Normally ‘something gives’ when the greenback gets this strong

With so many conflicting signals about markets, the economy in the U.S. and abroad, the impact of the China-U.S. trade war, and more, what’s an investor to think?

Through all the noise, there’s one measure that bears watching. Even investors who don’t trade currencies should pay attention to the strength of the U.S. dollar, according to a note out Monday. That’s because while the strong dollar has a lot of effects, its cause, at least right now, is that investors around the world are skittish.

Normally when the greenback gets this strong, something gives, and other currencies start to strengthen, observed Nicholas Colas, co-founder of DataTrek Research. “If they don’t, it means something is very different this time around. And ‘different’ in this case probably doesn’t mean ‘good’ when it comes to investor risk appetites,” he said.

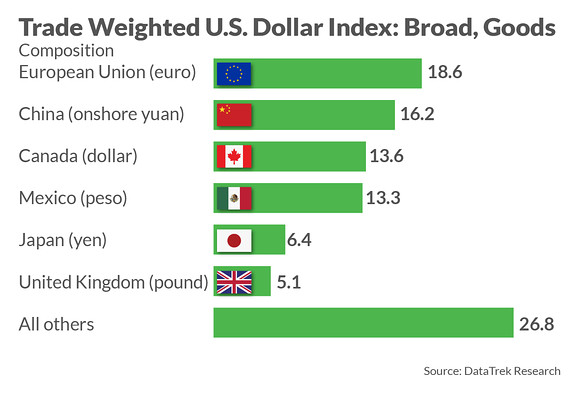

The currency measure Colas prefers is called the Trade Weighted U.S. Dollar Index: Broad, Goods, and it’s hovering around all-time highs — although data only goes back to the mid-1990s. The index tracks how well America’s currency is performing against currencies for other countries with whom the U.S. has a trading relationship.

The biggest contributors to the index are in the graphic above. And for some context, here’s a chart showing the index’s level over its full history:

The question of what, exactly, it means for a currency to “perform against” others is important, and anyone who pays attention to President Donald Trump’s Twitter tirades about the dollar has a sense of both its significance and its ambiguity.

Fact check: true. It does make it harder for American companies that export to remain profitable when the currency is higher. But focusing only on manufacturers misses a lot of the bigger context, as well as why things are so complicated right now for the dollar.

“Super-cap tech stocks — important market leaders for U.S. equity markets — have the greatest financial exposure to non-dollar revenues of any S&P group,” Colas noted. “At 57% non-domestic revenues, Tech companies face a strong currency headwind just now.” Other sectors that have a higher-than-average exposure to the dollar include materials, consumer staples and energy.

Where else does a strong dollar create potential headaches? The Federal Reserve.

That’s because when interest rates are low elsewhere in the world, investors try to find places to get a little yield. Of course, when more investors are chasing U.S. bonds, that drives the price up — and returns down. Depending on what kind of policy the central bank is trying to achieve, that can be a headwind or a tailwind. But it’s a mistake to assume that the Fed can make monetary policy in a vacuum.

As Colas notes, it’s not just the trade war, and the corresponding 6% hit to the yuan, that’s keeping the dollar index so high. The euro, which has the biggest position in the index, “is 11% lower from its March 2018 high-water mark, back when the German 10-year bund was yielded +0.6% instead of its current -0.4%.”

Why would investors chase a yield of -0.4% when they could pick up 1.7% on the U.S. 10-year bond TMUBMUSD10Y, -3.26% ?

There’s a final component of what’s making the dollar so strong, and it’s the one that serves as a signal for how markets may behave over the coming months. As MarketWatch’s Bill Watts explained in late September, the U.S. dollar is the world’s safe haven — even when the U.S. is the one making global markets so uncertain, in part, because of its dominance in the global payments system.

One of the reasons European interest rates are so low, in other words, is that the U.S.-China trade war isn’t just confined to those two countries.

“Risk aversion, negative European/Japanese interest rates, and trade war blowback are the trifecta of reasons the dollar sits at multidecade highs,” Colas concluded. “If we’re moving from that story line to something more positive in 2020, then the dollar should begin to weaken soon. And if it doesn’t, that’s an important sign as well.”