Investors who ignore short interest “do so at their own peril,” says analyst

The technology-laden Nasdaq Composite Index stands less than 2% from its early September peak, as of late Tuesday trade, reflecting its resurgence from its jaunt into correction territory less than a month ago.

However, rather than betting on continued progress in the popular benchmark that has led the run-up from coronavirus-induced lows, investors are mounting bets that the benchmark continues to be overpriced and faces a fresh collapse in the near-term.

“Somebody, somewhere, still wants to bet against this market,” writes Jason Goepfert, head of SentimenTrader and founder of independent investment research firm Sundial Capital Research, in a Tuesday research note.

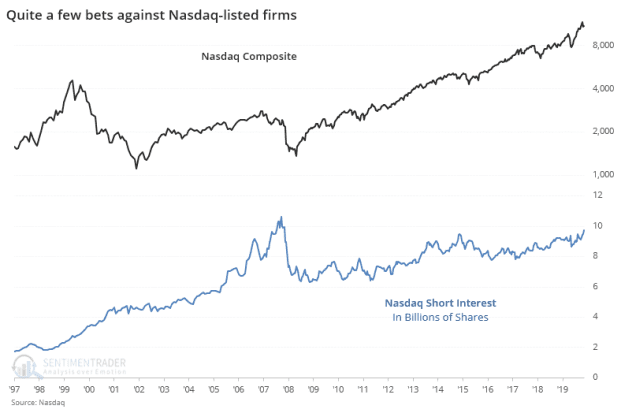

Goepfert writes that so-called short interest, or the total number of shares of a particular stock or fund that have been sold short by investors, but haven’t yet been covered or closed out, on stocks trading on the Nasdaq Composite COMP, -0.10% rose in the last two weeks of September to around the highest level in 10 years, at around 9.7 billion shares (see chart below expressed as a percentage below a chart of the Nasdaq Composite’s absolute value).

Of note, Goepfert said some investors view rising short interest as a contrarian sign, one that may signal a bullish trend for the benchmark market, since it also reflects a potential snapback trade for stocks if bearish investors suddenly are forced to unwind their short bets and buyback stocks they have borrowed in their short bets.

However, the SentimenTrader analyst says investors willing to dismiss the current rise in short-term interest, or view it as a potential cause for buying and not caution, do so at their own peril.

As the stock market has surged higher in the aftermath of its swoon back in March, amid the peak of selling precipitated by worries about the economic damage from the coronavirus spread, moves for equities have become more unsteady.

The volatility in markets also has been spurred by concerns about a resurgence of COVID-19 and its impact on the economy and uncertainties surrounding the outcome of 2020 presidential race between Democratic challenger and former Vice President Joe Biden and incumbent Donald Trump.

Investor bets in the Nasdaq Composite COMP, -0.10%, which is up 72% since the market’s March 23 lows, while the more market-capitalization concentrated Nasdaq-100 NDX, -0.04% has gained by about the same amount over the period. Those tech-heavy benchmarks have risen because investors have viewed tech-related companies, like software and e-commerce, as potentially more resilient to the landscape being carved out by the viral outbreak.

Gains in tech also have helped to push the broader-market benchmarks higher, but to a lesser degree. The Dow Jones Industrial Average DJIA, -0.54% is up a still-impressive 54% from its March lows, while the S&P 500 index SPX, -0.63% has rallied by more than 56%.

It also may be worth taking stock of SentimenTrader’s observations around potentially contrarian bets on the Nasdaq.

Back in August, a number of investors highlighted bullish bets piling up on the S&P 500, with some observing a doubling of options bets that the S&P 500 would extend its run-up, far exceeding trading in securities that would be used to bet on an imminent decline in stock values.

What ensued?

The Nasdaq Composite fell into correction on Sept. 8 after hitting a fresh peak on Sept. 2 and the S&P 500 hung on the precipice of a similar decline of at least 10% from its recent peak before recovering.

Goepfert warns that the current setup for markets offers some reasons to be optimistic, but the analyst isn’t sold.

“We do it because these short interest figures get tossed out frequently, and if we see this and assume it’s a buy signal, because that’s what we’re taught to believe, then we’re fooling ourselves,” Goepfert wrote. “There are reasons to be optimistic here; this ain’t one,” the SentimenTrader strategist said.