No bone cement, no problem. Smith & Nephew will now offer both cemented and cementless partial knee implants, thanks to the recent acquisition of Engage Surgical and its cement-free technology.

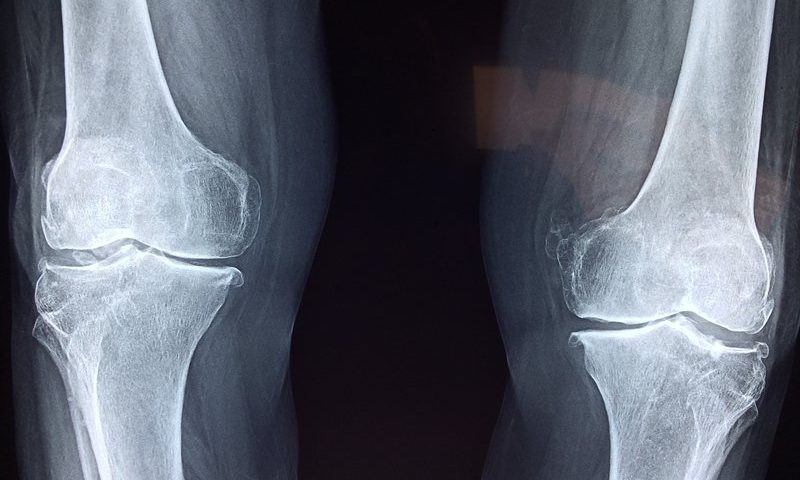

Engage Surgical’s Partial Knee System uses 3D-printed implants featuring porous surfaces that can bind more naturally to the bone without requiring cement. Excess bone cement can come loose over time and not only leave debris floating in the joint but also speed up the erosion of the implants.

Engage’s system is intended for use in medial unicompartmental knee arthroplasty procedures to treat osteo- or post-traumatic arthritis. With its FDA clearance in 2020, it became the first cementless partial knee implant system greenlighted for commercial sales in the U.S.

Smith & Nephew purchased Engage and its novel knee replacement tech in a deal valued at up to $135 million, contingent on the company’s sales performance over time. The U.K.-based medtech giant financed the acquisition with existing cash and debt facilities.

Privately held, Florida-based Engage hasn’t released past sales numbers, but the buyout is undoubtedly expected to build on the $207 million in revenue that Smith & Nephew’s knee implant segment raked in during the third quarter of 2021, the last reported period (PDF). According to the company, the U.S. partial knee market currently clocks in at around $300 million, with forecasts showing a solid 4% growth rate through the next several years, led by cementless tech.

Engage’s system will ultimately be developed for use with Smith & Nephew’s CORI robotic surgery system, which is already used to perform partial knee replacements with Smith & Nephew’s own Journey II cemented knee system.

“Smith & Nephew is now the only medical device company offering both cemented and cementless partial knee implants in the U.S., as well as robotics assistance through the CORI Surgical System that is well-suited for the precise alignment needed,” said Randy Kilburn, executive vice president and general manager of Smith & Nephew’s reconstruction, robotics and digital surgery departments.

The Engage technology’s new parent company will also work to expand the reach of the system, which has currently only been rolled out in a limited release in the U.S. In addition to expanding sales stateside, Smith & Nephew said it will also go after other regulatory clearances to take the system on a world tour.

This marks the first acquisition for Smith & Nephew since 2020. In September of that year, it put up a $240 million bid for the extremity orthopedics business of Integra LifeSciences. The buyout brought with it Integra’s product portfolios spanning shoulder replacements and hand, wrist, elbow, ankle and foot reconstructions, as well as the segment’s dedicated sales team and distributors.

The acquisition was completed in the first week of 2021, at which time Smith & Nephew said it was gearing up to launch a new, next-generation shoulder replacement system from the freshly tapped product pipeline sometime in 2022.