Dollar’s surge could lead to crisis, says top Wall Street analyst

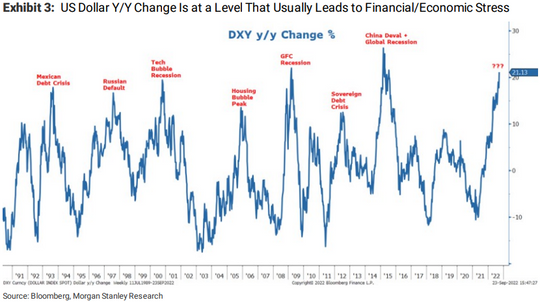

The U.S. dollar’s unrelenting surge is raising worries over corporate earnings, warned a closely followed Wall Street analyst, who noted that similar performances by the currency have historically led to some kind of financial or economic crisis.

Morgan Stanley chief equity strategist Michael Wilson, one of the Wall Street’s most vocal bears who correctly predicted this year’s stock market selloff, calculated, in a Monday note, that every 1% rise in the ICE U.S. Dollar Index has a negative 0.5% impact on S&P 500 earnings. He also saw an approximate 10% headwind for earnings growth in the fourth quarter.

The ICE U.S. Dollar Index DXY, +0.00%, a gauge of the dollar’s strength against a basket of rival currencies, declined 0.3% to 113.72 on Tuesday as the British pound GBPUSD, -0.11% crashed to a record low against the dollar on Monday after the U.K. government announced that it would implement tax cuts and investment incentives to boost growth. On a year over year basis, the DXY traded 21.8% higher, according to Dow Jones Market Data.

See: Don’t look for a stock market bottom until a soaring dollar cools down. Here’s why.

“The recent move in the U.S. dollar creates an untenable situation for risk assets that historically has ended in a financial or economic crisis, or both,” wrote strategists led by Wilson. “While hard to predict such events, the conditions are in place for one, which would help accelerate the end to this bear market.” (See chart below)

The analysts also forecast a year-end target for the dollar index of 118 with “no relief in sight.”

“In our view, such an outcome is exactly how something does break, which leads to major top for the U.S. dollar and maybe rates, too,” wrote strategists.

U.S. stocks finished the session lower on Monday with the Dow Jones Industrial Average DJIA, -0.43% entering its first bear market since March 2020. The S&P 500 SPX, -0.21% finished down by 38.19 points, or 1%, at 3,655.04 — below its June 16 closing low of 3,666.77. The Dow slumped 1.1%, while the Nasdaq COMP, +1.75% finished 0.6% lower.

According to strategists, the bear market in stocks is far from over until the large-cap index reaches the target range of 3,000 to 3,400 point-level later this fall or early next year.