Index logs longest losing streak in over 3 years as stocks tumble ahead of Labor Day

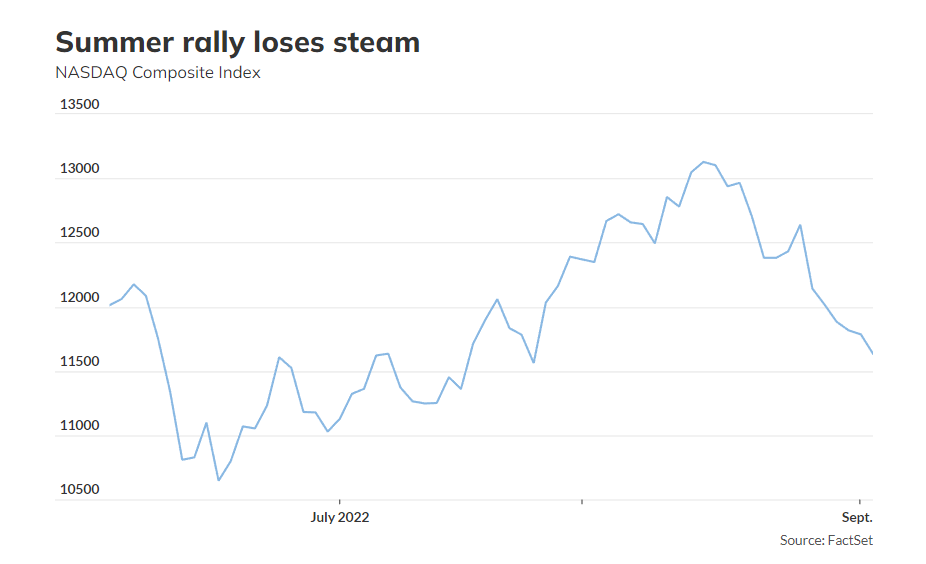

The U.S. stock market swoon that took hold in late August is demonstrating why last month’s declarations of the start of a new bull market for the beaten-down Nasdaq Composite were treated as suspect.

The Nasdaq COMP, -1.31% fell 1.3% friday afternoon, logging its sixth straight daily loss — its longest losing streak since a six-day run of losses that ended on Aug. 5, 2019. Moreover, its down 8% over that six-day stretch and more than 11% from its Aug. 15 close at 13,128.05.

Investors may recall that the Nasdaq met a widely used definition of a bull market on Aug. 11, when it finished 20.8% above it’s mid-June low. A 20% rise from a recent low in a bear market is a widely used definition of a bull market, but it’s hardly universally agreed. After all, stocks often bounce sharply in bear markets only to give back gains in short order.

So it was no surprise that calls for the start of a new bull met considerable pushback from veteran investors and analysts.

As Ross Mayfield, investment strategy analyst at Baird Private Wealth Management pointed out at the time, the Nasdaq saw three rallies of 40% or more over the course of the bear market that followed the dot-com burst in 2000-2001, none of which marked the beginning of a lasting bull.

Friday was ugly for all three major indexes, which had initially rallied following an August jobs report that saw payrolls rise in line with expectations as the unemployment rate ticked up to 3.7% from 3.5%. Equities turned south around midday, however, with the Dow Jones Industrial Average DJIA, -1.07% falling nearly 340 points, or 1.1%, while the S&P 500 SPX, -1.07% skidded 1.1%.

Investors have long debated the best way to define the start of a bull market. Some argue that attempting to measure from the date of a bear-market low is misguided, and instead look for an asset to take out its previous high before declaring a bull market. Others use much more complicated criteria, which underlines that the endeavor is more than a little subjective.