New Delhi: Trends in crude oil prices, domestic political dynamics, global interest rates and developments at the international trade front would be important factors impacting the equity market movement in the near term, say experts.

Of late, rupee woes, high crude oil prices, unabated foreign fund outflows and escalating trade tensions between the US and China have dampened the market sentiment.

Investors would closely watch assembly elections in some key states scheduled later this year, they added.

According to Jagannadham Thunuguntla, Senior VP and Head of Research (Wealth) at Centrum Broking, Indian markets are facing multiple headwinds such as all-time low rupee, rise in bond yields and rise in crude oil prices leading to vulnerability of Indian macros.

“Accentuating the volatility, we are in a politically charged up year with string of state assembly elections an ..

“At domestic level, earnings recovery led by demand improvement across segments will be the main trigger. Globally, easing of trade war related concerns, fall in crude prices will be very important triggers for the market,” said Teena Virmani, Vice President-Research, Kotak Securities.

Samco Securities & StockNote Founder & CEO Jimeet Modi said, “Key triggers to watch out for would be global interest rates, international trade disruptions due to tariff wars, currency cross-currents, inflationary expectations and domestic political dynamics would be important events impacting the markets.”

State elections this time would be the key event that the market will watch for before taking any significant direction, he added.

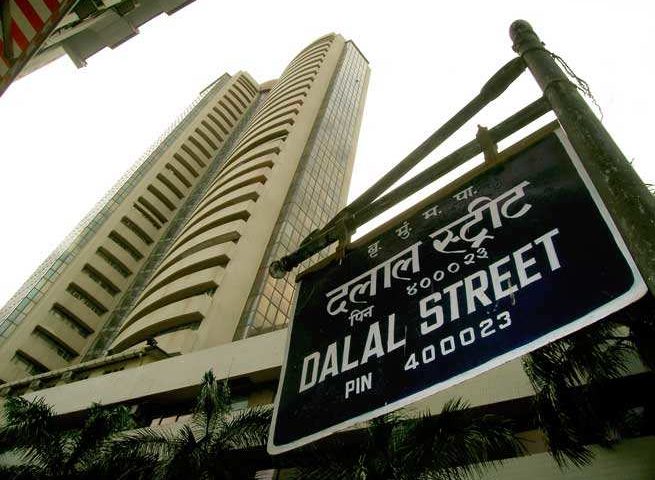

Markets scaled its lifetime peak this year, with the benchmark Sensex hitting its all-time high level of 38,989.65 on August 29.

On the outlook for the market for year-end, Nair said, “In 2018, performance of main indices like Nifty and Sensex has been very skewed. It is not reflecting the reality of the muted broad market with negative returns. The strength of the market has been decided by some handful set of stocks and sectors. This trend may continue throughout the year, as indicated by an increase in the market risk with spike in yield, USD/INR and selling by FIIs.”

“Sensex could trade in the range of 35,000 to 35,500 and Nifty in the range of 10,500 to 10,800,” Jimeet Modi said.

“The fall principally will germinate from the fact that the markets are overvalued and lot of optimistic expectations are built into,” he added.

On the headwinds of the market, Virmani said, “Increasing tensions on trade war front along with likely strengthening of dollar vis-a-vis other currencies and rising crude prices may hamper the markets adversely.”