Amazon has forecast lower-than-expected sales for the first three months of the year sparking investor fears over slowing growth.

Shares in the online giant fell almost 5% in after-hours trading despite it reporting record sales and profit for the Christmas holiday period.

Amazon expects sales to grow between 10% and 18% in the first quarter, slightly below analyst forecasts.

A hit from currency exchange rates was partly to blame, the firm said.

In the three months to the end of the year, which included the crucial Christmas period, profit rose 63% to $3bn (£2.2bn) while revenue was up 20% to $72.4bn.

While this was better than analysts had expected, it was still the slowest sales growth for the firm since the start of 2015.

The deceleration comes as the firm encounters challenges abroad, with changing regulations in markets such as India.

It also faces increased competition at home, as rival retailers such as Target and Walmart invest heavily in online operations.

Neil Saunders, analyst at research firm GlobalData, said competitors’ gains had hurt the growth of Amazon’s retail division.

“In our view, the gap between Amazon and the rest is now narrowing,” he said.

“Amazon will now need to work doubly hard to achieve any future sales gains.”

Nonetheless, he said that compared to many other retailers, the firm’s retail sales figures were still strong.

In North America, sales increased 18% year-on-year, while its international sales climbed 15%.

‘Impressive’ profit

Mr Saunders said the firm’s profits were also “impressive”.

Amazon’s widening profits are largely driven by the growth of its high-margin businesses, including its cloud, advertising and third-party seller services.

Amazon’s cloud computing arm, Amazon Web Services provided two thirds of the firm’s profit last quarter.

It is one of the services the firm is relying on to help offset slowing revenue growth in its retail arm.

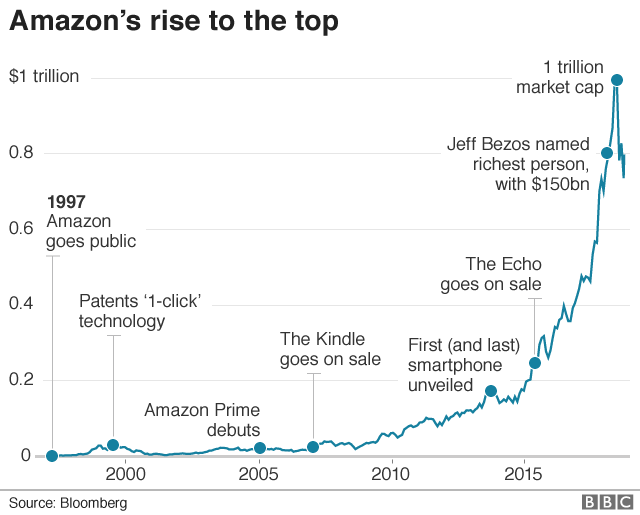

Amazon founder and chief executive Jeff Bezos, who is also the world’s richest man, singled out its smart speaker Alexa, saying it was the company’s best-selling device.

Nicholas Hyett, analyst at Hargreaves Lansdown, said the online retailer was “tightening its grip” on its customers with add-on services such as Amazon Prime which offer free delivery and other benefits.

“With so many opportunities, the biggest problem facing Amazon CEO Jeff Bezos is where to focus the attention,” he added.

Mr Hyett said that while he would have preferred sales guidance to be in line with expectations, “given the rate of growth Amazon’s delivering it could be more than made up by a slight outperformance in future quarters”.

“There’s no evidence of a systemic slowdown as yet.”