Stock Markets

During the past week, data showing the highest inflation in the last thirty years caused investor sentiment to dip and stocks to retreat from their record highs. The S&P 500 recorded its first loss on Tuesday in the last nine consecutive sessions that ended its longest winning streak going back to 2017. Within the S&P 500 index, the consumer discretionary shares underperformed all the other sectors due to a steep fall in Tesla. The sell-down was sparked by an announcement by CEO Elon Musk of plans to sell some of his shares. Energy shares likewise plummeted in line with the oil price drop-offs from their recent highs. Of the sectors that outperformed, the small materials sector was the strongest, apparently boosted by the passage of the $1.2 trillion infrastructure bill in the U.S. House of Representatives. Also noteworthy for the week was the initial public offering of Rivian, maker of electric vehicles. Since the launch of Facebook’s offering in 2012, this was the largest IPO for an American company. Thursday was marked by the observance of Veteran’s Day, during which fixed income markets were closed.

U.S. Economy

On Wednesday morning it was announced that the consumer price index (CPI) surged 0.9% for October, overshooting consensus expectations pegging the increase at 0.6%. This latest rise brought the year-over-year CPI increase to 6.2%, the highest CPI level since December 1990. A large part of the reason for this rise in inflation can be attributed to the sudden increase in energy prices. Nevertheless, core inflation (i.e., excluding the energy and food segments) also increased by 0.6% which is also higher than expected, bringing the core reading to 4.6%.

Inflationary pressures may be transitory, however. Components of inflation that are temporary by nature are the volatile prices for energy and gas, automobiles, and food and lodging. These sectors are sensitive to supply chain disruptions, labor shortages, and higher demand, all three of which are transient disruptors in the recovering post-pandemic economy. It is highly likely that the surge in prices seen to date will not occur again in the coming months. Supply-chain bottlenecks are likely to ease in the near future, which will also tend to ease up the production costs in the automobile industry. There are some areas, however, where inflationary components may tend to remain elevated, such as wage inflation, shelter and rent costs, medical care services, and education costs.

Over the long term, such as ten years or more, other factors may exert downward pressure on inflation. These include an aging demographic, rise in automation, and globalization. The older population in many developed economies, and the working age population are likely to shrink, putting a broad downward pressure on consumption and inflation. Technological advances that enhance automation in production make it possible for larger parts of the workforce to be replaced or supplemented, keeping the wage inflation down and thereby also reducing inflation overall. Finally, globalization implies that multinational companies may source labor and parts from other parts of the world where they cost less. There appears to be a diminishing trend towards globalization, however, which is a development that must be studied.

Metals and Mining

The announced increase in the U.S. CPI last Wednesday has triggered concerns that the Federal Reserve might not be up to the task of controlling the fast-rising inflation. The impression is that the U.S. Central Bank is losing control is due to the lack of further actions that it may take to halt the rising trend in prices. A global supply crunch is driving the present inflationary push, Hiking interest rates is not likely to be effective in increasing the supply of needed manufacturing supplies such as microchips, or the volume of consumer goods to fill grocery store shelves. Rate hikes will also not effectively reduce the soaring gas prices. What is worse, data from the University of Michigan point to the early prospect of weakening consumer sentiment, which may lead to less consumption. This creates lower growth, and thus stagflation.

The fear of a faltering economy is driving the precious metals market, which is now seeing a five-month high. Gold is the one asset of intrinsic value that investors flee to when the other financial markets become volatile. The precious metals market is currently performing well as the flight-to-risk investment vehicle, particularly in this inflationary environment. Over the past week, the spot price of gold climbed 2.56% to $1,864.90 per troy ounce at Friday’s close of trading, from the previous week’s close of $1,818.36. Silver rose 4.80%, from the previous week’s close of $24.16 to last week’s closing price of $25.32 per troy ounce. Platinum climbed from $1,036.24 in the previous week to rise 4.78% and end at $1,085.80 per troy ounce. Palladium gained 3.50% week-on-week, starting from $2,040.09 to close the week at $2,111.41 per troy ounce.

Base metals also made solid gains for the week. Copper began at $9,439.00 per metric tonne and closed last week at $9,633.50 for a gain of $2.06%. Zinc, which ended the previous week at $3,240.50, closed the succeeding week at $3,279.00 for a gain of 1.19%. Aluminum began with a price of $2,554.50, the earlier week’s close, to end at $2,660.00 for this week, registering an increase of 4.13%. Tin, which previously closed at $36,452.00, ended this week at $37,708.00, gaining 3.45% in market value.

Energy and Oil

Crude prices have recently been trading the range between $80 and $85 per barrel, but their loss of momentum from the past surge will bring them to a third consecutive weekly decline. Other than the pullback in the futures markets, other indications point to a further slump in crude oil prices. The U.S. government will likely decide on further SPR releases in the coming days. In addition, the demand scenario is likely to weaken further as OPEC decided to reduce its fourth-quarter demand forecast by 330,000 barrels per day (b/d), driven down by the adverse effect of rising energy prices and inflation on the economic recovery. A further consideration is the increasing pressure put by the strengthening dollar on crude prices. As the dollar’s value appreciates, the price of crude tends to go down in terms of the U.S. currency.

Natural Gas

With the forward view of providing sufficient winter supplies for gas and electric consumers, the California Public Utilities Commission (CPUC) voted unanimously on Nov. 4 to increase the amount of natural gas stored at the Aliso storage facility in Los Angeles County, to 41 billion cubic feet (Bcf) from 34 Bcf. This move guarantees that Southern California Gas Co. (SoCalGas), the operator at the Aliso Canyon facility, will be able to meet the minimum reliability needs of the region. The supply conditions throughout the region have been tight for most of the summer and well into autumn. For the coming winter, a technical assessment by SoCalGas shows that gas demand may reach 4,967 million cubic feet per day (MMcfd), should a one-in-10- year cold day event take place.

The steep discounts in forward prices were part of the large sell-off throughout the country. Henry Hub December prices further declined due to a bearish weather outlook, stronger production, and inconsistent feed gas demand by the U.S. LNG facilities. The New York Mercantile Exchange (NYMEX) trading established the trend for the U.S. benchmark as contracts ended in the red for most trading days. The December futures contract capped the week at $4.791, off $0.358 day/day and lower from a $5.516 settlement on Nov. 5. Although we are two weeks into November, the winter weather remains absent from forecasts. Other bearish factors continue to dominate the gas market.

World Markets

In Europe, share prices rose in response to the continued accommodative monetary policy and the prospects of continued economic growth, negating for the moment concerns about the rising inflation. The pan-European STOXX Europe 600 Index rose 0.68%. Also gaining are Germany’s Xetra DAX by 0.25%, France’s CAC 40 Index by 0.72%, and the UK’s FTSE 100 Index by 0.60%. Going in the opposite direction is Italy’s FTSE MIB, which lost 023%. Among the fixed income investments, core eurozone bond yields rose. Earlier in the week, the markets did not expect an increase in interest rates in light of the European Central Bank’s dovish comments. However, the surge in the U.S. inflation rate to higher-than-expected levels prompted a reversal, forcing yields higher. Broadly following the trend of the core markets are the peripheral eurozone and the UK government bond yields.

In Japan, news about the particulars in the government’s proposed fiscal stimulus package and the impression that Japanese valuations were lagging behind their U.S. peers incentivized some investor accumulation in the country’s equity markets over the past week. The corporate earnings report season indicated that there were positive effects from the weakness of the currency. The Nikkei 225 and the broader TOPIX indexes traded sideways, generating neither gains nor losses. The yen further weakened to JPY 114.05 versus the U.S. dollar, down from JPY 113.41, primarily because of speculation that the Bank of Japan will maintain low interest rates beyond the central banks of other developed countries. The yield on the 10-year Japanese government bond remained unchanged at 0.07%.’

The Chinese stock markets gained ground consistent with expectations that Beijing will be adopting easing measures to aid highly leveraged property companies with looming debt defaults. The large-cap CSI 300 Index ascended 0.95% while the Shanghai Composite Index climbed 1.4%. Over the week, embattled China Evergrande Group was able to avoid a last-minute default for the third time in the month. Furthermore, the Kaisa Group informed its creditors that it may not be able to pay the coupons on its bonds due to legal and cross-default issues offshore and domestically. Kaisa is also on the brink of default as it has the most offshore bonds of any Chinese developer after Evergrande. In 2015 Kaisa became the first property developer to default on its dollar bonds, which became a landmark event at the time. The property sector remains a key industry in China’s economy, giving rise to the possibility of a spillover effect into the other sectors.

The Week Ahead

In the coming week, expect Retail Sales, Initial and continuing jobless claims, and the Leading Economic Indicators index to be among the important economic data to be released.

Key Topics to Watch

- Empire State manufacturing index

- Retail sales

- Retails sales ex-autos

- Import price index

- Industrial production

- Capacity utilization

- NAHB home builders’ index

- Business inventories

- Building permits (SAAR)

- Housing starts (SAAR)

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Philadelphia Fed manufacturing index

- Leading economic indicators

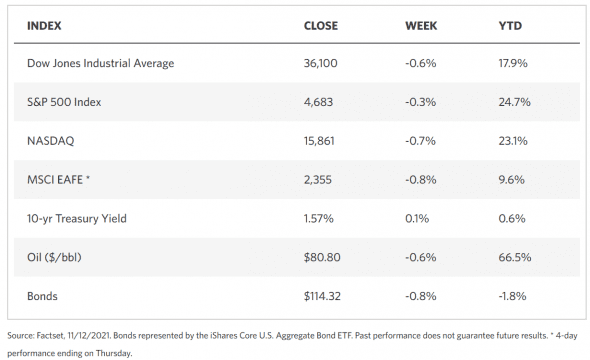

Markets Index Wrap Up