Stock Markets

While it was trade-deals that were expected to drive the markets last week, the limelight moved quickly to economic fundamentals, which drove global stocks higher. It appears that international stocks outperformed domestic ones based on the fourth straight month of improvement in global manufacturing PMI, which is seen as a reflection of global growth. Data seems consistent with an improving demand climate. This seems to indicate that the manufacturing downcycle may over, for now. The U.S. jobs report was astounding and set off U.S. stocks best daily gain in over a month. The report showed strong job gains, rising wages, and a return to a 50-year-low unemployment rate. The attention of Trump’s economy has created a seven-month high in consumer sentiment, solidifying the fact that the U.S. economy is on course to finish 2019 on a high note.

U.S. Economy

For the first week of December, the U.S. economic news set an optimistic case for December and a bull market that will continue to year end and beyond. Stocks rose 0.9% on Friday on the solid news. Compared with the first week of December 2018, things were a real step up. Last year stocks slumped based on a yield curve inversion that worried investors with talk of recession. Last year too, the November jobs market missed expectations, and trade negotiations, were bogged down. This week has ended up being completely different from that period. With recession fears in the far distance and trade battles making headway, there is reason for real optimism ahead, albeit a cautious outlook.

Metals and Mining

Gold prices softened on Friday as increased hopes of reaching a phase one and broader US-China deal increased investors’ appetite for riskier assets. A very strong US jobs data report also took its toll on gold. President Donald Trump said in the week that talks with China were making progress, indicating they may be nearing a deal and that there may be a potential end to the trade war. During 2019, gold has been supported largely by the trade war, helping the safe haven metal gain over 14 percent in that period. Gold was also hurt this week by the robust US jobs data report released earlier Friday. The report revealed that US job growth increased the most in the last 10 months in November. That put to rest investor fears that the economy may be headed for a major downturn. The better-than-expected jobs report took the favor out of demand for safe haven products such as gold, analysts said. Silver was also held back, dropping over 1 percent during Friday morning. Silver slid as its safe haven appeal declined too, but those were losses were capped by investors waiting to hear the upcoming Fed meeting. Overall, silver is up 9.7 percent on a year-to-date basis. In other precious metals, platinum was flat at the end of the trading week. Once again analysts at FocusEconomics believe that platinum prices are likely to pick up based on a fall in global supply. Palladium on the other hand was the leading precious metal with a large enough increase to hit US$1,880.37 per ounce for the first time. Palladium has gained over 40 percent since the beginning of 2019. Its large gains can be traced to stricter environmental regulations around car emissions. Air quality rules in line with cutting pollution have prompted automakers to increase the amount of palladium used in catalytic converters. As demand increases from the automotive sector, supply shortfalls are beginning to appear. That creates a spot price a boost on the market for palladium.

Energy and Oil

Oil jumped this week thanks to news from Vienna. It appears OPEC+ has agreed to cut 500,000 bpd more than the current arrangement, which raised some questions. However, Saudi officials are reported as saying they would maintain their unilateral cuts beyond what is required in order to defend oil prices. Global markets responded immediately with a bounce. OPEC+ agrees to keep the cuts until March. At the same time Saudi Arabia promises to maintain unilateral cuts that they say voluntarily take out 400,000 barrels a day. The news from Saudi Energy Minister Prince Abdulaziz bin Salman sent oil prices much higher. On the domestic front, the U.S. has become a net petroleum exporter. In September, the U.S. exported 89,000 barrels of crude and petroleum products, the first month since 1973 that its overall petroleum balance was net positive. In comparison, the U.S. was importing 10 million barrels per day on a net basis just a decade ago. Natural gas spot prices fell at most locations this week. The Henry Hub spot price rose from $2.33 per million British thermal units (MMBtu) last week to $2.37/MMBtu this week. At the New York Mercantile Exchange (Nymex), the December 2019 contract expired November 26 at $2.470/MMBtu. The price of the January 2020 contract decreased 10¢, from $2.501/MMBtu last week to $2.399/MMBtu this week. The price of the 12-month strip averaging January 2020 through December 2020 futures contracts declined 7¢/MMBtu to $2.333/MMBtu.

World Markets

In Europe, stocks basically ended the week flat. This after retracing earlier losses set off by fears that a U.S.-China trade deal might be delayed even further – possibly until after the U.S. 2020 election. Stocks increased Friday after President Trump added reassurance that trade talks were “moving right along.” The stronger-than-expected U.S. jobs report really eased market fears of a global economic slowdown. The pan-European STOXX Europe 600 Index ended the week flat, Germany’s DAX index fell 0.5%, and the UK’s FTSE 100 Index dropped 1.6%. UK stocks tend to decline when the pound rises because many index companies are multinationals with overseas revenues. In Britain, the pound headed to a seven-month peak against the U.S. dollar and the euro. That marks its highest level yet under Prime Minister Boris Johnson. That speaks directly to Johnson’s popularity, especially in polls for the UK election. Analysts caution that even a 10% poll lead may not extrapolate as expected. Tactical voting—where voters support a candidate other than their first choice in order avert an undesirable outcome—as well as a surge in new voter registrations are making the election more difficult to predict.

China saw its stocks advance, snapping the last three straight weeks of losses. Apparently, investors felt that an interim U.S.-China trade deal is getting close. For the week, the benchmark Shanghai Composite Index rose 1.4%, and the large-cap CSI 300 Index added 1.9%. Friday added the largest weekly gains for both indexes since the week of October 11. China said it has started to waive retaliatory tariffs on U.S. pork and soy imports by domestic companies on Friday. The Chinese Finance Ministry is reported to be working to waive the tariffs resulting from the trade war after domestic companies bought a certain amount of U.S. farm products. That statement led traders to further support the notion that the U.S. and China were drawing closer to a phase one trade deal that is expected to create the groundwork for a broad, full scope agreement.

The Week Ahead

There are several Important economic data points emerging in the week including the NFIB small business optimism index, consumer inflation, unit labor costs and November retail sales. In what is expected to be an uneventful announcement, the Federal Reserve will release its policy rate on Wednesday. The rate is widely predicted to remain unchanged.

Key Topics to Watch

- NFIB small-business index

- Productivity revision

- Unit labor costs revision

- Consumer price index

- Core CPI

- Federal budget

- FOMC announcement

- Weekly jobless claims

- Producer price index

- Retail sales

- Retail sales ex-autos

- Import prices ex-fuels

- Business inventories

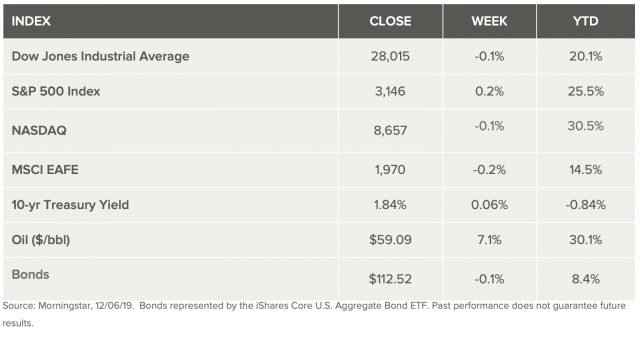

Markets Index Wrap Up