Credit Suisse analysts lowered their S&P target, but said the revision is not due to ‘recessionary concerns’

Credit Suisse Group analysts have again cut their price target for the S&P 500 index, lowering their estimate for the U.S. stock-market benchmark by 600 points to 4,300.

“Our target is being adjusted lower to reflect the higher cost of capital on valuations, not recessionary concerns,” analysts led by Jonathan Golub said in a Credit Suisse research note Tuesday. Their previous S&P 500 target of 4,900 is below what they had been predicting late last year.

Credit Suisse analysts were bullish on the U.S. stock market heading into 2022, saying in a Dec. 8 research report that they raised their S&P 500 price target to 5,200 from 5,000, partly because of projections for “robust” economic growth. Their current target is above the S&P 500’s SPX, +0.16% trading level Tuesday afternoon, when it was down 0.3% at around 3,813, FactSet data show, at last check.

See: ‘Proceed with caution’: here’s what Wall Street analysts see for the U.S. stock market in 2022

However, investors this year have worried that the U.S. could slip into a recession as a result of the Federal Reserve tightening its monetary policy to combat high inflation. In the view of the Credit Suisse analysts though, while economic growth is now slowing from elevated levels, it is not “recessionary.”

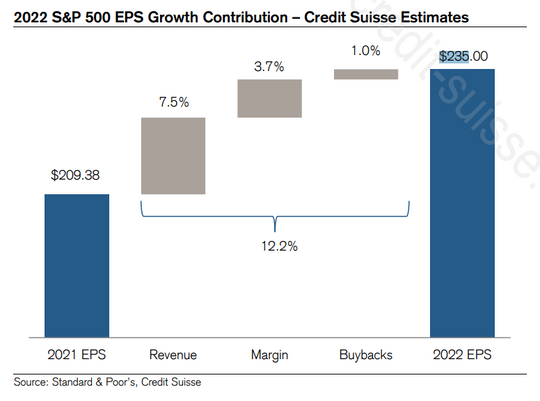

“Given current earnings trends and elevated nominal GDP, we reiterate our 2022-23 EPS estimates of $235 and $255, implying 12.2% and 8.5% growth,” the analysts said in their note Tuesday, referring to their outlook for earnings per share for the S&P 500 companies. Revenue is a large contributor to their estimate for S&P 500 EPS growth in 2022, a chart in the report shows.

“Recessions are most accurately characterized by a meltdown in employment accompanied by an inability of consumers and businesses to meet their financial obligations,” the Credit Suisse analysts wrote. “While we are currently experiencing a meaningful slowdown in economic growth (from extremely high levels), neither of the above conditions are present today.”

The U.S. Department of Commerce said Tuesday that new orders for manufactured goods rose 1.6% in May. Factory orders beat forecasts, picking up even as the economy slows, as economists polled by The Wall Street Journal had expected a 0.6% increase in May.

The U.S. economy contracted at an annual rate of 1.6% during the first quarter. On July 1, the Federal Reserve Bank of Atlanta’s GDPNow tracker estimated that U.S. gross domestic product shrank 2.1% in the second quarter, deeper than the 1% contraction calculated for the period at the end of June.

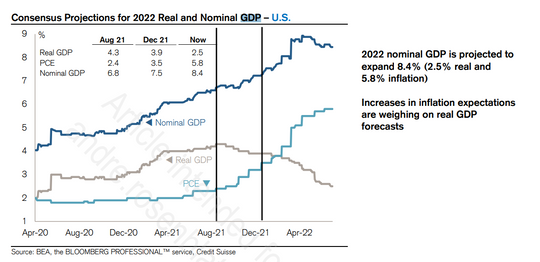

Credit Suisse’s Golub said in Tuesday’s note that economists are still forecasting real GDP growth this year of 2.5%, despite the Fed’s monetary tightening. That’s considering consensus projections for 8.4% nominal GDP growth in 2022 and inflation of 5.8% as measured by the personal-consumption-expenditures-price index, the note shows.

Other Wall Street banks have cut their S&P 500 targets for 2022. In late June, Citigroup analysts lowered their estimate by 500 points to 4,200, a revision that was determined by blending their “soft landing” and recession scenarios.

In April, analysts at RBC Capital Markets trimmed their 2022 target for the S&P 500 to 4,860 from 5,050, citing a rise in bond yields as the Fed tightens its monetary policy by raising interest rates.

While the yield on the 10-year Treasury note is higher than at the start of this year, the yield has been falling again in recent weeks.

The 10-year yield TMUBMUSD10Y, 2.837% was down about 7 basis points Tuesday afternoon at around 2.82%, FactSet data show, at last check. Before the July 4 holiday, the yield on the 10-year Treasury note ended Friday at its lowest level since May 31 based on 3 p.m. Eastern Time levels, according to Dow Jones Market Data.

The U.S. stock market was trading mixed Tuesday afternoon. The Dow Jones Industrial Average DJIA, -0.42% was down around 0.9%, while the Nasdaq Composite COMP, +1.75% was up 1.2%, FactSet data show, at last check.

U.S. stocks have been pummeled in 2022.

The S&P 500 fell 20.6% during the first half of 2022, its worst performance for a first half of a year since 1970, according to Dow Jones Market Data. Credit Suisse analysts see upside for the remainder of this year, with their new price target suggesting the S&P 500 will rise 12.4% from 3,825 on July 1.