Diamondback Energy Inc (NASDAQ:FANG) – Stock analysts at Jefferies Financial Group lowered their Q1 2020 earnings per share estimates for Diamondback Energy in a research note issued to investors on Wednesday, August 14th, Zacks Investment Research reports. Jefferies Financial Group analyst M. Lear now expects that the oil and natural gas company will post earnings per share of $2.09 for the quarter, down from their previous forecast of $2.18. Jefferies Financial Group also issued estimates for Diamondback Energy’s Q2 2020 earnings at $2.07 EPS, Q3 2020 earnings at $2.29 EPS, Q4 2020 earnings at $2.57 EPS and FY2020 earnings at $9.02 EPS.

Diamondback Energy (NASDAQ:FANG) last announced its earnings results on Tuesday, August 6th. The oil and natural gas company reported $1.70 earnings per share (EPS) for the quarter, missing the Zacks’ consensus estimate of $1.74 by ($0.04). The business had revenue of $1.02 billion for the quarter, compared to analysts’ expectations of $1.04 billion. Diamondback Energy had a return on equity of 6.50% and a net margin of 26.92%. The firm’s revenue was up 93.7% compared to the same quarter last year. During the same period in the previous year, the firm posted $1.59 earnings per share.

Several other brokerages have also weighed in on FANG. JPMorgan Chase & Co. lowered their price objective on Diamondback Energy from $155.00 to $149.00 and set an “overweight” rating for the company in a report on Wednesday, August 14th. TD Securities lowered Diamondback Energy from an “action list buy” rating to a “buy” rating and set a $155.00 target price for the company. in a report on Friday. Williams Capital reaffirmed a “buy” rating and set a $165.00 target price on shares of Diamondback Energy in a report on Tuesday, July 30th. Credit Suisse Group initiated coverage on Diamondback Energy in a report on Monday, June 17th. They set an “outperform” rating and a $135.00 target price for the company. Finally, Piper Jaffray Companies set a $156.00 target price on Diamondback Energy and gave the company a “buy” rating in a report on Friday, August 16th. One analyst has rated the stock with a sell rating, two have assigned a hold rating, twenty-three have assigned a buy rating and two have issued a strong buy rating to the company’s stock. Diamondback Energy has a consensus rating of “Buy” and an average target price of $152.95.

Diamondback Energy stock traded down $2.05 during midday trading on Thursday, hitting $95.60. The stock had a trading volume of 1,031,828 shares, compared to its average volume of 1,757,518. The company has a current ratio of 0.82, a quick ratio of 0.79 and a debt-to-equity ratio of 0.29. The stock has a market cap of $15.95 billion, a P/E ratio of 16.29, a P/E/G ratio of 0.48 and a beta of 0.83. Diamondback Energy has a 12 month low of $85.19 and a 12 month high of $140.78. The business has a fifty day moving average price of $98.42 and a 200 day moving average price of $102.82.

A number of institutional investors and hedge funds have recently added to or reduced their stakes in FANG. Nuveen Asset Management LLC acquired a new stake in Diamondback Energy in the second quarter worth approximately $303,291,000. JPMorgan Chase & Co. lifted its position in Diamondback Energy by 11.4% in the first quarter. JPMorgan Chase & Co. now owns 13,528,463 shares of the oil and natural gas company’s stock worth $1,373,546,000 after purchasing an additional 1,388,245 shares during the period. Geode Capital Management LLC lifted its position in Diamondback Energy by 128.1% in the fourth quarter. Geode Capital Management LLC now owns 2,040,175 shares of the oil and natural gas company’s stock worth $188,797,000 after purchasing an additional 1,145,573 shares during the period. Boston Partners lifted its position in Diamondback Energy by 16.5% in the first quarter. Boston Partners now owns 3,990,944 shares of the oil and natural gas company’s stock worth $405,201,000 after purchasing an additional 566,290 shares during the period. Finally, Dimensional Fund Advisors LP lifted its position in Diamondback Energy by 60.3% in the fourth quarter. Dimensional Fund Advisors LP now owns 1,374,465 shares of the oil and natural gas company’s stock worth $127,413,000 after purchasing an additional 517,292 shares during the period. Hedge funds and other institutional investors own 99.35% of the company’s stock.

In other news, CFO Hof Matthew Kaes Van’t sold 1,500 shares of the business’s stock in a transaction that occurred on Thursday, June 20th. The stock was sold at an average price of $107.47, for a total transaction of $161,205.00. Following the completion of the transaction, the chief financial officer now directly owns 27,465 shares in the company, valued at $2,951,663.55. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Also, CEO Travis D. Stice acquired 4,186 shares of Diamondback Energy stock in a transaction dated Friday, August 9th. The shares were acquired at an average price of $95.55 per share, with a total value of $399,972.30. The disclosure for this purchase can be found here. Over the last quarter, insiders have sold 11,500 shares of company stock valued at $1,199,165. Insiders own 0.47% of the company’s stock.

The firm also recently disclosed a quarterly dividend, which was paid on Monday, August 26th. Stockholders of record on Friday, August 16th were given a dividend of $0.188 per share. The ex-dividend date was Thursday, August 15th. This represents a $0.75 annualized dividend and a dividend yield of 0.79%. Diamondback Energy’s dividend payout ratio is presently 12.78%.

Diamondback Energy Company Profile

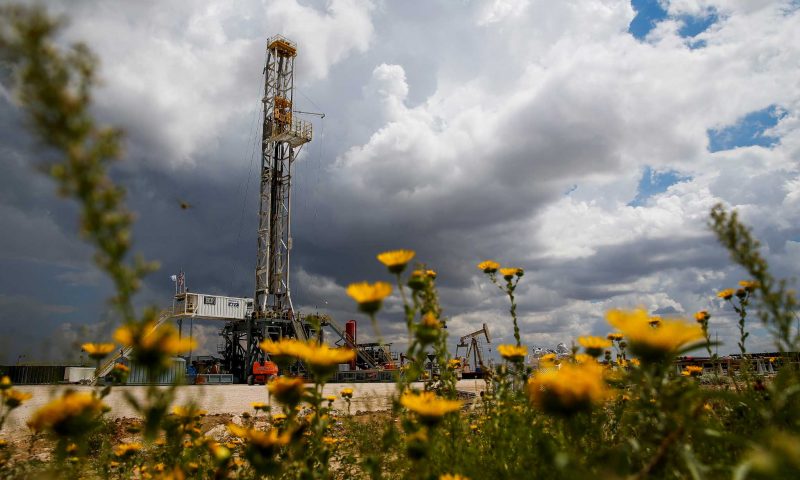

Diamondback Energy, Inc, an independent oil and natural gas company, focuses on the acquisition, development, exploration, and exploitation of unconventional and onshore oil and natural gas reserves in the Permian Basin in West Texas. It primarily focuses on the development of the Spraberry and Wolfcamp formations of the Midland basin; and the Wolfcamp and Bone Spring formations of the Delaware basin, which are part of the Permian Basin in West Texas and New Mexico.