To hedge or not to hedge international equities has been a perennial question for Australian investors for decades, with conventional wisdom dictating that hedging against foreign currency moves is good risk management and reduces volatility.

But our analysis over the past 20 years reveals that for Australian investors, whose portfolio value is denominated in Australian dollars (AUD), hedging international equities may have a detrimental outcome, adding to volatility without improving returns.

Why? Because of the procyclical behaviour of the Australian economy and the AUD. Because the former is commodities-focused, the AUD moves up and down with the price of commodities.

Strong global growth, which has been led by China and the US, translates into higher demand for raw materials. When demand for commodities is strong, the Australian economy is generally stronger, and so is the AUD. Conversely, when the global economy is weak, demand for manufactured goods and commodities is also weak and so puts downward pressure on the AUD.

How this translates into stock market prices is interesting.

When global growth is weak, stock markets tend to be weak as well, but we also know that under this scenario the AUD tends to depreciate against foreign currencies. If, for example, US shares are falling, the AUD is falling at the same time. Thus when the value of those US shares is translated back into AUD, the loss in value is smaller. The movement in the AUD/USD acts as a buffer for returns.

Same direction

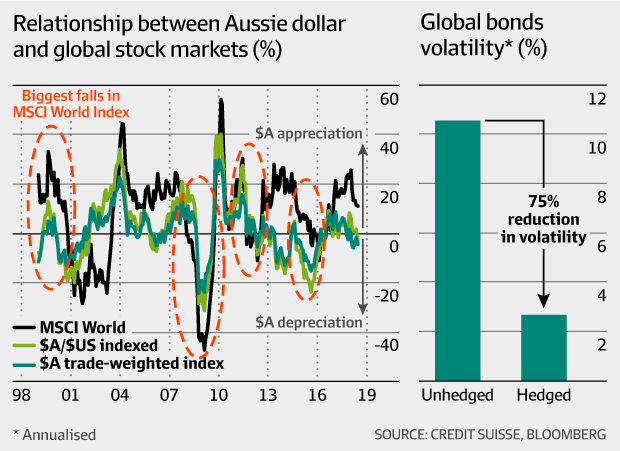

Statistically speaking, our mapping of the relationship between global stock markets and the AUD shows a positive correlation – they move in the same direction, more often than not. This relationship is shown in the graph. The dotted red circles highlight those periods when the MSCI World Index suffered its biggest falls. Note the depreciation in the AUD/USD and AUD Trade Weighted Index (TWI) that occurs concurrent with each correction.

The conclusion is that not hedging foreign exchange on international shares over the long term will reduce volatility.

But when we turn to the bond market, should Australian investors hedge forex risk on foreign-currency-denominated bonds? The answer is the opposite – yes, they should.

Analysis of the same 20-year data set shows a reverse relationship between the AUD/USD and the direction of bond prices. The AUD generally appreciates with weak bond prices, which is usually concurrent with stock market strength.

If international currency bonds aren’t hedged to AUD, the bond price fall is exaggerated when translated to AUD. In a low bond-yield environment, the move in the currency can completely offset the yield from bonds, driving bond returns into negative territory.

On the other hand, if bond prices are rising as investors seek certainty in a volatile market for global growth, the AUD is likely to be depreciating, exaggerating the return on the upside.

Portfolio stability

Although this is a positive during an uncertain environment – such as the present – we need to consider the overall risk return characteristics created by an unhedged position. The point to note here is that bonds are in a portfolio to provide income and portfolio stability. In a fully unhedged position, the bond returns, and stability of those returns, may be overwhelmed by the movement in the currency. This changes the risk profile of a bond allocation from one of stability to one that resembles a more volatile risk asset, which is undesirable from an overall portfolio perspective.

On measuring the impact on volatility of hedging global bonds to AUD, the reduction in volatility is dramatic.

The alternative to hedged foreign bonds is to own AUD bonds. In fact, we recommend that our Australian clients have a bond portfolio dominated by AUD bonds. The yield on AUD bonds is generally higher than other developed markets, and provides a stable flow of AUD income. It also provides a more direct counterweight to volatility in Australian-biased equity portfolios.

But to be clear, investors can add value by hedging or not hedging at particular times – they just have to get it right, and be aware that picking short-term foreign currency moves is notoriously difficult. An Australian investor who wants insurance against weaker global growth and a falling AUD may consider holding unhedged US Treasuries.

Our overall conclusion is that the starting point for long-term investors who expect to stay invested through the cycle should be not to hedge international equities, but do hedge foreign currency bonds.