Treasury yields extend drop as investors seek havens

Stocks suffered their biggest one-day decline of 2019 on Monday as China allowed its currency to fall to a more-than-10-year low versus the dollar after President Donald Trump rattled markets by announcing additional tariffs on Chinese goods late last week.

Stocks ended off of session lows, which had seen the Dow Jones Industrial Average DJIA, -2.90% drop by more than 900 points, but still suffered sharp losses. The Dow ended the day down 767.27 points, or 2.9%, at 25,717.74 , while the S&P 500 SPX, -2.98% declined 87.31 points, or 3%, to close at 2,844.74. The Nasdaq Composite COMP, -3.47% shed 278.03 points to finish at 7,726.04, a decline of 3.5%, as China-sensitive tech stocks came under pressure.

The rout marked the biggest one-day selloff, in percentage terms, for the Dow since Dec. 24 and the biggest drop for the S&P 500 and Nasdaq since Dec. 4. The drop marked the lowest close for the S&P 500 and Nasdaq since June 6 and the lowest finish for the Dow since June 5. It left the S&P 500 off 6% from its record close set on July 26, while the Nasdaq is off 7.3% from its all-time closing high set the same day and the Dow has pulled back 6% from its July 15 record finish.

The steep selloff came just one trading day after the S&P 500 and Nasdaq had their biggest weekly declines of 2019.

Until last week, market participants had been able to “compartmentalize” the U.S.-China trade war, said Art Hogan, chief market strategist at National, in a phone interview. Investors were aware of the continued trade tensions, but were reassured that negotiations were continuing and that neither side was prepared to escalate, he said.

That changed Thursday, when Trump announced 10% tariffs on an additional $300 billion of imports from China to take effect on Sept. 1, and was compounded when China allowed the yuan to drop.

“The escalation of the U.S.-China trade war puts us in a place where it’s almost impossible to calculate the collateral damage,” Hogan said. That’s likely to continue to cast a cloud over the market unless there are signs of a de-escalation.

Stocks extended early losses after the Institute for Supply Management said its nonmanufacturing, or services, index fell to 53.7% in July from 55.1% in June — marking a slowdown in growth. The reading was the lowest since August 2016. A reading of more than 50 indicates expansion in activity.

China’s yuan traded recently at 7.0975 to the dollar in offshore trade USDCNH, -0.4437% , after breaching the 7 level — long referred to by market watchers as a “line in the sand.” The Wall Street Journal, citing data from Refinitiv, said the yuan fell as much as 1.9% to a record offshore low of 7.1087 in Hong Kong on Monday. In mainland trade USDCNY, -0.2624% , the yuan traded at more than 7 per dollar for the first time since 2008.

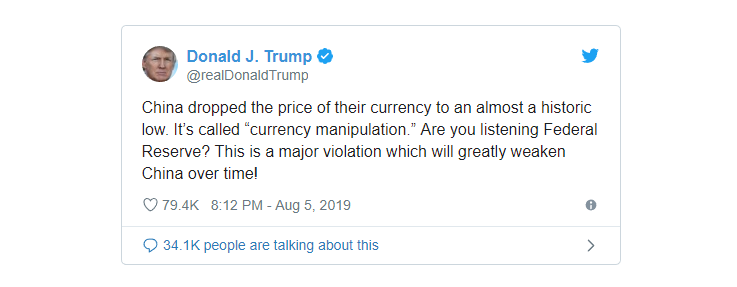

Trump, in a Monday-morning tweet, accused China of currency manipulation and said the Federal Reserve should “listen”:

Meanwhile, expectations for a half-point interest-rate cut by the Fed when policy makers meet in September continued to rise Monday, with traders reflecting almost even odds of a half- or quarter-point trim.

Fed officials said they were watching the stock-market moves, but didn’t signal any outright alarm over the moves. Kansas City Fed President Esther George and Fed Gov. Lael Brainard, speaking at a Kansas City Fed event, both said the best strategy for the central bank was to “monitor” markets.

Global equities tumbled overnight as the yuan slumped. In Asia, Hong Kong’s Hang Seng Index HSI, -0.67% dropped 2.9% and may have also felt pressure from continued protests and a call for a general strike, while the Shanghai Composite SHCOMP, -1.56% lost 1.6%. The pan-European Stoxx 600 SXXP, +0.61% was down more than 2%.

“China’s retaliation has already provoked a hostile response from the U.S. president. So we think that investors are right to mark down the prices of global equities in the expectation of a further escalation of the trade war,” said John Higgins, chief markets economist at Capital Economics, in a note.

The Dow slumped 2.6% last week, its biggest weekly percentage loss since May, while the S&P 500 dropped 3.1% and the Nasdaq gave up 3.9%. Despite the latest trade rumblings, all three major indexes are still up by double-digits for the year to date.

Stocks suffered last week after investors expressed disappointment over Federal Reserve Chairman Jerome Powell’s description of the latest rate cut as a “mid-cycle adjustment,” which they took as a sign the central bank might not be as aggressive as expected when it comes to future rate cuts.

Losses were extended after Trump on Thursday announced he was imposing 10% tariffs on $300 billion worth of imports from China — a move that took investors by surprise after both Beijing and Washington had described recent talks as constructive.

The scramble for havens saw Treasury yields, which move in the opposite direction of prices, extend a drop that last week took the 10-year rate to its lowest level since October 2016. The 10-year yield TMUBMUSD10Y, +2.85% fell 12.6 basis points to end at 1.738, its lowest since Oct. 7, 2016, according to Dow Jones Market Data.

Earnings season, meanwhile, is entering its final phase. Through Friday, 77% of S&P 500 companies had reported second-quarter results.

The blended earnings decline, which combines actual results for companies that have reported and estimated results for companies that have yet to report, for the second quarter stands at -1%, up from -2.7% last week, according to FactSet. If -1% is the actual decline for the quarter, it will mark the first time the index has reported two straight quarters of year-over-year declines in earnings since the first and second quarters of 2016, meeting the definition of an “earnings recession.”

Shares of Apple Inc. AAPL, -5.23% dropped more than 5% to lead Dow decliners as investors weighed its exposure both to China’s manufacturing sector and its consumers. All 30 Dow components declined on Monday.

Amazon.com Inc. AMZN, -3.19% shares ended 3.2% lower, marking an eighth straight decline for the longest losing streak since a nine-day fall that ended on July 14, 2006.

Other tech-related heavyweights were also under pressure, with Facebook Inc. FB, -3.86% , Google parent Alphabet Inc. GOOG, -3.49% GOOGL, -3.47% and Snap Inc. SNAP, -3.35% all falling more than 4% amid the global equity selloff, as well as fears of increased potential government oversight after a pair of mass shooting over the weekend.

Shares of Tyson Foods Inc. TSN, +5.10% rose more than 5%, making it one of only a handful of S&P 500 gainers in Monday’s session. The stock was lifted as stronger-than-expected earnings outweighed the disclosure of a Justice Department subpoena.