Stock Markets

Major U.S. indexes are down for the shortened trading week due to market closure on Thursday in honor of the recently deceased former US President Jimmy Carter. The 30-stock Dow Jones Industrial Average (DJIA) dropped by 1.07% although the Total Stock Market Index dipped by only 0.72%. The broad S&P 500 Index fared a bit worse than the total stock market, declining by 0.71%. The technology-tracking Nasdaq Stock Market Composite lost by 0.62%, and the NYSE Composite Index gave up 0.69%. Investor risk perception, as indicated by the CBOE Volatility Index (VIX), rose by 8.98% over last week.

The week began on a positive note, as most indexes were up on Monday on reports that the incoming Trump administration will pursue a softer stance on tariffs than previously indicated. The initial optimism faded during the week after the president-elect refuted those reports and some economic data were released that resurrected concerns about stubborn inflation. The markets could remain choppy over the coming weeks as investors receive upcoming corporate earnings releases, Federal Reserve outlook updates, and the policy proposals of the incoming administration.

U.S. Economy

In the first US jobs report in 2025, the nonfarm payrolls for December amounted to 256,000 which is well above the 165,000 expected level. The unemployment rate dropped from 4.2% to 4.1%. Signaling some modest potential easing in services inflation as well, the average hourly wage growth rose 3.9% year-over-year which is slightly below the forecasted 4.0% wage growth. Other economic data releases on Tuesday noted that the Institute for Supply Management (ISM) Services Purchasing Managers’ Index (PMI) came in at 54.1 for December, two percentage points higher than its November level. The ISM-PMI is a measure of economic activity in the services sector, and readings above 50 indicate expansion while those lower than 50 denote contraction.

Fears that progress on reducing inflation has stalled and that interest rates could remain “higher for longer” were stoked when the component of the index that measures prices paid by service organizations for materials and services increased by 6.2 percentage points to 64.4. Further fueling these fears was Fed Governor Michelle Bowman’s observation that inflation has held “uncomfortably above” the Fed’s 2% long-term target and that there remained upside risks to inflation even though the Fed made significant progress since 2023 to control inflation. While the data capped off a resilient year for the economy, the labor market in particular still faces several headwinds and appears to provide the Fed with another data point that favors moderating the pace of rate cuts.

Metals and Mining

For 2024, gold closed the year with a 26% gain, however, it ended December disappointing investors as a Santa Claus rally failed to materialize in the gold market for the first time in seven years. The new year brings fresh hope, nevertheless, as new opportunities push gold to test its critical resistance level near $2,700, and likewise defy critical headwinds from rising bond yields and the surging bullishness of the U.S. dollar. Analysts note that the delinking of gold from its traditional relationship with currency and bond yields may be due to investors paying less attention to the higher opportunity costs of holding gold while they hedge against growing inflation risks, geopolitical turmoil, and economic uncertainty.

The spot prices of precious metals registered gains for the week. Gold climbed from $2,640.22 last week to $2,689.76 per troy ounce this week for a gain of 1.88%. Silver came from last week’s close of $29.62 to this week’s close of $30.41 per troy ounce for an appreciation of 2.67%. Platinum closed last week at $939.51 and this week at $965.80 per troy ounce for a gain of 2.80%. Palladium ended last week at $925.64 and this week at $951.17 per troy ounce to register a gain of 2.76%. The three-month LME prices of industrial minerals, on the other hand, ended mixed. Copper closed this week at $9,091.50 per metric ton, 3.28% higher than last week’s close at $8,802.50. Aluminum closed this week at 1.68% higher than last week’s closing price of $2,529.00, ending this week at $2,571.50 per metric ton. Zinc lost 2.02% from the last weekly close of $2,927.00 to settle this week at $2,868.00 per metric ton. Tin gained 4.65% above last week’s closing price of $28,557.00 to end this week at $29,886.00 per metric ton.

Energy and Oil

Oil prices began the year noticeably bullish, as Brent broke $80 per barrel for the first time since October 7, 2024. The rally’s momentum may be traced to several reasons, including the eleventh-hour sanctions the Biden Administration imposed on Russia, continued concerns that inflation may once more rise, cold temperatures across the Atlantic Basin, and widening backwardation in all crude futures. The bullishness in the oil market has once more been felt for the first time in months. In other news, Chinese consumers have nominated 43.5 million barrels of Saudi crude next month shortly after Saudi Aramco hiked formula prices for Asian term buyers by $0.50 to $0.60 for February. This is down by 2.5 million barrels from January.

Natural Gas

For the report week beginning Wednesday, January 1, and ending Wednesday, January 8, 2025, the Henry Hub spot price rose by $0.37 from $3.39 per million British thermal units (MMBtu) to $3.76/MMBtu. Regarding Henry Hub futures, the January 2025 contract expired on Friday, December 27, at $3.514/MMBtu. The price of the February 2025 NYMEX contract decreased by $0.009 for the report week, from $3.660/MMBtu to $3.651/MMBtu. The price of the 12-month strip averaging February 2025 through January 2026 futures contracts increased by $0.03 to $3.678/MMBtu. Natural gas spot prices increased at all major pricing locations this report week. Price increases ranged from $0.29 at Eastern Gas South to $11.69 at Algonquin Citygate.

International natural gas futures prices increased this report week. Weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.14 to a weekly average of $14.30/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands increased by $0.06 to a weekly average of $14.55/MMBtu. In the week last year corresponding to this report week (from January 3 to January 10, 2024), the prices were $11.44/MMBtu in East Asia and $10.35/MMBtu at the TTF.

World Markets

European stock markets rose this week as the pan-European 600 Index closed 0.65% higher in local currency terms. Despite an uptick in the inflation rate, investors continue to expect the European Central Bank to cut interest rates in January. Germany’s DAX climbed by 1.55%, France’s CAC 40 Index ascended by 2.04%, and Italy’s FTSE MIB added 2.82%. The UK’s FTSE 100 Index gained by 0.30%. Various data painted a varying picture of the eurozone economy. Driven by higher energy prices and service costs, December’s year-over-year inflation speeded up to 2.4% from November’s 2.2%. The core rate (excluding energy, food, alcohol, and tobacco prices) remained unchanged at 2.7%. After falling in October, retail sales barely grew in November. In the meantime, the jobless rate stayed at a record low of 6.3% in November. In its latest Economic Bulletin, the European Central Bank (ECB) said that the disinflation process was well on track and that most indicators underlying inflation suggested that inflation will sustainably settle at the bank’s 2% medium-term target. The Italian newspaper, Corriere della Sera, quoted policymaker Piero Cipollone as saying that the ECB “shouldn’t try to guard excessively against possible future inflation shocks” and that “running the economy below potential weakens it and reduces the scope to react to shocks when they occur.” This and other individual comments by other policymakers encourage investors to believe that future monetary policy would contribute to a stronger economic outlook.

Over the week, Japanese equities lost ground, as the Nikkei 225 Index slid by 1.8% and the broader TOPIX Index dropped by 2.5%. The timing of Bank of Japan’s (BoJ’s) next interest rate hike remained the most speculated topic among market observers. Japan’s currency weakened over the week from around JPY 157.3 per USD at the end of last week, to about JPY 158.1 at the end of this week. The yen’s weakness was due to the uncertainty of the pace of further monetary policy normalization by the BoJ, as well as the pressure from a recent widening of the U.S.-Japan interest rate differential. The authorities have expressed their readiness to take appropriate action against excessively speculative, one-sided moves in the currency market. In the past, Japan’s monetary authorities have intervened in the foreign exchange markets to prop up the yen, most recently in July 2024. The central bank maintained its tightening bias, and its Governor Kazuo Ueda reiterated that if economic and price conditions keep improving, rates will be raised. Investors believe that it is unlikely that the BoJ will raise rates soon, and instead expect the policy rate hike will be delayed until March or April. Japan’s real (inflation-adjusted) wage growth, a closely watched indicator of consumers’ purchasing power, fell by 0.3% year-on-year in November. This is the fourth consecutive month of negative real wage growth. The BoJ’s case is that if the economy, prices, and wage growth develop in line with its projections, interest rates will rise.

Chinese stock markets receded after data released showed that the economy remained in deflation territory. The Shanghai Composite Index lost 1.34%, and the blue-chip CSI 300 slid by 1.13%. The Hong Kong benchmark Hang Seng Index plunged by 3.52%. On Thursday, inflation data released indicated that China is still struggling with deflationary pressures. The consumer price index (CPI) rose by 0.1% in December from one year ago. This is in line with estimates and down by 0,2% in November due to lower food and fuel prices. Excluding volatile food and energy costs, core inflation ticked up to 0.4% from November’s 0.3% growth. The producer price index (PPI) fell by 2.3% year-on-year, slowing from the 2.5% decline of the previous month and extending the deflation in factory gate prices for the 27th straight month. In other developments, the private Caixin S&P Global survey of services activity climbed to 52.2 in December, a better-than-expected result and the highest level since May. This matches the official data released in the previous week indicating that nonmanufacturing activity rose to 52.2 in December, the highest level in six months after Beijing introduced a broad stimulus package in late September. Furthermore, the People’s Bank of China (PBOC) announced after its quarterly policy meeting that to support economic growth, it will implement a moderately loose monetary policy this year. The PBOC vowed to increase financial support directed at the technology, emissions, pensions, and digital sectors. It likewise declared that, when appropriate, it would reduce the reserve requirement ratio and interest rates in order to boost consumption.

The Week Ahead

The CPI and PPI inflation for December, retail sales data, and industrial production data are among the macroeconomic reports scheduled for release in the coming week.

Key Topics to Watch

- Monthly U.S. federal budget for Dec.

- NFIB optimism index for Dec.

- Producer price index for Dec.

- Core PPI for Dec.

- PPI year over year

- Core PPI year over year

- Kansas City Fed President Jeffrey Schmid speaks (Jan. 14)

- Fed Beige Book

- New York Fed President Williams delivers opening remarks (Jan. 14)

- Consumer price index for Dec.

- CPI year over year

- Core CPI for Dec.

- Core CPI year over year

- Empire State manufacturing survey for Jan.

- Richmond Fed President Barkin speaks (Jan. 15)

- New York Fed President Williams speaks (Jan. 15)

- Chicago Fed President Goolsbee speaks (Jan. 15)

- Initial jobless claims for Jan. 11

- U.S. retail sales for Dec.

- Retail sales minus autos for Dec.

- Import price index for Dec.

- Import price index minus fuel for Dec.

- Philadelphia Fed manufacturing survey for Jan.

- Business inventories for Nov.

- Home builder confidence index for Jan.

- Housing starts for Dec.

- Building permits for Dec.

- Industrial production for Dec.

- Capacity utilization for Dec.

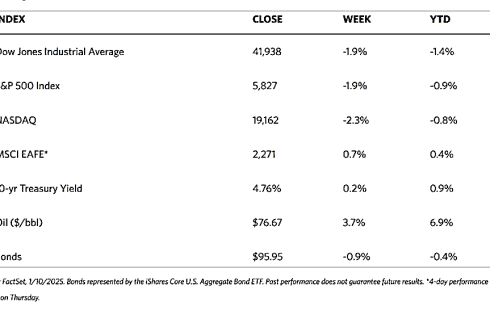

Markets Index Wrap-Up