Palladio Biosciences has raised a $20 million series B round. The financing, which attracted support from Roche Venture Fund and Medicxi, sets Palladio up to test its vasopressin V2 receptor antagonist in a phase 3 kidney disease trial.

Pennsylvania-based Palladio set up shop in 2017 to advance a drug—lixivaptan, licensed from Chiesi—using the proceeds of a Medicxi-led series A round. The round equipped Palladio to repurpose a drug that made it to the cusp of approval in heart failure patients, only to be rejected by the FDA in 2012, as a treatment for autosomal dominant polycystic kidney disease (ADPKD).

Palladio presented pharmacokinetic and pharmacodynamic data on lixivaptan in ADPKD patients last year, clearing it to file to run a 50-subject phase 3. With that trial now enrolling patients, Palladio has disclosed a series B round to fund the study.

Samsara BioCapital led the round with support from fellow new investor Roche Venture Fund. The series B also attracted the support of existing investors Medicxi and Osage University Partners.

The funding will support a phase 3 that is assessing the ability of lixivaptan to slow kidney function decline in patients who permanently discontinued treatment with Otsuka’s Samsca due to elevated liver enzymes. Physicians can only use Samsca, another vasopressin V2 receptor antagonist, in the U.S. in ADPKD under an FDA-approved Risk Evaluation and Mitigation Strategy due to liver toxicity.

Lixivaptan is functionally equivalent to tolvaptan, the active ingredient in Samsca, and appears to be similarly effective based on cross-trial comparisons. Importantly, to date lixivaptan has been free from the liver toxicity associated with Samsca.

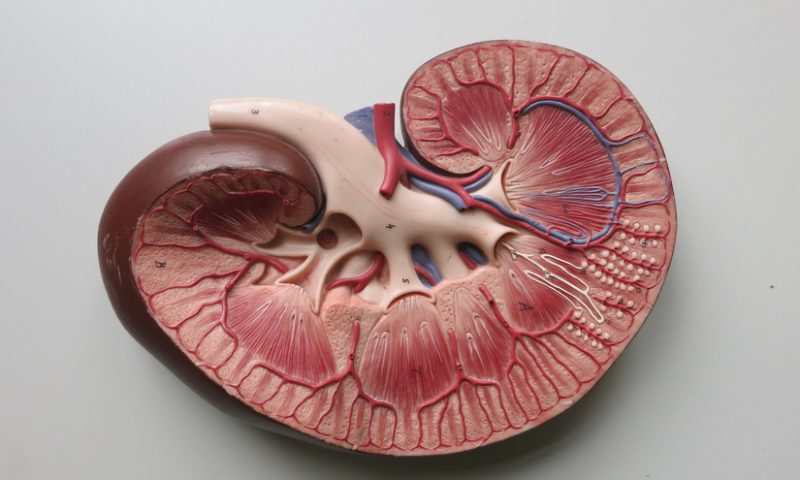

Success in phase 3 would position Palladio to establish lixivaptan as an alternative option for patients with ADPKD, a genetic disease that causes cysts to grow large enough to affect kidney function. The effects of the cysts only become apparent in adulthood but can lead to kidney failure.

Lixivaptan was originally developed as a treatment for an electrolyte disorder that affects heart failure patients. Biogen partnered with Cardiokine to develop the drug in heart failure patients in 2007, only to bail on the program a few years later before the completion of phase 3. Cardiokine filed for FDA approval in 2011 and was bought by Cornerstone Therapeutics shortly thereafter.

However, the FDA rejected lixivaptan and asked for additional clinical and nonclinical information. Chiesi took control of the drug when it bought Cornerstone in 2014 and granted Palladio global rights to the molecule in 2017.

Lixivaptan is indicative of the sort of late-phase programs Medicxi has invested in since expanding beyond its traditional focus on early-stage biotechs. Like fedratinib, which cleared phase 3 at Sanofi only to get hit by a regulatory setback, lixivaptan is a drug that had slipped off the radar but already had a body of clinical data supporting its use. Impact Biomedicines, with the support of Medicxi, revitalized fedratinib and went on to be acquired by Celgene for $1.1 billion upfront.