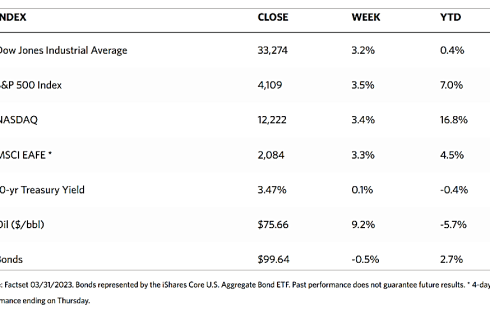

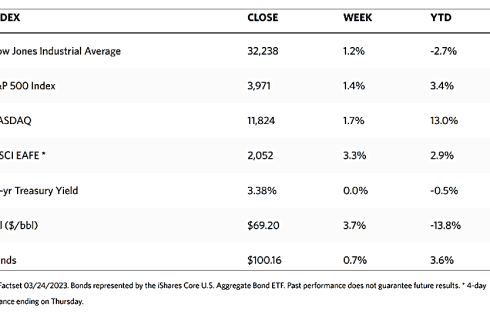

Over the trading week, the benchmark indexes moved slightly higher as investors weighed slowing economic growth signals. The Dow Jones Industrial Average moved up by 1.2% for the week while the total stock market average inched up by 0.89% on the back of a 2.01% gain in the transportation sector that offset a 1.48% slide in the utility average. The broad-based S&P 500 Index also moved up slightly by 0.79% while the technology-heavy Nasdaq Stock Market Composite gained marginally by 0.29%. The NYSE Composite index advanced by 1.45%. The CBOE Volatility Index dropped by 7.23%, indicating a reduction in investor risk perception of the market.

Materials and industrials shares outperformed within the S&P 500 Index, while technology shares underperformed. The technology sector was weighed partly by a decline in graphics and artificial intelligence chipmaker NVIDIA as it continued on its recent retreat from a 52-week high. Early in the week, trading was exceptionally thin, reflecting the closed markets in Europe following the Easter holiday. Volumes eventually picked up as the week progressed, but trading was muted as investors waited for the release of the quarterly corporate earnings expected to begin on Friday. By the end of the week, analysts expected overall earnings for the S&P 500 to have contracted by 6.5% year-over-year in the first quarter. Earnings in the financial sector were expected to increase moderately.

U.S. Economy

The Wednesday morning release of the Labor Department’s consumer price index (CPI) for March was highly anticipated by investors and analysts alike. The news that the CPI rose only by 0.1%, slightly below expectations, caused the markets to act positively as it brought the year-over-year inflation rate to 5.0%, the slowest pace since May 2021. The indexes subsequently fell back for the day, which may partly be due to comments from Federal Reserve Bank of Richmond President Thomas Barkin to the effect that “there is still more to do “to calm inflation down. More encouraging news on the producer side was released on Thursday which tended to suggest that consumers could look forward to better prices in the pipeline. The core (excluding food and energy) producer price index dipped by 0.1% in March. This is the first decrease in the prices businesses pay for inputs going back to the height of the pandemic shutdowns in April 2020.

In the meantime, encouraging data on inflation signaled that consumer prices continue to trek a path of moderation after rising to decades-high levels in the past year. As the year progresses, moderating demand and improvement in supply chain disruptions will likely foster lower inflation readings. Moderating inflation and a decelerating economy will possibly provide the conditions for the Federal Reserve to reduce its degree of intervention and move to the sidelines in the coming months, effectively terminating its aggressive rate hike cycle. Although this may not eliminate the economic slowdown, it remains a positive development for the markets since ending monetary tightening is traditionally a favorable economic catalyst.

Bond investors appear to perceive Friday’s data as giving the Federal Reserve some room to life rates further, which resulted in a rise in longer-term U.S. Treasury yields. Technical conditions characterized by relatively lighter dealer inventories and below-average supply continued to support the municipal market. New issuance and trading both remained calm in both the high-yield corporate and the investment-grade bond markets.

Metals and Mining

The past week had been a hectic one for precious metals, but the robust bullish optimism may not be sufficiently sustained as yet to push gold beyond the $2,000 resistance to establish a new all-time high. On Friday, gold started predictably with profit-taking, normally expected after a three-day rally surged gold prices to a new 13-month high above $2,050 per ounce. The profit-taking, however, morphed into a significant retreat as economic data helped to strengthen expectations that the Federal Reserve may continue to raise interest rates by another 0.25% next month. At one point during trading, gold prices slumped by 2% during the session, relinquishing all of its weekly gains. Despite the solid-selling pressure, it is still optimistic to note that gold remained resilient above the $2,000 per ounce support level heading into the weekend.

Over the past week, the spot gold price came from its week-ago level of $2,007.91 to this week’s close at $2,005.21 per troy ounce, losing by a slight 0.13%. Silver gained by 1.64% to end at $25.39 per troy ounce from its prior week’s close at $24.98. Platinum, which closed the previous week at $1,011.80, ended the past week at $1,048.13 per troy ounce for a gain of 3.59%. Palladium closed this week at $1,505.38 per troy ounce, gaining 2.40% from the previous week’s close at $1,470.06. The three-month LME prices of base metals generally closed up for the week. Copper closed 2.94% higher from its previous week’s price of $8,800.00 to end the week at $9,058.50 per metric tonne. Zinc moved up from its week-ago closing price of $2,779.00 to this week’s closing price of $2,837.00 per metric tonne for a gain of 2.09%. Aluminum began at the previous closing price of $2,333.50 and ended this week at $2,367.00 per metric tonne, higher by 1.44%. Tin closed one week ago at $24,308.00 and this week at $24,442.00, a slight increase of 0.55%.

Energy and Oil

The bullish optimism that pushed Brent prices north of $87 per barrel, backed mainly by the US CPI figures reported at 5.6%, appeared prepared to slacken just as OPEC reduced its demand forecast for the second semester of 2023. Simultaneously, OPEC retrospectively increased demand in the first quarter, leaving it with the same annual growth as it had previously, at 2.3 million barrels per day. The report of the International Energy Agency (IEA), on the other hand, boosted oil prices on Friday as the agency drew cautious attention to a significant supply deficit later this year. The head of the IEA, Faith Birol, announced that oil markets may see some tightness in the second half of 2023 if the voluntary production cuts of major OPEC+ producers remain in place until the end of the year, thus pushing prices even higher than present levels. The agency warned in its Oil Market Report that a supply deficit, exacerbated by OPEC+ cuts, may adversely impact global economic growth.

Natural Gas

This report week began on Wednesday, April 5, and ended Wednesday, April 12, 2023. The Henry Hub spot price rose by $0.04 from $2.17 per million British thermal units (MMBtu) at the beginning of the week to $2.21/MMBtu by the end of the week. The price of the May 2023 NYMEX contract fell back by $0.062, from $2.155/MMBtu on April 5th to $2.093/MMBtu on April 12th. The price of the 12-month strip averaging May 2023 through April 2024 futures contracts fell by $0.103 to $2.897/MMBtu. International natural gas futures prices decreased throughout the report week. Weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia fell by $0.35 to a weekly average of $12.61/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, fell by $1.12 to a weekly average of $13.84/MMBtu. In the corresponding week last year, the week ending April 13, 2022, the prices were $33.12/MMBtu and $32.91/MMBtu in East Asia and at the TTF, respectively.

World Markets

European stocks rose as recession fears diminished. The pan-European STOXX Europe 600 Index rose by 1.74% over the trading week ending April 14. Major stock indexes in the region likewise posted gains. Germany’s DAX advanced b 1.34%, Italy’s FTSE MIB gained 2.42%, and France’s CAC 40 Index surged by 2.66%. The UK’s FTSE 100 Index ascended by 1.68%. Investors weighed the prospects of more policy tightening, resulting in the rise of European government bonds. The yields on 10-year German government debt rose, with some policymakers supporting a half-percentage-point rate increase should the inflation data warrant it. The yields on 10-year UK and French sovereign bonds also climbed.

Japanese equities realized gains over the week. The Nikkei 225 Index increased by 3.54% while the broader TOPIX Index also climbed by 2.71%. Investor sentiment turned optimistic with a comment by prominent investor Warren Buffett that his company, Berkshire Hathaway, would pour more investments into Japan. Also supporting risk assets were dovish comments from the new Bank of Japan (BoJ) Governor Kazuo Ueda and subsequent yen weakness. While Ueda dampened expectations that any sudden major change will take place in monetary policy, he nevertheless signaled that there may be a revision in the central bank’s large-scale easing stance, the consideration of which may take place in the near future. The yen weakened to about JPY 132.5 versus the U.S. dollar, from the previous week’s JPY 132.2. The yield on the 10-year Japanese government bond remained unchanged at 0.46%, on the anticipated continuity of monetary policy under Ueda. The IMF revised its projection for Japan’s 2023 economy downward, from 1.8% to 1.3% in January, due to weak economic performance over the final quarter of last year.

Chinese stocks were mixed at the end of a volatile week, in light of pessimistic consumer sentiment caused by softer-than-expected inflation. New loans and trade data surprised investors positively, however, it was not sufficient to offset the more serious concerns regarding the strength of the economic recovery. The Shanghai Stock Exchange Index climbed by 0.32% while the blue-chip CSI 300 slipped by 0.76% in local currency terms. In Hong Kong, the benchmark Hang Seng Index ascended by 0.53%. Inflation slowed for the second straight month in March. For this month, China’s consumer price index rose by 0.7% from last year, down from a 1% rise the month before. Core inflation (which excludes food and energy prices, the volatile components) increased to 0.7% in March from 0.6% in February. Following the trend is the producer price index, which receded by 2.5%, the lowest since June 2020 and its sixth straight monthly decline.

The Week Ahead

Included among the important economic data scheduled for release this week are the PMI indexes, leading economic indicators, and the initial and continuing jobless claims.

Key Topics to Watch

- Empire State manufacturing

- Home builder confidence index

- Richmond Fed President Tom Barkin speaks

- Housing starts

- Building permits

- Fed Gov. Michelle Bowman speaks

- Fed Beige Book

- New York Fed President Williams speaks

- Initial jobless claims

- Continuing jobless claims

- Philadelphia Fed manufacturing survey

- Existing home sales

- S. leading economic indicators

- Fed Gov. Christopher Waller speaks

- Cleveland Fed President Loretta Mester speaks

- Dallas Fed listens with Dallas Fed President Lorie Logan and Fed Gov. Michelle Bowman

- Atlanta Fed President Raphael Bostic speaks

- S&P flash U.S services PMI

- S&P flash U.S. manufacturing PMI

- Fed Gov. Lisa Cook speaks

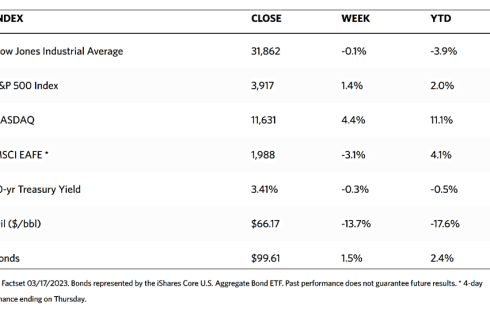

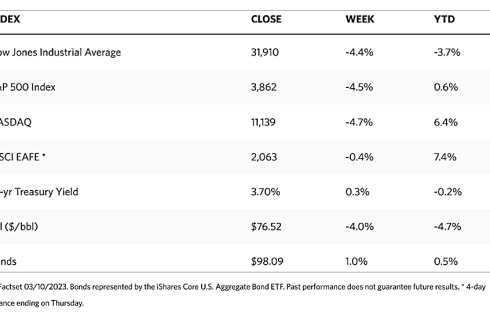

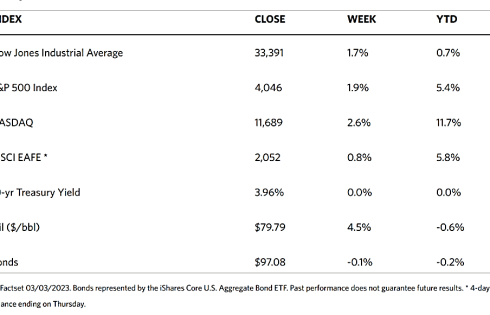

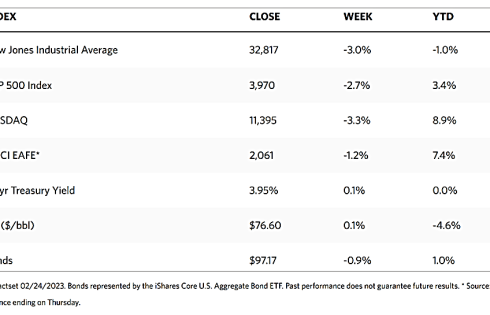

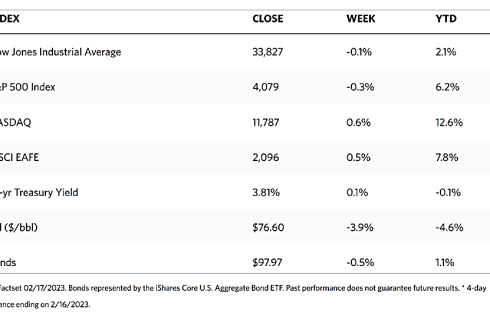

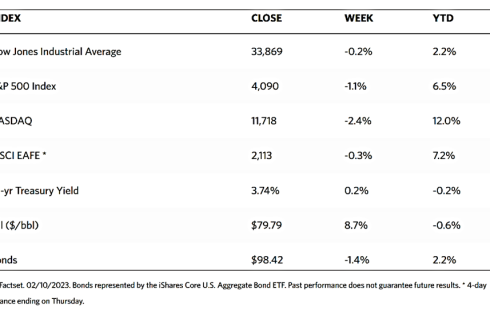

Markets Index Wrap Up