Shares soared 44% over the past 6 days to close at a 2-month high

Shares of AMC Entertainment Holdings Inc. rallied Friday to a sixth straight gain, which is the longest win streak in nearly two years, as Wall Street’s lone bull got a little more bullish after the movie theater operator completed its latest stock sale program.

The stock AMC, +1.64% rose 1.6% to close at a two-month high of $12.98. It has rocketed 44.2% over the past six sessions, which included a 23.7% jump on Thursday amid renewed interest from Reddit users.

Also on Thursday, AMC said it completed its previously announced 43 million shares “at-the-market” equity sale program, at an average price of $9.94 to raise $428 million.

The last time the stock rose for six consecutive days was the six-day stretch that ended July 31, 2019. There have been four five-day win streaks since that last six-day streak. The last five-day streak ended on Jan. 27 — the stock soared 570% during that streak — to mark the peak of the trading frenzy engulfing heavily-shorted “meme” stocks.

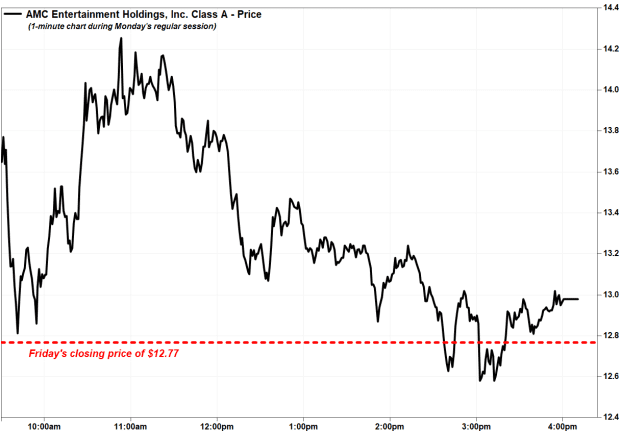

The outcome of the streak was a bit tough-and-go toward the end of Friday’s trading sessions, as the stock swung to an loss of as much as 1.6% with less than an hour before to closing bell, reversing earlier mid-morning gains of as much as 12.3%, before the late recovery.

Analyst Eric Wold at B. Riley Securities reiterated his buy rating he’s had on AMC’s stock since April 5 and raised his stock price target to $16 from $13, saying the completion of the latest at-the-money (ATM) stock sale program bolsters the balance sheet and provides “strategic optionality” to boost shareholder value.

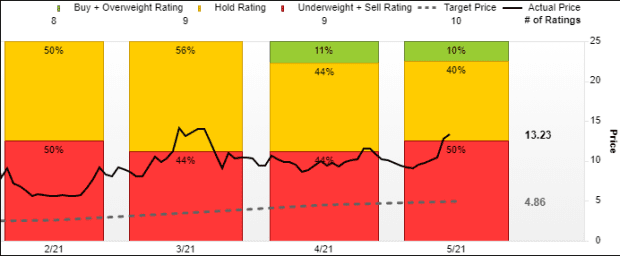

Of the 10 analysts surveyed by FactSet who cover AMC, Wold is the only one who is bullish on the company. There are five analysts with the equivalent of sell ratings and four with the equivalent of hold ratings.

Wold’s new stock price target is more than triple the average analyst price target of $4.86.

“Given our increasingly positive view on AMC’s balance sheet position, renegotiated terms with landlords and improved cash flow outlook on a box office recovery into year end [as discussed on April 16], we viewed any future equity as opportunistic vs. necessary to keep the company afloat,” Wold wrote in a note to clients.

“Any liquidity concerns should now be eliminated,” Wold wrote.

AMC shares have rallied 132.2% over the past three months, while the S&P 500 index SPX, +1.49% has tacked on 6.1%.