U.S.’s largest banks draw investor support as havens from commercial real estate woes

JPMorgan Chase & Co., Wells Fargo & Co. and Citigroup Inc. all report second-quarter earnings next Friday after relative strength in their stock prices this year as investors continue to lean into the U.S.’s largest banks as havens from banking-sector woes.

With their diverse business models and an uptick in investment-banking activity, the biggest banks have been able to deflect concerns about exposure to office-property loans that have weighed on banks with fewer revenue streams.

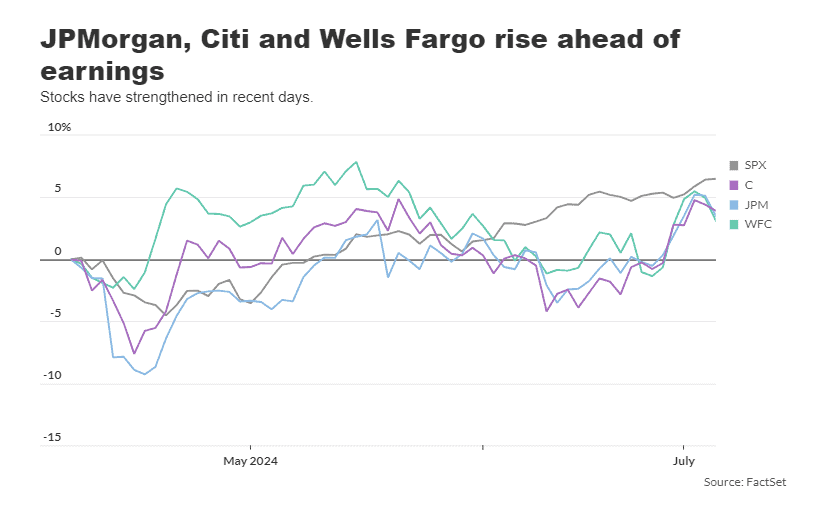

Of the trio of big banks, Citigroup C, -0.67% notched the largest gains during the second quarter, with a rise of 14.1%, followed by a 9.2% gain for JPMorgan Chase JPM, -1.33% and a 7.9% rise by Wells Fargo WFC, -1.71%.

By comparison, the S&P 500 SPX was up 6.3% during the quarter, while the KBW Nasdaq Bank Index BKX gained 8.4%.

Earnings estimates for most of the big banks have increased during the course of the second quarter as analysts grew more favorable toward their ability to generate profits.

As the biggest U.S. bank, JPMorgan Chase‘s stock has touched all-time highs in recent session as a key contributor to the 16.1% rise in the S&P 500 this year.

JPMorgan has outpaced the broad equities market with a year-to-date gain of 22%.

Wall Street analysts currently expect JPMorgan to earn $4.13 a share on revenue of $41.9 billion, according to FactSet data. The earnings estimate JPMorgan has increased slightly from $4.11 a share at the start of the quarter.

During the quarter, JPMorgan’s chief executive, Jamie Dimon, remained in the spotlight via interviews and other public appearances. He spoke about the risks and rewards of private credit, as well as the prospects of an economic slowdown on the horizon.

“The consumer is in pretty good shape,” Dimon said in an interview with CNBC-TV in May. “However, [consumer] confidence levels are low, and that seems to be mostly because of inflation.”

Meanwhile, analysts expects Wells Fargo to report second-quarter earnings of $1.28 a share on revenue of $20.23 billion, according to FactSet. The profit estimate has increased from $1.19 a share at the start of the second quarter.

Wells Fargo’s stock price has reflected some of this optimism, with a year-to-date rise of about 23%, outpacing JPMorgan and the S&P 500.

Citigroup is expected to report second-quarter earnings of $1.41 a share on revenue of $20.09 billion, according to analyst estimates. Analysts have become a little less bullish on its second-quarter prospects than their earlier projection of $1.48 a share at the start of the quarter.

Citi Financial Chief Mark Mason last month reported a pickup in investment-banking activity compared to year-ago levels, due partly to a rise in mergers-and-acquisitions activity, as well as capital raising.

Among three other top U.S. banks, Goldman Sachs Group Inc. GS, -0.68% is on deck to report second-quarter earnings of $8.66 a share on revenue of $12.55 billion on July 15. The analysts’ view on Goldman’s performance has grown more bullish compared with the estimate of $8.21 a share at the start of the second quarter.

Goldman operating chief John Waldron said in May that Wall Street deal making has gained momentum due to investments in artificial intelligence, but clients continue to worry about inflation and geopolitical flare-ups.

Bank of America Corp. BAC, -1.20% is expected to report second-quarter earnings of 80 cents a share on revenue of $25.3 billion on July 16. The analyst earnings estimate for the bank is unchanged from where it was at the start of the quarter.

Morgan Stanley MS, -0.61% is forecast to report second-quarter earnings of $1.67 a share on revenue of $14.35 billion on July 16. During the quarter, analysts have become more optimistic. An earlier estimate, as of March 1, called for earnings of $1.58 a share.

Last month, Morgan Stanley Chief Executive Ted Pick said the bank continues to navigate “unusual” economic conditions with inflation and geopolitical uncertainty.

The regulatory environment grew a bit more favorable for the big banks, at least in the short term, as industry watchers predicted that an update for proposed capital requirements for banks won’t come until after the November elections.