Boeing stock has worst day in nearly 5 months after Ethiopian Airlines crash

U.S. stocks snapped a five-day losing streak to close higher Monday as technology shares rallied, offsetting some of the gloom from Boeing Co.’s woes after the second deadly crash in about six months involving the company’s 737 Max 8 aircraft.

How did major indexes fare?

The Dow Jones Industrial Average DJIA, +0.79% rose 200.64 points, or 0.8%, to 25,650.88. The blue-chip index had fallen more than 200 points earlier in the session.

The S&P 500 SPX, +1.47% gained 40.23 points, or 1.5%, to 2,783.30, with the information technology sector up 2.2%. The Nasdaq Composite IndexCOMP, +2.02% climbed 149.92 points, or 2%, to 7,558.06, logging its best day on a percentage basis since Jan. 30.

What drove the market?

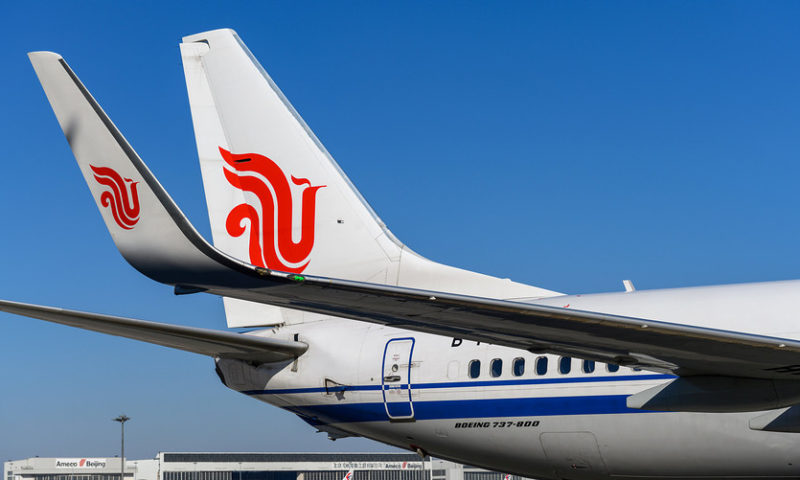

Shares of Boeing BA, -5.33% had their worst day in nearly five months, falling 5.3%, after one of the company’s 737 Max 8 planes operated by Ethiopian Airlines crashed shortly after takeoff from Ethiopia’s capital, Addis Ababa, on Sunday, leaving no survivors among the 157 on board. At session lows, the Dow’s most heavily weighted company‘s stock was down more than 13%, subtracting 152.77 points from the Dow on the day.

It comes months after a crash of the same model plane flown by Indonesia’s Lion Air, which went down into the Java Sea shortly after takeoff, killing 189 people. The plane maker released a statement expressing sympathy for the families of the victims, and said it would be sending a technical team to assist in the crash investigation.

Investigators will be looking at the two crashes, which both took place as the aircraft were taking off. The pilot of the Ethiopian flight was reportedly trying to return to the airport after reporting technical problems, and the weather was clear. China has grounded all 96 of its 737 Max 8 planes, and Ethiopian Airlines has reportedly done the same.

Boeing has delivered about 350 of its best-selling 737 Max planes, with orders for more than 5,000 more, and the plane already in use by American Airlines Group Inc. AAL, +0.44% , United Continental Holdings UAL, -0.02% and Southwest Airlines Co. LUV, -0.31% .

Southwest said it was in close contact with Boeing following the crash, but said it had no plans to change operations. Still, shares of Southwest were down 0.3%.

Last week, Boeing Chief Executive Officer Dennis Muilenburg told an aviation conference that purchases of his company’s planes by China could be part of a trade deal being hammered out by the two countries, Reuters reported. U.S. and Chinese officials have cited progress in trade negotiations, but the market is still waiting for news of hard details or a concrete deal.

Investors are struggling with growing concerns about a global slowdown that overshadowed the 10th anniversary of the start of the bull market on Saturday. Investors were caught off guard Friday by surprisingly weak jobs numbers after the Labor Department announced the U.S. economy added just 20,000 new jobs in February, well below the 178,000 forecast by economists in a MarketWatch poll.

Federal Reserve Chairman Jerome Powell played down worries over the economy in an interview with “60 Minutes” on Sunday, saying “there is no reason why this economy cannot continue to expand.”

What economic data were in focus?

Retail sales rose 0.2% in January, above the 0.1% increase predicted by economists polled by MarketWatch. More disappointing, December’s 1.2% drop was revised even lower to a 1.6% decline, marking the largest fall in nearly 10 years.

Business inventories in the U.S. rose 0.6% in December, the Commerce Department said, while reporting that sales fell 1%.

U.S. consumers expect prices to rise more slowly in the short and medium term, the Federal Reserve said Monday. Median inflation expectations at both the one- and three-year time horizons fell by 0.2% to 2.8%, after having been unchanged since last April.

What were analysts saying?

“Investors have been waiting to see if December’s retail sales were an aberration, and [Monday’s] number was pretty decent,” said Dave Lafferty, chief market strategist at Natixis Investment Managers, in an interview. “The consumer is doing the heavy lifting in this economy, and it’s good the market’s worst fears about the health of the consumer weren’t confirmed,” he added.

Meanwhile, Lafferty said, Powell’s interview on “60 Minutes” was “reassuringly dovish,” adding to optimism Monday, Boeing’s woes aside.

“The 1.1% m/m rebound in underlying control group retail sales in January may provide some reassurance that consumer spending isn’t falling off a cliff,” wrote Andrew Hunter, senior U.S. economist with Capital Economics, in a research note.

“But with December’s reading revised down to show an even sharper 2.3% plunge, the data confirm that real consumption growth is on course to slow sharply in the first quarter,” he added.

What stocks were in focus?

Shares of Tesla Inc. TSLA, +2.39% rose 2.4% after the electric-car maker reversed a decision to close most of its physical stores and move to online sales and to cut prices of the autos by 6%.

Nvidia Corp. NVDA, +6.97% shares soared 7% after the chip maker said it reached an agreement to acquire Israeli server and storage company MellanoxTechnologies Ltd. MLNX, +7.78% in a deal with an enterprise value of $6.9 billion. Mellanox shares jumped 7.8%.

Shares of Apple Inc. AAPL, +3.46% gained 3.5% after an analyst at Bank of America upgraded the stock to buy from neutral.

Ross Stores Inc. ROST, +1.89% shares rose 1.9% after the discount retailer announced plans to open 100 new locations in 2019.

How did other markets trade?

Asian stocks had a mostly positive session, with the Shanghai CompositeSHCOMP, -1.21% climbing 1.9%.

European stocks closed higher, with the Stoxx Europe 600 index SXXP, +0.78%rising 0.8%.

The ICE Dollar Index DXY, -0.34% edged lower, while gold prices GCJ9, +0.40% settled lower, and oil priced CLJ9, +0.46% gained more than 1%.