Gold futures ended higher Monday, with the precious metal scoring a partial rebound from its steepest weekly decline since March 2020.

Bullion’s gains came as a surge in the U.S. dollar receded somewhat after hitting its highest level in around 10 weeks and posting its sharpest weekly rise in over a year. The currency’s advance has weighed on dollar-pegged assets, like gold and silver, mightily.

“The rally in the U.S. Dollar Index pummeled gold last week, but we think that the dollar rally is now in the rear view mirror,” Michael Armbruster, managing partner at Altavest, told MarketWatch.

“If we are right and the dollar weakens this week, that will be a good excuse for gold to bounce,” he said. “In the short-run, we are bullish gold.”

August gold GCQ21, -0.34% GC00, -0.34% rose $13.90, or 0.8%, to settle at $1,782.90 an ounce, after the metal saw a weekly loss of 5.9%, marking the largest such loss for a most-active contract since the week ended March 13, 2020, according to FactSet data.

July silver SIN21, -0.61% SI00, -0.61% added 6 cents, or 0.2%, to settle at nearly $26.03 an ounce.

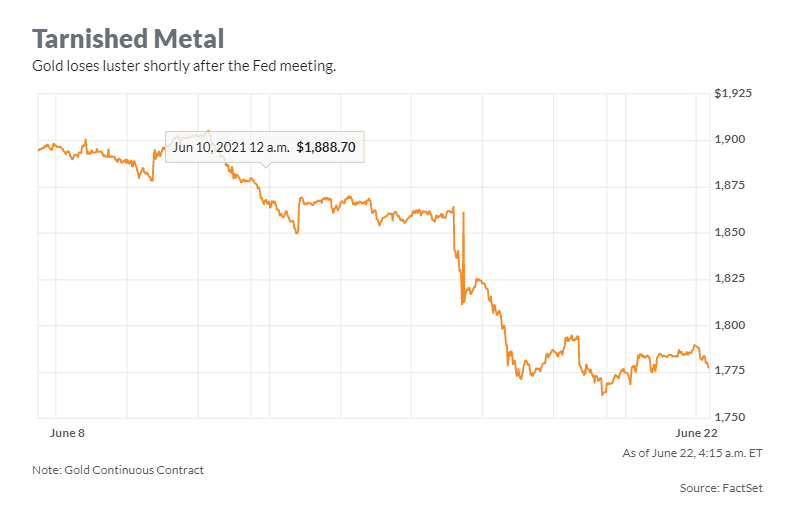

Strength in the dollar has potentially been one of the biggest headwinds for gold, which has withered since recently retaking a psychological perch at $1,900 in late May. It hasn’t traded above level since June 11.

The tone of the Federal Open Market Committee meeting last week “judging from the projections paper, was less accommodative than it has been in the past, but the changes weren’t actually that material,” said Rhona O’Connell, head of market analysis, EMEA and Asia regions at StoneX.

“To judge from some markets’ reactions, one would have thought that the meeting had been much more hawkish and signifying a substantive change in policy,” she said in daily note. “ Gold, already under some pressure, took a heavy loss and fell deep into oversold territory.”

Now, however, it is “meeting substantial bargain hunting and we should expect a further rally,” said O’Connell.

On Friday, St. Louis Federal Reserve President James Bullard said he expects the central bank to raise its benchmark interest rate in 2022, which sent gold prices back toward session lows.

“Whether gold’s rebound can turn into something more sustainable will depend a lot on which way the greenback goes in the coming days and that will likely be determined by what Fed officials lined up to speak this week say,” wrote Raffi Boyadjian, senior investment analyst at XM, in a research note.

On Monday, Bullard and Dallas Fed President Rob Kaplan said during a webinar sponsored by the Official Monetary and Financial Institutions Forum, that they see high inflation persisting in 2022 above the central bank’s 2% target, and at a stronger rate than many of their colleagues predict. Bullard isn’t a voting member of the rate-setting FOMC this year but will be in 2022 and Kaplan will be a voting member in 2023.

Against that backdrop, the ICE U.S. Dollar Index DXY, 0.17% edged lower by 0.4% in Monday dealings, easing back after last week’s climb, contributing support for dollar-denominated prices of gold.

Also on Comex, July copper HGN21, -0.20% tacked on nearly 0.7% to $4.18 a pound. July platinum PLN21, 0.31% rose 0.9% to $1,050.60 an ounce and September palladium PAU21, 1.22% settled at $2,558.30 an ounce, up 3.6%.