Blackstone’s Byron Wien says gold ‘has a chance to be an interesting investment’

Gold has a chance to be an interesting investment in the coming year, says Blackstone investment luminary Byron Wien:

‘Watch gold in 2020. It has a chance to be an interesting investment.’Byron Wien

That is how the veteran investor, whom U.S. News & World Report report described as a modern-day cult figure on Wall Street and one of the most influential investors, described the outlook for the yellow metal in the coming 12-month stretch, during a CNBC interview, ahead of the release of his well-read list of market surprises.

Wien didn’t provide further clarity on his gold estimates or the precise direction of gold trading in 2020.

However, his comments came as the precious commodity was on pace to enjoy one of its strongest daily gains since late November and its highest finish since early last month, rising past a psychologically significant level above $1,500 an ounce. Gold for February delivery GCG20, +1.05% was most recently trading up $14.20, or 1%, at $1,503.10 an ounce on the Comex exchange.

Gold has gained 17.3% so far this year, based on the most active contract, according to FactSet data. That is a relatively healthy run-up for the metal considering that stocks, which tend to move in the opposite direction of gold, have been trading near all-time highs.

Indeed, the Dow Jones Industrial Average DJIA, -0.13% has gained 22.3% so far in 2019, the S&P 500 index SPX, -0.02% has climbed nearly 29% over the same period and the Nasdaq Composite Index COMP, +0.08% has advanced nearly 35%, putting those indexes on track for their biggest annual gains in years.

What’s keeping gold afloat at the same time that stocks are riding high? Partly, worries that the equity market could turn lower after a mostly bullish 2019.

But commodity experts also say that a détente between the U.S. and China on the trade front could be helping to build bullish sentiment around gold appetite.

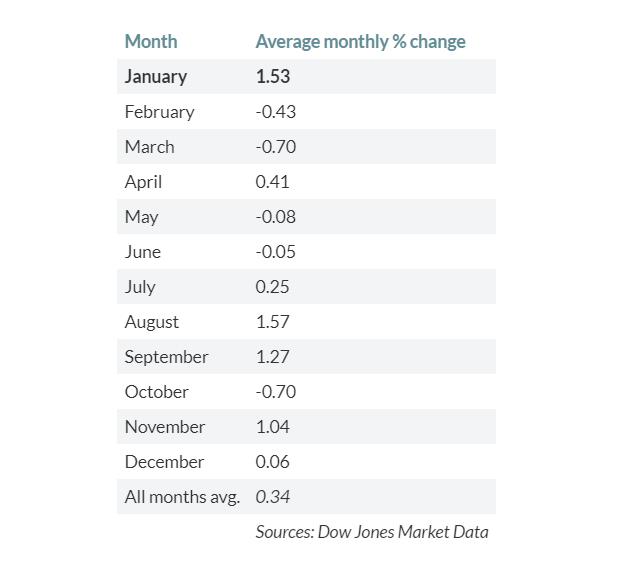

Meanwhile, seasonal trends could also be set to help gold push higher in January. Since 1980, January marks one of the best months for gold, with an average gain during the month of 1.53%, according to Dow Jones Market Data.

The best month for gold, however, is August, when the precious metal averages a gain of 1.57% (see table below):

January, however, tends to be a strong period of gold buying, with Asian investors usually taking a shine to the commodity around Lunar New Year, when gold is offered as a gift.