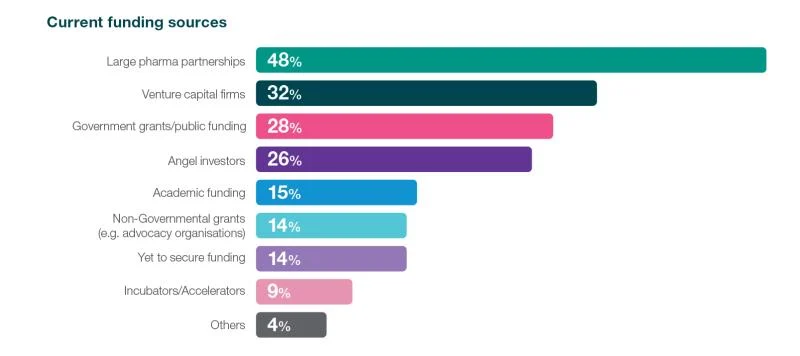

Against a backdrop of a tough funding environment, nearly half (48%) of biotechs are using partnerships with Big Pharmas as a financing method, according to a survey commissioned by CRO Icon.

Venture capital firms are the second most sought-after financiers, at 32%, followed by government grants/public funding at 28%, according to a Citeline report commissioned by Icon. The survey was completed this summer by 133 senior-level decision-makers in biotech, about half (46%) of whom are based in North America, with a similar proportion based in Europe and 8% in the Asia-Pacific region.

A total of 51% of respondents said their organization had more than four ongoing clinical trials, and the most prominent drug modalities reported were small molecules (35%) and cell therapies (31%).

The dependence on Big Pharmas to stay afloat isn’t surprising, as biopharma VC funds are expected to hit $24 billion for the year—the lowest tally in four years, according to PitchBook. This is compared to annual values of $38.1 billion in 2020, $53.9 billion in 2021 and $36.9 billion in 2022, representing a $12.9 billion year-over-year drop.

Despite cash struggles, 60% of the survey respondents anticipate their R&D spend rising over the next one to two years, with only 2% expecting development expenditure to fall. The remaining 15% of respondents said they were actively attempting to secure additional funding at the time of the survey.

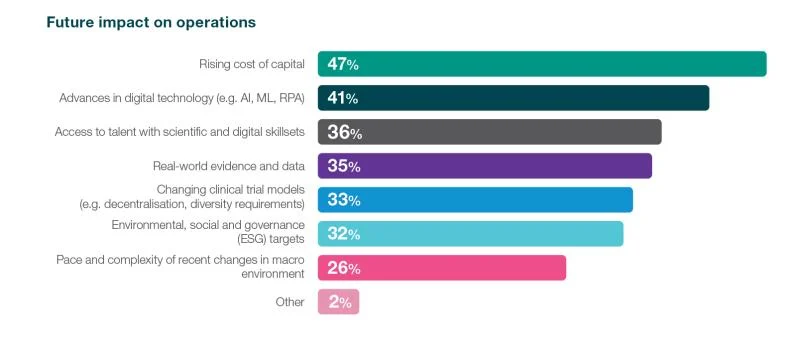

Nearly half (47%) of participants said the rising cost of capital will have the greatest influence on future operations, followed closely (41%) by advances in digital tech such as AI, machine learning and robotic process automation.

Amid the financial crunch, 32% of biotech leaders said they were “very” confident about meeting their next investment milestone, with the majority (61%) “somewhat” confident. On the flip side, 6% of respondents were somewhat unconfident and 1% were very unconfident about hitting their financial goals.