Evidence of the type of confidence that can eventually prove ‘problematic’: RenMac

Red-hot initial public offerings may offer another sign of froth in a rallying stock market that saw all three major U.S. benchmark indexes and a small-cap index hit all-time highs this past week.

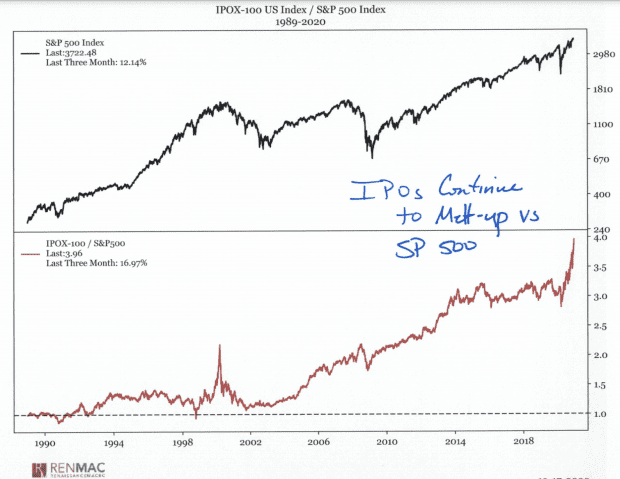

The bottom half of the chart below, from Renaissance Macro Research, shows the performance of the IPOX 100 U.S. index, which tracks the performance of new listings, relative to the S&P 500 SPX, -0.35%.

“One example of market enthusiasm is the performance of IPOs relative to SPX,” wrote Jeff deGraaf, founder of Renaissance Macro Research, in a note.

“Simply put, IPOs have crushed the broader market, a sign of confidence that eventually can lead to the type of speculative excesses that become problematic for stocks,” he said.

Big post-listing gains for a trio of newly listed stocks last week — Airbnb Inc. ABNB, +6.97%, DoorDash Inc. DASH, +7.87% and C3.ai Inc. AI, +17.36% — set off alarm bells for some market watchers as U.S. stock indexes put a pandemic-induced bear market in the rearview mirror and now remain on track for large 2020 gains. All three new listings fell after their pop. C3.ai bounced back and is trading above its debut price.

The S&P 500 remains up more than 14% for the year to date, while the Dow Jones Industrial Average DJIA, -0.41% is up 5.7%.

The Nasdaq Composite COMP, -0.07% is up more than 40% for the year, reflecting stunning gains for large-cap technology and internet-related stocks that have been seen as beneficiaries of the work-from-home environment during the pandemic.

More recently, previously neglected stock sectors have shone as investors looked past a renewed surge in COVID-19 cases to cheer progress toward vaccines and prospects for another yet-to-be-completed package of economic relief from Congress. The small-cap Russell 2000 RUT, -0.41%, up 19% year to date, has outpaced its large-cap counterparts in recent months.