Stock Markets

Concerns about inflation that dominated much of April were generally ignored in the past week while the focus shifted to announcements of corporate earnings and what is generally seen as a deterioration of the global growth for the rest of the year. The ongoing war in Ukraine remains to be the overriding threat to European economic activity. In China, the pandemic continues to impact the country’s growth rate, while in the U.S. the key worry revolves around the slowdown in economic momentum. Due to these uncertainties, stocks treaded lower this week to revisit their lowest levels in the year’s trading range.

The S&P 500 is down 14% from its recent peak. Meanwhile, the technology-heavy Nasdaq Composite and the small-cap Russell 2000 Index succumbed to bear markets, both of which are down approximately 24% from their highs. This was the indexes’ fourth consecutive weekly loss. Disappointing earnings reports from Amazon.com weighed down most of the indexes. Earnings reports from Microsoft and Alphabet, Google’s parent company, offset each other for the most part during Wednesday’s trading, as positive guidance from Microsoft helped to compensate for the poor earnings report from Alphabet.

During Friday’s trading, a similar situation developed between Amazon and Apple. Weak online sales caused Amazon shares to dive 14% due to the company’s first quarterly loss since 2015. Apple stock initially rose on the news of record first-quarter revenues, but cautious guidance for the second quarter regarding supply chain problems dampened the fledgling rally somewhat. Within the S&P 500, the energy sector outperformed, gaining strength after Russia announced that it was banning gas exports to Bulgaria and Poland.

U.S. Economy

The economic data that emerged during the week appeared to draw the prospect of a possible “stagflation,” but there is sufficient information to support the easing of inflationary pressures in the coming months. Topping the list of surprising economic data was the advance estimate of the Commerce Department that indicated that the economy contracted at an annualized rate of 1.4% for the first quarter. This fell way below the 1% economic expansion analysts expected for 2022 Q1. Mostly to blame for this underperformance were falling inventory investment and a record trade deficit. Optimism was supported, however, by what economists saw as solid consumer spending (higher by 2.7%) and an increase in business investment by 7.3%, which was well above expectations. It is therefore premature to conclude that the economic data are signaling the start of a recession, which is technically defined as an economic contraction for two consecutive quarters.

Other reports point to continued expansion. Personal spending rose 1.1%, higher than expected by 0.7%, while core capital goods orders (excluding defense and aircraft) increased by 1.0% in March, which is double the consensus expectation. The increase in the core personal consumption expenditures (PCE) price index, which is the preferred inflation gauge of the Federal Reserve, slid to 5.2% year-over-year. The year-over-year headline PCE measure surged to 6.6%, a 40-year high, but it also missed estimates. The employment cost index rose 1.4% in the first quarter, above analysts’ expectations and reflective of the tight labor market.

Metals and Mining

The week was disappointing for the gold market since spot prices fell below the $1,900-per-ounce support level. After it was unable to break above $2,000 an ounce, gold fell roughly 5%. There still appears to be some buying momentum among the gold bulls as the market continues to challenge the $1,900 during the end of trading for the week. The selling pressure exerted upon gold is a result of the strength in the U.S. dollar, which pushed it to almost a 20-year high. The unusually bullish momentum of the greenback is a result of traders and investors preparing for the Federal Reserve’s monetary policy meeting in the first week of May. The U.S. central bank will likely raise interest rates aggressively, which markets expect will amount to three 50-basis point hikes in the next three meetings. Interest rates are expected to end the year above 3%, with some betting that this may be an overestimation.

Gold, which ended the previous week at $1,931.60, closed this past week at $1,896.93 per troy ounce, for a slide of 1.79%. Silver went from $24.14 to $22.78 per troy ounce last week, falling by 5.63%. Platinum gained slightly from the earlier week’s close at $931.38 to last week’s $939.32 per troy ounce, inching up by 0.85%. Palladium moved from the previous week’s $2,378.75 to last week’s $2,326.92 per troy ounce, losing 2.18%. The three-month base metal prices did not do much better. Copper, which used to be $10,110.00 in the week prior, ended at $9,769.50 per metric tonne in the week just concluded, a loss of 3.37%. Zinc began at $4,434.50 and dropped by 7.39% to close last week at $4,107.00 per metric tonne. Aluminum also lost 5.95%, from $3,245.50 to $3,052.50 per metric tonne. Tin, formerly at $42,165.00, lost 4.52% week-on-week when it ended at $40,259.00 per metric tonne last week.

Energy and Oil

The OPEC+ meeting scheduled for next week has raised the question among investors and market players whether it remains necessary to formally “rubber stamp” the OPEC+ members’ monthly production quotas. Russia’s production is now down by almost one million barrels per day (b/d) compared to its levels in February, and Libya is constantly plagued by supply disruptions against which it is constantly contending. Against this backdrop, the oil group’s compliance rate is only going to increase. Although the demand from China has significantly dropped, the price of oil is headed towards a fifth consecutive monthly gain, with ICE Brent hovering at approximately $110 per barrel. OPEC+ is expected to greenlight another 432,000 b/d monthly increase for June when they once more meet on June 5, even as Russia and Kazakhstan further reduce their oil production, and the OPEC+ is on its second year of supply discipline.

Natural Gas

Spot prices of natural gas increased at most locations during the report week beginning April 20 and ending April 27. From the beginning to the end of the week, the Henry Hub spot price fell from $7.04 per million British thermal units (MMBtu) to $6.94/MMBtu. International gas prices were mixed for this report week. In East Asia, the swap prices for liquefied natural gas (LNG) cargoes fell by $4.43/MMBtu to a weekly average of $25.39/MMBtu. The day-ahead prices at the Title Transfer Facility (TTF), the most liquid natural gas spot market in Europe, increased by $0.50 to average $30.94/MMBtu for the week. This is the second week in a row that the TTF price average higher than the East Asia price, which is notable since historically, the natural gas prices in East Asia average higher than the natural gas prices in Europe. At about the corresponding time last year, for the week ending April 28, 2021, the prices at the TTF and in East Asia were $7.48/MMBtu and $8.58/MMBtu, respectively.

Domestically, the prices along the Gulf Coast rose due to forecasts of higher temperatures and rising air conditioning demand. In the Midwest, prices increased as temperatures shifted from above-normal to below-normal during the report week. Prices rose across the West as mid-continent production fell. In New England, prices increased in tandem with the lingering lower-than-normal temperatures in the region, and as pipelines experienced outages and maintenance. U.S. natural gas supply decreased slightly and natural gas consumption decreased in all sectors this report week. U.S. LNG exports decreased by three vessels this week from the previous week.

World Markets

In Europe this past week, shares pulled back due to worries that economic growth will slow down while high inflation and tightening monetary policy will prevail. Moderating this dire outlook were the encouraging quarterly earnings reports which somewhat offset the losses. The pan-European STOXX Europe 600 Index ended the week lower by 0.64% while major market indexes were mixed. Italy’s FTSE MIB Index moved sideways while France’s CAC 40 Index lost 0.72% and Germany’s DAX Index slid by 0.31%. The FTSE 100 Index, on the other hand, gained 0.30%. Core eurozone bond yields dipped as concerns grew about inflationary pressures and weakening economic growth caused demand for high-quality government bonds to increase. UK government bond yields followed the trend of core markets and peripheral bond yields rose in general.

Over the week, stocks fell in Japan. The Nikkei 225 Index lost 0.95% while the broader TOPIX Index slid 0.29%. The Bank of Japan (BoJ) continued with its accommodative policies at its April monetary policy meeting, causing interest rates to remain unchanged at near-zero levels and maintaining the current scale of its asset purchases. The BoJ remained committed to its easing stance by declaring that it will carry out fixed-rate bond-buying every business day rather than on an ad hoc basis. This pushed the 10-year Japanese government bond yields downward, falling to 0.21% from 0.24% at which level it closed during the previous week. The central bank’s pronouncement signaled that it will continue its divergence from the other major central banks’ monetary tightening, thus sharply weakening the yen, from the prior week’s JPY 128.47 to this week’s JPY 130.39 per U.S. dollar. This is the lowest level the currency has seen in 20 years. With these developments, the BoJ revised its inflation estimate to rise by a median of 1.9% from 1,1% in its consumer price index (CPI) for the year 2022. It revised its downward forecast for economic growth from 3.8% to 2.9% year-on-year. The factors cited were the coronavirus resurgence, rising prices of commodities, and the slowdown in economies overseas.

China’s stock markets ended mixed on reports that the country’s Politburo pledged to boost economic stimulus and called for its technology sector to undergo a “healthy development.” The broad Shanghai Composite Index dipped 1.3% while the blue-chip CSI 300 Index that tracked Shanghai’s and Shenzhen’s largest listed companies ended mostly unchanged. The markets appeared to recover their earlier losses that were caused by the zero-tolerance approach of the government to the coronavirus. The Politburo meeting did not elaborate further on how China will support its economy, although it was consistent with recent reports regarding infrastructure, consumption support, and tax cuts. China’s government bonds firmed on expectations of easing liquidity. The yield on the 10-year Chinese government bond declined to 2.854% from the previous week’s 2.88%. The yuan weakened to 6.6143 per U.S dollar, compared to 6.47 one week earlier. In April, the yuan fell approximately 4.2% against the dollar, its biggest monthly drop on record, as a result of foreign investors selling Chinese assets in favor of higher-yielding U.S. bonds.

The Week Ahead

Important data scheduled for release in the coming week include the unemployment rate, hourly earnings growth, and the manufacturing index.

Key Topics to Watch

- S&P Global U.S. manufacturing PMI (final)

- ISM manufacturing index

- Construction spending

- Job openings

- Quits

- Factory orders

- Core capital goods orders (revision)

- Motor vehicle sales (SAAR)

- ADP employment report

- International trade balance

- S&P Global U.S. services PMI (final)

- ISM services index

- FOMC statement

- Fed Chair Jerome Powell news conference

- Initial jobless claims

- Continuing jobless claims

- Productivity (SAAR)

- Unit labor costs (SAAR)

- Nonfarm payrolls

- Employment rates

- Average hourly earnings

- Labor force participation rate, 25-54

- Consumer credit

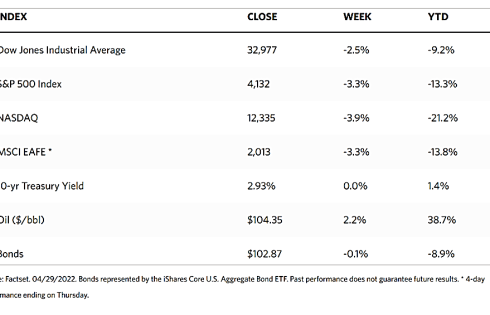

Markets Index Wrap Up